All improvement Firsthand Technology Value Fund (SVVC) Discount To NAV May Narrow Significantly As

Post on: 13 Октябрь, 2015 No Comment

Firsthand Technology Value Fund (SVVC): Discount To NAV May Narrow Significantly As Twitter And Facebook Values Surge

Last week, a Seeking Alpha contributor laid out the case why GSV Capital (GSVC ) was materially undervalued relative to its NAV. We also believe the Firsthand Technology Value Fund (SVVC ) has a tremendous amount of value to be unlocked at its current share price of $24.20. This closed end fund holds an increasingly valuable portfolio of Twitter (TWTR ) and Facebook (FB ) shares, along with a fortress of cash, and private securities that are almost free options at the current price. In total, SVVC shares are trading

23% below our estimate of its current Net Asset Value (NAV) per share of $31.30.

According to some recently cited research from Morningstar. the average closed-end fund discount was 6.7% at the end of September 2013. The discount had widened from 2.8% at the end of 2012 and was nearly double the 10-year average of 3.5%. From this perspective, SVVC appears to trade at an irrationally and unreasonably large discount to NAV, which we think should narrow over time.

Discrepancies with NAV can result from a variety of factors. In the case of SVVC, we believe the discount is attributable to the low trading liquidity, its private securities portfolio that is difficult to value and comprises

28% of gross fund assets, low yielding cash hoard, and shareholder’s discontent with Kevin Landis, the fund’s investment manager. One shareholder in particular, Bulldog Investors, has waged an activist campaign against the manager and claims his abysmal track record does not justify the 2%/20% fee structure, which is more suited for an outperforming hedge fund manager, and not a closed end investing vehicle. Bulldog has been adding to its position, and its most recent 13D filing on December 11, 2013 indicates it now controls just under 10% of the shares. Whether or not Bulldog is successful in completely closing the valuation gap remains to be seen, but having them involved in the situation should keep a watchful eye over the manager, and at least insure the valuation gap doesn’t get excessively larger.

We believe there are other factors in play that could further close the excessively large valuation gap. First, the Fund’s two largest holdings, Facebook and Twitter, have dramatically increased in value; just in the month of December Twitter has appreciated by 76% and Facebook by 23%. We estimate from these factors alone, and assuming the fund has not sold shares, that SVVC’s NAV has increased from $27.37/share on 11/30/13 to approximately $31.30 as of 12/26/13. As a result, approximately 36% of gross fund assets are Facebook/Twitter shares, and accordingly, the value attributable to the fund’s other private securities has shrunk as a percentage of gross assets to just 27%.

Now that SVVC has begun harvesting some profits from investments made in prior years, the fund can begin distributing profits to shareholders. This may attract new shareholders to the fund, and help to alleviate the persistent discount. For example, on December 2nd, the fund announced a cash distribution of $0.32c/share related to long-term capital gains from its Solar City (SCTY ) investment. To the extent the fund demonstrates an ability to harvest gains and return capital in a more consistent manner, the discount should narrow further.

Below is a sensitivity table of SVVC’s NAV to changes in value of Facebook and Twitter shares. The table illustrates the margin of safety that exists at the current price even if the underlying shares move by 15%.

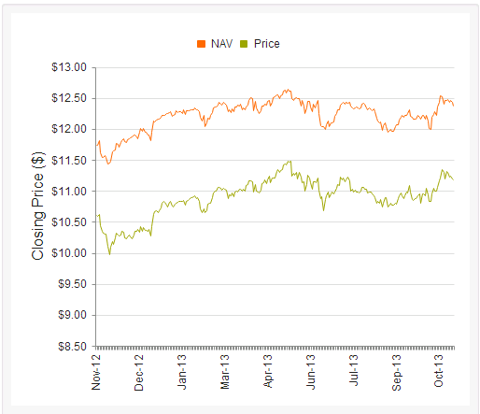

Also, as the share price rises and becomes more liquid, we think the discount should narrow. There is some historical precedent to support our case. As can be seen in the following table, SVVC’s discount to NAV narrowed earlier this year as the share price rose through mid-October, only to widen again when the stock swooned from mid-October through the end of November.

The discount may also narrow as investors get more clarity about the value of its private holdings. Investors may have a more difficult time evaluating the company’s stakes in IntraOp Medical (

8% assets), wearable technology firm AliphCom (

4% assets), or solar provider Sunrun Inc. (

2% assets), but at the current NAV investors are essentially receiving these stakes for free. Never mind these holdings, we are more intrigued that, according to its recent 10Q, SVVC also owns a small stake in Gilt Groupe. which will undoubtedly be a hot IPO in 2014 or 2015, and may act as a catalyst; SVVC acquired these shares in April and October 2012 for a nominal cost of a $1.7 million. According to AllThingsD. Gilt Groupe is growing rapidly with sales of $550m in 2013, compared with $450m in 2012. For comparative purposes, Zulily (ZU ) just came public and closed up 70% from its $22/share IPO price. Zulily is of similar size to Gilt with $567m in LTM sales; its current valuation is around 10x revenues. It’s not possible to know what SVVC’s nearly 200,000 common shares of Gilt Groupe are worth, but it’s not unreasonable to assume they may be worth many multiples of the $1.7m stated book value given the rapid explosion in comparative valuations.

In summary, we believe the discount to SVVC’s current NAV is too large given the reality that its Facebook and Twitter stakes have been revalued significantly higher. The discount allows investors to acquire nearly a free option on the remaining private securities in the portfolio, where we think at least the Gilt Groupe, may have a catalyst in 2014 to unlock further value. Meanwhile, we are encouraged that activist shareholder Bulldog Investors continues to purchase shares, and keep a watchful eye over the company. As a cautious investment manager in today’s euphoric equity market environment, we have been hard pressed to find value in any pocket of the market, and in particular, growth equities. We believe SVVC is a rare opportunity to acquire a high quality portfolio of technology stocks, at a significant margin of safety. There also exists liquid options to hedge the FB/TWTR underlying shares to protect against declines in the shares, and capture a portion of the NAV discount.

Disclaimer: This research report expresses Spruce Point Capital Management LLC’s (Spruce Point) opinions. Use of the research produced by Spruce Point is at your own risk. This is a long-biased article and you should assume the author of this report and its clients and/or investors hold a long position and derivatives tied to the security of Firsthand Technology Value Fund, Inc. that will benefit from a rise in the price of the common stock. Following publication of the report, the author (including members, partners, affiliates, employees, and/or consultants) along with its clients and/or investors intend to continue transacting in the securities covered therein, and may be long, short, or neutral at any time hereafter regardless of the initial recommendation. The author of this report has obtained all information contained herein from sources believed to be accurate and reliable and has included references where available and practical. However, such information is presented as is, without warranty of any kind- whether express or implied. The author of this report makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. Forward looking statement and projections are inherently susceptible to uncertainty and involve many risks (known and unknown) that could cause actual results to differ materially from expected results. All expressions of opinion are subject to change without notice, and the author does not undertake to update or supplement this report or any of the information contained herein. Spruce Point is not a broker/dealer or financial advisor and nothing contained herein should be construed as an offer or solicitation to buy or sell any investment or security mentioned in this report. You should do your own research and due diligence before making any investment decision with respect to securities covered herein, including, but not limited to, the suitability of any transaction to your risk tolerance and investment objectives and consult your own tax, financial and legal experts as warranted.

Disclosure: I am long SVVC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More. )

This entry passed through the Full-Text RSS service if this is your content and you’re reading it on someone else’s site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.