Bill Gross and Mohamed ElErian In Depth on Outlook and Perspective

Post on: 23 Июль, 2015 No Comment

2011-10-26

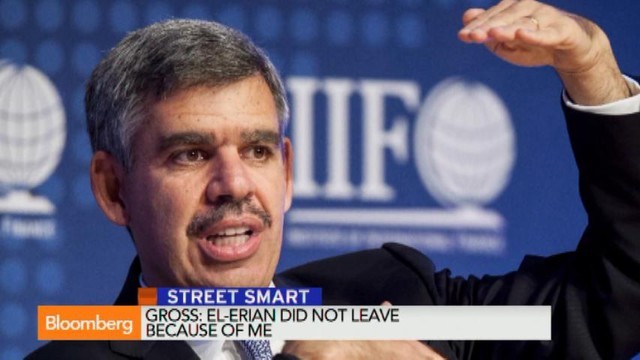

Two of the investment world’s biggest stars! Bill Gross and Mohamed El-Erian, Co-Chief Investment Officers of money management powerhouse PIMCO, sit down together for an exclusive WealthTrack two part series.

Here is the full transcript of Part One:

Consuelo Mack WealthTrack October 21, 2011

CONSUELO MACK: This week on WealthTrack- when these two speak, the investment world listens. Two of the world’s most influential investors sit down together for a WealthTrack exclusive- PIMCO’s co-chief investment officers, Great Investor Bill Gross and global Thought Leader Mohamed El-Erian together next on Consuelo Mack WealthTrack.

Hello and welcome to this edition of WealthTrack. I’m Consuelo Mack. Every week on WealthTrack, we try to bring you the best minds in the business to make sense of an increasingly complex and fast changing world. This week we have two of them, who work closely as a team, but rarely if ever appear on television together. They are doing so exclusively on WealthTrack for the next two weeks. One is Bill Gross, the man widely known as the bond king for his stellar management of the world’s largest bond fund, the nearly $250 billion dollar PIMCO Total Return Fund, which has outpaced bond market indices and the vast majority of competitors over the past 5, 10, and 15 year periods. Much to Gross’ chagrin, the fund is seriously lagging the pack this year- more on that later.

The other is Mohamed El-Erian, former head of Harvard’s endowment, 15 year veteran of the International Monetary Fund, once top-ranked emerging markets bond manager, who is now CEO and shares the co-chief investment officer title with Gross at Pacific Investment Management Company, known simply as PIMCO, the firm Gross founded in 1971. Both Gross and El-Erian are legendary for the sheer scope of their activities, insights and influence. Both multitask as money managers, analysts, commentators and advisors to clients, businesses and governments. Each writes and speaks several times a week. Bill now tweets daily, and has over 40,000 followers.

In the last month alone, they have covered topics ranging from the European debt crisis to the value of a college education to the Occupy Wall Street movement. And Bill has written a now widely covered Mea Culpa to clients for his lagging Total Return Fund performance explaining that he didn’t anticipate the “global flight to quality triggered by the European debt crisis and the politically induced deterioration in this country’s growth outlook.” His biggest mistake was not having any U.S. Treasury bonds when the world decided it wanted nothing but. The very competitive Gross went on to say that “there is “no ‘quit’ in me or anyone else on the PIMCO premises. The early morning and even midnight hours have gone up, not down, to match the increasing complexity of the global financial markets.”

I started by asking them to update PIMCO’s now widely quoted and accepted 2009 prediction that the U.S. and the rest of the developed world had entered a “new normal” economic environment of slow growth and sub par investment returns. It turns out they believe recession is now a very real risk.

BILL GROSS: In the United States, perhaps, we’re still at a one to two percent growth rate and that’s for the third quarter. The fourth quarter is problematic going forward based upon a very weak consumer, based upon real wages that haven’t really kept pace certainly with profits and with other growth metrics, and the spending power of consumers being 65 to 70% of the total growth in the United States. And so consumer dependent, but consumer weak. So that means that in the United States we might be inching close to a zero to one percent level going forward. We might be what approaching stall speed and perhaps Mohamed can speak to that concept.

CONSUELO MACK: So Mohamed let me ask you, because speaking of risks, the European debt crisis is a risk that you’ve been writing about now and kind of more and more vehemently in recent months. So how big a risk is the Eurozone crisis to the global economy and markets?

MOHAMED EL-ERIAN: It’s a big risk. I mean, we have to remember the Eurozone is the biggest economic region in the world. It also has a lot of banks, and therefore, if it struggles there will be implications. And what’s ironic about the Eurozone crisis that it didn’t need to get this bad. Bill has a wonderful analogy. You know, you start with an infection in the toe and you don’t diagnose it properly, you don’t treat it properly. The next thing you know your leg is infected. You don’t do anything about that. Next thing you know other parts. And suddenly your vital organs are threatened. So that’s what has happened in Europe.

CONSUELO MACK: So are the vital organs threatened in Europe? I mean, we’re that close to a critical condition?

MOHAMED EL-ERIAN: So what is the market telling us? The market is telling us they’re worried about the banks in the core. They’re worried about French banks. What’s the market telling us? That they’re getting nervous about the credit rating of certain countries like France. Even Germany’s CDS, the credit default swaps, at one point were well above 100, they went up to 120. So the indications are from the market to the Europeans, please get your act together because this infection is spreading and if you’re not careful, it’s also going to affect the rest of the world.

CONSUELO MACK: Now, you’ve talked about that Europe needs a circuit breaker and you haven’t seen a circuit breaker yet. And I have to admit, you know, who would have thought that U.K. Prime Minister David Cameron says that the European leaders need to take a big bazooka approach to this problem. So what kind of a circuit breaker do we need? What’s missing?

MOHAMED EL-ERIAN: So it’s not only Prime Minister Cameron, I mean, even Trichet, the outgoing governor of the European Central Bank, went to the politicians said this is now a systemic crisis. You need two things. First you need a circuit breaker to slow things down, which means that you need firewalls and you need to protect the banking system and the really big countries, which are Spain and Italy.

CONSUELO MACK: So what is a circuit breaker? What kind of financial instrument is that?

MOHAMED EL-ERIAN: So in the case of the banks, you need three things. You need, first, the ECB to provide liquidity which they’re doing. Secondly, you need to put equity in and third, you need to improve the asset side.

CONSUELO MACK: So put equity into the banks?

MOHAMED EL-ERIAN: Into the banks.

CONSUELO MACK: So you want the ECB to buy bank stocks?

MOHAMED EL-ERIAN: No, that would have to come from what’s called the EFSF, which is more a fiscal operation than liquidity. Then you need something else and we’ve talked about it. You need Europe to have its moment of truth. Europe needs to make a political decision. What does it want to look like in five years time? Does it want to look like a fiscal union where Germany is willing to pay for the others or is it a smaller, but stronger Eurozone? That is that decision that it needs to make. It needs to have its moment of truth because unless you tell people you’re going, they’re not going to stick with you. Right? So you need both a circuit breaker and a vision as to where it’s going.

CONSUELO MACK: So you’re asking a lot from the Eurozone. So what is the reality that you two are depending upon to invest in as far as what do you think is the real situation that we’re dealing with as far as Europe solving this crisis? Doing what Mohamed says, Bill. Or the fact the facts on the ground are not what he recommending right now?

BILL GROSS: Well, our sense is that Euroland will solve it, but in solving it that doesn’t necessarily mean that we return to the old normal. It simply means that we don’t spiral downward in terms of a debt deflation or in terms of a big R, such as we had in Lehman Brothers. You know, solving the Euroland crisis is just a big piece of the entire puzzle which is really represented by structural problems that will take a long time to correct and which haven’t been addressed by policy makers, not only in Euroland, but in the United States as well.

CONSUELO MACK: So let me ask you about this because you two have become increasingly vocal on policy issues and on political issues. And Bill I’m going to quote you. In a recent Investment Outlook, you said that “Long term profits cannot ultimately grow unless they are partnered with near equal benefits for labor. If Main Street is unemployed and under-compensated, capital can only travel so far down Prosperity Road.” And your solutions are more government enhanced and expanded unemployment benefits or benefits for the unemployed and also by American policies. So what does this have to do with managing money?

BILL GROSS: Well, it has a lot to do with managing money because the solutions or lack of solutions read down significantly to government yields and to risk speaks, obviously, to equity markets where growth and the potential for growth is discounted. So all of it comes back to a price, so to speak, in terms of financial assets.

CONSUELO MACK: And Mohamed, I’m going to ask you the same question because you two are on the same page and you had a recent editorial in the Huffington Post where you said, “Listen to the Occupy Wall Street movement.” You liked it to the Arab Spring. You say, “It’s part of a worldwide drive for greater social justice and in the U.S. it is about a system that privatized massive gains and socialized huge losses. The result is a growing gap between the haves and have nots in today’s America.” And given what Bill just said as well, why do these issues matter to PIMCO and its clients?

MOHAMED EL-ERIAN: So they matter a great deal. If you bring in an equity investment manager, I suspect he or she would be very frustrated today. They’ll say no matter how hard I work in figuring out what the company’s outlook is like, in differentiating, everything is treated the same. One day is risk on, one day is risk off, and all the work that I do, all my training is not paying off. He or she would be absolutely right. Why? Because today the markets, and therefore a client’s, capital is being influenced to a huge extent by policy makers. It is the macro issues, the policy issues that are governing markets today. Markets hate that. We are much more comfortable looking at bottom up issues as a society, as an industry. But the reality is, you know, we’re now sitting in a back seat of a car that is being driven erratically by policy makers. They’re arguing among each other. They’re not even looking through the windscreen. They’re not telling us where they’re going and somehow we have to stay in that car. So it’s really important to understand. Now, when it comes to policy issues, and Bill always reminds the Investment Committee, it’s very important to distinguish between what is likely to happen and what should happen.

CONSUELO MACK: Yes.

MOHAMED EL-ERIAN: Right? And we spend a lot of time on both. What’s likely to happen; and then what if there is a policy reaction, as there will most likely be, what does that policy reaction look like? So whether we like it or not, we as an industry and we as investment managers who have an oath responsibility towards our clients have to understand the policy making process.

CONSUELO MACK: What do you think is likely to happen with policy, Bill, about what you’re saying is the underemployed and the inequality between the haves and the have nots?

BILL GROSS: Well, the most important fact, I think, to recognize is that policy makers are limited in terms of their options going forward. And we can talk about fiscal policy and that has to do with deficits or reducing deficits.

CONSUELO MACK: Well, start with the Fed, for instance.

BILL GROSS: And it has to do with the Fed on the monetary side. The Fed having limited options going forward- I mean, they’ve brought interest rates basically down to zero and they did several years ago. They’ve gone through QE1, QE2, and now Operation Twist and all of those have basically tried to reduce the cost of interest and expand the discounted value, so to speak, of risk assets. To a certain extent, that’s been successful. But now as we approach zero for many treasury maturities it’s obvious that there are limitations going forward and that the policies themselves have produced some aberrations that are unfriendly to markets and to citizens.

CONSUELO MACK: And you’ve actually been critical of the Fed. “Helicopter Ben,” as you’ve called him, and saying that, in fact, the policies of zero interest rates have helped Wall Street and have helped the banking industry, but have actually really hurt Main Street. I mean, savers are getting the shaft.

BILL GROSS: Exactly.

CONSUELO MACK: But that’s the reality that we’re dealing with as investors, right? I mean, I don’t know what you’re recommending. What are you recommending the Fed do instead?

BILL GROSS: Well, we’re suggesting there’s not much that they can do. I think it would be unrealistic to have them raise interest rates in order to recreate the six percent era of CDs. That would certainly constrict the economy and produce a new recession. But from this point forward, monetary policy and Ben Bernanke, I think, is limited in terms of their option choices, which means that the economy itself is depended upon structural solutions as opposed to fiscal and monetary solutions which have been the old recipe for regenerating an economy.

CONSUELO MACK: So let’s talk about the structural issues, Mohamed. And I know there have been three issues that you two have talked about in your writings. And you call them “structural roadblocks” that are pressuring domestic wages and employment. One is globalization. It’s hollow developed economy labor markets. Technology has outdated entire industries that produce physical, as opposed to cloud oriented goods and services. And aging demographics is favoring savings, as opposed to consumption. Now these strike me as three structural issues that policy I mean, how can we change globalization, technology, you know, this is the buggy whip manufacturers of old, and the aging demographics? I mean, I wish I could reverse it, but I’m not going to get younger.

MOHAMED EL-ERIAN: I wish it too.

CONSUELO MACK: So what policies can begin to address those structural roadblocks?

MOHAMED EL-ERIAN: So the reason why we came up with this concept of the new normal was to try and signal that the system is not going to reset in a cyclical manner. That there are major structural forces that for a while were hidden, they were masked by a tremendous amount of leverage. And credit and debt entitlement. And once we came to the end of this great age of debt, we would have to address to our structural realities.

CONSUELO MACK: And you two were absolutely right on about warning about this, seeing this wind, these hurricanes coming.

MOHAMED EL-ERIAN: Right. So part of the reaction is to recognize that it’s not just about stimulating demand. It’s about also seeing what you can do on the structural side. So there’s lots we can do. We can do better on the housing. Housing is critical to this country. It impacts how people feel about their wealth because it’s such an important part of wealth. If people are upside down on their mortgages and they can’t refinance, etcetera, they can’t take advantage of the low interest rates. They can’t even move to where it drops off. Second, our labor market- we have a real structural issue in our labor market. We have long term unemployment at record level. We have 25% of the 16 to 19 year olds unemployed. At that age you go from being unemployed to being unemployable. Credit. We have this funny situation where the big companies can get credit, but they don’t need it and the small ones that depend on the banks have no credit. Infrastructure. So we have lots of structural issues that we can address in order to help overcome these bigger issues that we have to accept. Right? And the point PIMCO has been making over and over again since 2009 is don’t depend on a cyclical recovery. It’s not going to happen. This is much harder. It requires much longer work. It requires a certain amount of political commitment because structures take a long time, and let’s diagnose the issue properly. Now, unfortunately, we wasted two years as a society.

CONSUELO MACK: The last two years?

MOHAMED EL-ERIAN: The last two years.

BILL GROSS: You know, this debate between Republicans and Democrats, whether or not it’s beneficial to reduce the deficit and ultimately produce a balanced budget or whether it’s beneficial to expand the deficit, a la Paul Krugman, and inject the government into the solution. It’s a critical debate. Perhaps it will have to wait until 2012, but it’s one in which we think the government’s balance sheet almost by necessity has to be substituted for the private balance sheet because private investors and private corporations are basically unwilling to take a chance. That’s one of the problems of capitalism. When the animal spirits diminish to a certain point that capitalism is unwilling to take risk then, it seems to us, that policy makers, from the standpoint of the public balance sheet, have to be willing to fill that in. And that speaks to the housing market, as Mohamed just suggested. It speaks to infrastructure spending. Let’s ask is the private market really willing to repair our roads, to repair our bridges, etcetera? Probably not unless sufficiently incented. And if not, then it’s the public sector’s responsibility to fill in the gap in a very valid and useful way going forward for the next five or ten years.

CONSUELO MACK: So my reading of the current political climate is that the debate is not going your way and that the debate seems going to be towards deficit debt reduction which is not more spending.

MOHAMED EL-ERIAN: So first, I don’t know which way the debate was going. I hope there was clarity. One of the problems is we seem to be flip-flopping.

CONSUELO MACK: We do.

MOHAMED EL-ERIAN: And not getting anywhere. The investment implications are consequential. And remember, there are two parts of the world that are having that new normal. There’s the Western world, which is stuck with too much debt; and there is the emerging markets that have the ability to take on debt, but not the willingness to take on debt. And investors have to look at this and decide what’s the right thing to do. So when you are investing in the West, in the over-indebted West, the best way for new investments to evolve is if there’s growth. Growth is the perfect way to safely delever. But we’re not going to see growth because of the structural impediments.

CONSUELO MACK: Here? In the developed world we’re not going to see growth?

MOHAMED EL-ERIAN: We’re not going to growth, enough growth to get us out of our debt issues. So as an investor, whether you like it or not, you’re making an assumption of how society is going to deal with its debt issues. And we’re seeing a whole range of responses. In the case of the United Kingdom, they are implementing austerity on a voluntary basis. They have decided to spend less in order to pay off their debt. It has implications for equities. It has implications for debt.

In the case of Greece there’s no doubt, certainly in my mind, that they’re going to default. So as an investor you want to know that that’s how they’re going to respond. The U.S. has taken a very different path and Bill has written a lot about it. It has decided to financially repress us by keeping interest rates very low in order to do what you and Bill were talking about, which is to transfer money and wealth from savers to debtors. Now, as an investment management firm, it’s very important to have a view as to what regime is going to implemented where you invest your money because it has massive implication for the capital structure. So regardless of what should happen, right, the fact that we are in this new normal where growth is not going to be enough, it has massive implications. Similarly in the rest of the world. Suddenly we’re seeing to use the wonk-ish term- countries like Brazil move from being a credit risk to an interest rate risk. So they are changing paradigms and that provides massive opportunities for investors who understand it.

CONSUELO MACK: So they’ve been raising rates, and now there’s a possible, and cutting rates.

MOHAMED EL-ERIAN: To lower rates.

CONSUELO MACK: Right, to lower rates.

MOHAMED EL-ERIAN: So in the past, people would say, wow, if the West sneezes then Brazil is going to end up not only with a cold, but probably in the hospital. That’s not the case today anymore. The balance sheets are so solid, okay, and the flexibility is such that they have many more responses they can implement. So when PIMCO, you know, the reason why we come up with this and the reason why we make a point of trying to analyze them in different parts is because the investment implications are profound.

CONSUELO MACK: Right. So what are your working assumptions, Bill, in the U.S. for starters? What is the working assumption?

BILL GROSS: Well, the working assumption, in terms of growth for the next six to twelve months, is a zero to one percent number. And it could tip based upon what we call stall speed, but it’s basically no growth whatsoever.

CONSUELO MACK: And so, therefore, what kind of assets do well in that kind of an environment?

BILL GROSS: Well, at these levels of prices and these levels of yields actually not very many. You know, certainly risk assets don’t do well in a low growth or a no growth environment. And risk assets being stocks, which depend on growing earnings, or even high yield bonds which depend upon basically the maintenance of profitable cover or profitable spreads. Really, the attractive investments in a no growth or low growth world, it’s a high quality AAA or double A plus treasury. T

The problem with treasuries, however, is that their yields are so low.

Let me give you an example of the frustration of not only PIMCO, but the investor class from this point going forward. If there is going to be no growth, if safe assets are the safe haven, what will they return to the investor? A TIP or an inflation protected security is the best evidence of this. They trade at negative yields. In some cases for a five year TIP, for instance, at a minus 60 basis points. That’s a definitive statement. It means that over the next five years, an investor in a five year TIP will not be able to keep up with purchasing power. It means that, yes, they’ll be compensated for the CPI or for inflation, but in return they’ll sacrifice a minus 60 basis points in the process. So an investor looking to stay up with inflation and to basically just stay even with purchasing power cannot do it in a TIP market. And basically, if there’s no growth they’re taking lots of risk in order to try to do it in the equity market. So it’s a frustration, not just for PIMCO, but for the investor class in which it says, we’ve come down in terms of yield so far that the returns going forward are certainly not the double digits that you’re used to over the past ten or twenty years, but maybe closer to zero, to one, to two percent going forward and that’s a distinct change.

CONSUELO MACK: Next week we will continue our exclusive interview with PIMCO’s dynamic leadership duo. We’ll find out where in the world they are finding better than “new normal” returns, including some specific investment ideas.

At the conclusion of every WealthTrack, we give you one suggestion to help you build and protect your wealth over the long term. This week’s Action Point: learn from Bill Gross’ recent mistake and don’t make big investment bets. Bill’s mission as a professional investor is to beat his benchmarks and his peers, which he has done brilliantly over the last 20 years. But in order to do that, he sometimes makes big market bets, like being entirely out of U.S. treasuries in the second quarter when they became the only game in town. Individuals’ objectives are to build and preserve capital over time- they don’t have to beat the markets or peers. And they are better off being broadly diversified all the time, with disciplined and regular rebalancing.

For those of you who want to see our WealthTrack interviews ahead of the pack, including the second part of our conversation with Bill and Mohamed next week, subscribers can now see our program 48 hours in advance on our website. To sign up, go to wealthtrack.com. Thank you for watching and make the week ahead a profitable and a productive one.