AVOID paying PMI Insurance with your home loan and reduce your payments

Post on: 31 Март, 2015 No Comment

AVOID PAYING PRIVATE MORTGAGE INSURANCE

Private Mortgage Insurance (PMI) protects the lender in case the buyer defaults on the loan. Lenders generally require mortgage insurance on small or no down payment loans because statistics show that a borrower with less than 20 percent of personal investment in a home has a higher risk of default. In effect, the mortgage insurance company insures the risk of default for the lender. This allows the mortgage to be approved with less than 20 percent down payment as long as the coverage is provided to the lender.

What is PMI ?

Private Mortgage Insurance- as it is known is basically a kind of insurance that mitigates lenders losses due to foreclosure and loan defaults.

Many companies provide such type of protection by charging a monthly fee. Mortgage insurance also facilitates the mortgage marketplace. Lenders can make loans that otherwise would be not possible to sell to investors like the Federal National Mortgage Association (FNMA) and the Federal Home Loan Mortgage Corporation (FHLMC). The recycling of these loans to these investors is crucial to the market liquidity and money flows.

GET RID OF PMI INSURANCE

Here is how to Avoid paying PMI insurance Mortgage. PMI insurance is not for ever and should be deleted after some time. If you develop 20 percent equity in your property than it can be canceled by the home buyer. Guidelines vary among lenders and dont forget removing PMI is not the favorite task for the lender. It may require an appraisal on the property.

PMI vs FHA Insurance

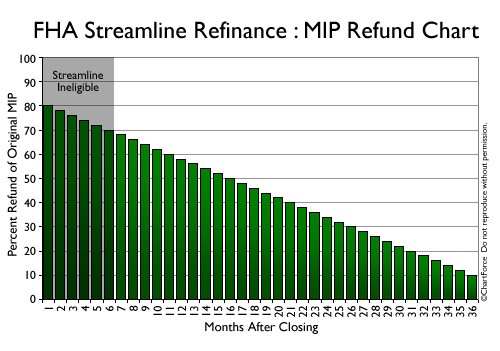

PMI is private insurance which can be canceled,while FHA insurance is for the life of the loan, and protects the loan from credit risky borrowers who otherwise will not qualify for the loan. FHA sets maximum regional loan limits that are lower than those with private mortgage insurance. FHA insurance is expensive,has fewer options and takes longer to get. You can always refinance FHA loans to reduce the payments.

NO PMI LOANS

Alliance Mortgage provides many loans that do not require PMI.

These loans are self-insured or they participate in pool of insurance, allowing borrowers to avoid paying PMI. Simply tell our Loan Team that you would like information about this type of loan and we will let you know if you can qualify.

Apply Now