Value Investors Club

Post on: 9 Апрель, 2015 No Comment

Description

AP Alternative Assets Athene (AAA NA)

We are recommending purchase of AP Alternative (traded in the Netherlands under AAA NA). Despite the Dutch listing, this is entirely a U.S. company. The accounting is in U.S. GAAP, assets are held in U.S. dollars and even the share price is quoted in U.S. dollars. We believe the shares are worth at least $50 today and are trading at only 2.3x normalized earnings.

AP Alternative was a public vehicle started in 2006 by Apollo (NYSE: APO) to hold stakes in Apollo private equity deals and funds. The structure at that time required a Dutch listing. The shares languished and consistently traded well below the funds stated Net Asset Value. The funds largest investment was in Athene, another company started by Apollo to purchase blocks of fixed annuities. In 2013, AP Alternative (AAA) traded its investment portfolio (Realogy, Rexnord, Smart & Final, Norwegian Cruise Lines, etc.) for a larger stake in Athene and now AAA basically has one asset: 73% of Athene.

Athene announced this week the closing of a transformative deal for Avivas U.S. life insurance business. Athene and Apollo have been incredibly tight-lipped about pro forma numbers, even by Apollo standards. We think this is because management likely does not want to parade high levels of profitability at the same time they were seeking deal approval from regulators (NY, the biggest and last hurdle struck an agreement to allow the deal in late summer).

Catalysts:

1) Closing of Aviva USA deal this week, 2) highlighting of pro forma financials, including $5B of statutory capital (vs $1.9B of last published GAAP BV at June 30) and $60B of assets (vs $15B of last reported assets) all increased with minimal dilution to AAA, 3) analyst day that will highlight these metrics, which was promised this summer, but pushed back to late 2013/ early 2014, 4) coming IPO of direct comparable Fidelity & Guaranty, likely at twice AAAs current multiple, 5) merger of AAA with Athene and re-listing from the Netherlands to the US, likely in 2014, but required by 2015 and 6) sellside analyst coverage concurrent with the US listing or earlier.

Here are the basic financials we have on Athene/AAA @ June 30:

Athene/AAA @ June 30, 2013

Athene Assets: $14.8B

Athene GAAP Equity: $1.9B (ex-AOCI)

AAA owns 73% of Athene valued at 1.2x equity and has 76m shares outstanding

AAA NAV: $21.67 / share ($1.9B x 1.2 multiple of equity x 73% ownership / 76m shares)

Here are the basic financials we have on Athene/AAA on a pro forma basis. This data is taken from company presentations, conference calls, and websites (some of which are no longer published):

Athene/AAA Pro Forma for Aviva USA Before APO Performance Allocation:

Athene Assets: $60B (Athenes current stated assets of $15B + Aviva USA has $57.5B but $10B of life assets will be sold to Global Atlantic, a Goldman entity)

Athene Statutory Capital: $5B from previously published website and confirmed by investor relations

When I asked AAA investor relations to bridge the gap between current stated GAAP equity of $1.9B to pro forma statutory capital of $5B, they said the main difference was that the Aviva book was being purchased at such a significant discount to stated book that the difference was the gain from the mark. GAAP recognizes similar gains so our best estimate of pro forma GAAP book value is $5B as well. Note: that the $5B of statutory capital has been previously published on Athene websites, but has recently been removed. However, additional ways to confirm this are that their stated leverage ratio is 10 to 12x so $60B of assets on $5B of statutory capital meets their leverage target. $60B of assets on their current $1.9B of stated GAAP equity value would be 32x leverage and probably unacceptable to regulators.

If we are correct that GAAP book value will approximate statutory then:

AAA owns 73% valued at 1.2x with 76m shares ($5B x 1.2x x 73% / 76m shares)

Pro-forma AAA NAV: $57.60 (97% above todays stock price).

AAA NAV After APO Carried Interest:

APO receives 20% of realized gains on AAAs Opportunistic Investments which is now only Athene. Management fees and carried interest can be payable either in cash or in shares of Athene valued at the current fair market value. We believe the most likely scenario is that Athene will go public in 2014, Apollo (APO) will receive their carried interest paid in Athene stock at the IPO price and AAA will be discontinue/rolled up into Athene. Our assumptions for each of these adjustments are as follows. Statutory book value will be $5 billion, the IPO valuation ill be 1.2x statutory book value for a total market capitalization of $6B. Apollo (APO) will receive a performance fee paid in increased ownership of Athene equal to 12% of Athene, thus AAAs ownership is reduced to 64%. Finally, AAA has agreed that their management contract with Apollo (APO) can be bought out for $30m in 2013, $25m in 2014, $20m in 2015, and zero thereafter. Exhibit 1 below combines each of these adjustments to estimate AAAs NAV assuming a 2014 IPO of Athene at 1.2x statutory book value.

AAA Book Value Assuming a 2014 IPO of Athene at 1.2x Book

BV @ June 30 (ex-AOCI): $1,900 from Athene presentation

Estimated Market Value Multiple on book 1.2x From AAA presentation

Estimated Market Value @ June 30 $2,280

Proforma BV Today 1 $5,000 From Athene website

Estimated Market Value Multiple of Book 1.2x We use the same multiple of book

Equity Value of Athene $6,000

AAAs Pro Forma Ownership 64% 73% diluted by 12%

AAAs NAV With Mgt Contract $3,837 64% of $6B

Cost to Terminate Mgt Contract ($25) We expect AAA to terminate the contract

AAAs NAV after Contract Termination $3,812

AAA has historically valued their Athene investment at 1.2x GAAP book value ex-AOCI so they must expect that the company will be reasonably profitable to justify a premium to book. In past presentations, they have presented investors with the following model:

Yield/Investment Returns: 6%

Cost of Funds: 3%

NIM: 3%

SG&A: 0.50%

Pretax ROA: 2.5%

Leverage: 10x 12x

ROE: 25% — 30%

Note: Athene is domiciled in Bermuda so pretax ROE = aftertax ROE

Athenes 1H13 ROE was 27% despite only 7x leverage vs 10 to 12x leverage target. This included gains on PE investments, but with the new portfolio composition, some level of PE gains will be recurring.

For an insurance company, their leverage is limited by statutory capital, not GAAP so really with this earnings based approach we dont need to worry about bridging the difference between statutory and GAAP book values.

Assets: $60B x 2.5% ROA = $1.5B of earnings or $14.21/share. On a proforma basis including the Athene ownership dilution from carried interest, EPS would be $12.62/share (assumes APOs Athene ownership increases 12% for carried interest). See Exhibit 2.

AAA Illustrative Normalized Earnings

Assets 1 $60,000

ROA % 2.5%

Net Income $1,500

AAAs Ownership interest 73%

After APO Carried Interest

AAAs Ownership interest 64%

AAAs % of Net Income $960

Normalized AAA EPS $12.63

Implied PE (x) 2.3x

Avg Life Insurance P/E 9.0x

AAA Price @ Avg Multiple $113.68

The company emphasizes this is their long-term model, not day 1 returns. But if we view this as normalized earnings, Athene will make $1.5B of earnings. AAA owns 73% of Athenes earnings which will be $1.1B or $14.41/share. If we assume APO received their 20% performance allocation in increased Athene ownership, EPS would be $12.63. Whats the lowest P/E multiple we could apply maybe 6x then its a $76 stock! At a life insurance average multiple of 9x its a $114 stock!

How Can APO Make Aviva USA Business So Much More Profitable?

The obvious question is: if the Aviva USA business is so valuable, why would they sell it for such a discount to book value? From speaking with insurance industry insiders, we found that the biggest answer is Bermuda. Bermuda has lower taxes, lower capital requirements and increased investment flexibility. From a Dupont model perspective Bermuda increases both ROA (lower taxes and investment flexibility) and leverage (lower capital requirements) to get to a higher ROE business. It also probably doesnt hurt that that deal with Aviva was announced in December 2012 when the 10-year yield was 1.76% (vs. 2.63% today), taper was not yet in our vocabulary and normalized earnings was nothing more than a dream. Since the deal was announced, other rate plays such as Schwab and Ameritrade are up 49% and 58% respectively while the larger life insurance companies are up 40-65%.

Coming IPO of Fidelity & Guaranty Life

Fidelity & Guaranty Life filed to go public in August. F&G is a leading provider of fixed indexed annuities and should be a direct comparable to Athene. Credit Suisse is the lead manager and we believe timing is later this year. From our review of the financials and from speaking with institutional investors in insurance, we believe this company will IPO at 1.0x book or higher. This should be a good comparable for Athene, should increase investor awareness in the space and highlight Athenes relative undervaluation. More about this IPO can be read from the following link:

Valuation

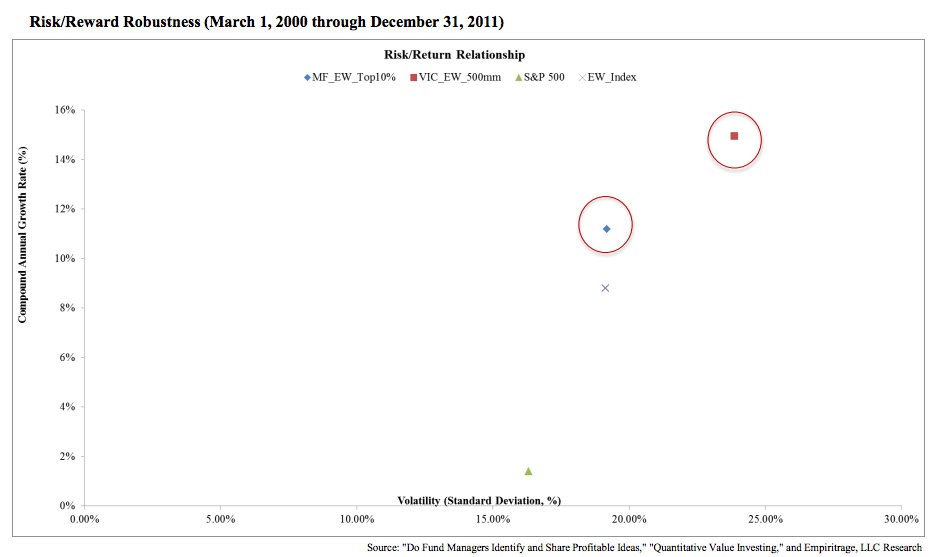

The valuation metrics used for our AAA analysis are reasonable when compared to publicly listed life insurers, annuity writers, the previously mentioned expected sponsor-owned life insurance IPO; and when compared to historical life insurance averages. See Exhibit 3, 4.

AAA Comparable Valuation Matrix

2014 Price /