A Homeowner’s Guide to Post Bubble Real Estate Five Steps You Can Take to Better Protect Your #1

Post on: 31 Март, 2015 No Comment

October 2, 2012 By Greenhomeguide Staff

Whether you already own a home or are planning to buy one, you are certainly familiar with the housing bubble. Fueled by easy credit, it grew from 1997 to 2006. According to the S&P/Case-Shiller national home-price index, during those years the price of an average American home increased by 124%*.

But when the housing bubble began to deflate, things turned bad very quickly. According to The Joint Center for Housing Studies of Harvard University. between 2006 and 2011, housing wealth in the U.S. fell by as much as 57%, with homeowners losing a staggering $8.2 trillion.

In April, The New York Times wrote that from the beginning of 2007 to early 2012, roughly four million families lost their homes to foreclosure. It also reported that, Tens of millions of others found themselves in homes worth less than their mortgages, unable to sell or refinance.

There is no doubt but that the bubble was and still is — a major fiasco.

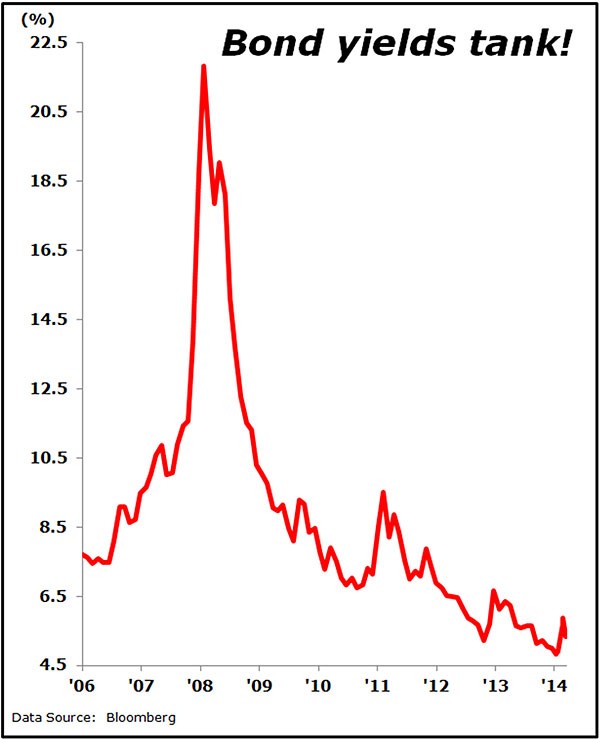

Thankfully, however, bright spots are starting to appear. In the second quarter of 2012, home prices rose ever so slightly for the first time since 2007. On another positive note, researchers at Harvards Joint Center for Housing Studies found that the number of loans 90 or more days past due fell almost steadily from 2.3 million at the end of 2009 to 1.3 million in the first quarter of 2012. Additional upward pricing pressure stems from historically low interest rates and home prices that have reset to their lowest level since November 2002. More recently, the Feds commitment to purchase $40 billion of mortgage-backed securities per month until the job market improves, while holding interest rates low, provided more good news for homeowners and buyers.

Even without those market upticks and boosts, there are more fundamental signs of increasing demand. According to the Harvard University study, projected immigration rates should support the addition of about 1.0 million new households per year over the next decade. The study also points to the maturation of the echo boom, children of the baby boom. It finds that, as this generation comes into its own, it has the potential to spur new home demand to an even greater extent than its parents did beginning in the 1970s. Indeed, with a bit more economic stability, experts believe that housing is well positioned for a turn around.

Still, in a changed housing market, questions remain. How can homeowners and homebuyers best protect their interests? Where is demand going? And how can you make sure that youre moving in that direction? Given current real estate trends, we propose that the following five steps could help you better protect your investment in a home.**

Build or Buy Sustainably.

According to Laura Stukel, long-time REALTOR®, market transformation expert. and consultant to the residential efficiency industry, “When it comes to real estate today, most people are worried about monthly costs and home appreciation. For those who have invested in improvements, the best way to protect home value is to document performance.” In this case, performance includes energy efficiency, water efficiency, indoor air quality, and durability. In other words, marketable homes today offer greater sustainability.

A Yahoo! Real Estate survey of current and aspiring homeowners concurs. It found that, while owning a home remains an important part of the American dream, the 21 st century dream home is now ‘green or energy-efficient’.

In support of those findings, the latest SmartMarket Report from McGraw Hill Construction estimates that green homes’ share of the construction market will increase from 17% in 2011 to as much as 38% by 2016. The study also reveals “more than 80% of builders say energy-efficient features are now pervasive in new homes and are making their construction greener than just two years ago.” Key perceptions driving this market transformation are “the fact that green homes are seen as having higher quality and that they save consumers money.”

Ms. Stukel adds, “This is not a fad. It is very bottom line driven. People buying today want to make sure that they can afford to operate the house. So, ideally, sellers need to document their home’s performance for prospective buyers. Third-party, green building certifications carry the most weight.”

Because sustainable renovation is relatively new, finding comparables and attaching premiums to existing homes is a bit more complicated. “All the more reason,” she adds, “for getting documentation for any and all performance-related home improvements.”

Get Educated Before You Get Renovated.

Ms. Stukel’s advice is to start with an energy audit since, for most homebuyers, energy consumption is the fundamental performance metric. She recommends calling your power utility first, as many of them offer the service for free or at steeply discounted rates. If your utility doesn’t offer that service, getting an energy audit is still worthwhile, especially since the average cost – depending on where you live and the service provider – is about $400 for a 2,000 square foot home.

Importantly, an energy audit not only tells you where your home needs help, it also helps you prioritize improvements based on your budget. You can learn more about energy audits on GreenHomeGuide.com.

Ms. Stukel suggests that, as improvements are made, energy or otherwise, homeowners should file contractor receipts, product warranties, and old bills for reference and comparison. These are all credible ways to document performance. With that documentation, the seller avoids any perception of ‘greenwashing’ – or the use of deceptive marketing to position a home as ‘green’.

Certify to Verify Performance.

As previously stated, the ultimate documentation involves third-party certification. Two of the most recognized options are Energy Star and LEED for Homes.

Energy Star is a rating system jointly sponsored by the U.S. Department of Energy and the Environmental Protection Agency. According to its website, “Energy Star certified new homes are independently verified to be at least 15% more energy efficient than homes built to the 2009 International Energy Conservation Code. They feature additional measures that deliver a total energy efficiency improvement of up to 30% compared to typical new homes and even more when compared to most resale homes.“

By comparison, LEED for Homes takes a whole-building approach that includes:

· Energy consumption

· Water usage

· The composition and durability of building materials

· Indoor environmental comfort and air quality

· And impact on the land, and surrounding communities and ecosystems

To earn LEED for Homes certification, whether it’s for new construction or a renovation, a home must perform as promised and as verified through an independent, third-party inspection.

The payback for that third-party certification can be substantial. New research involving more than 4,000 certified California homes sold between 2007 and 2012 found that, holding all other variables constant, the green certification label added, on average, 9% to a home’s selling value.

Find the Right Real Estate Agent.

All right, so you’ve made your home more efficient and sustainable. You’ve organized your documentation and maybe even earned certification. You’re ready to sell. Now what?

Amanda Stinton, Manager of the National Association of REALTORS (NAR) Green Designation program. recommends that, if the home you’re selling or the one you hope to buy is any shade of green, you interview an agent who has completed the NAR’s three-part Green Designee program.

The program makes sure participating agents fully understand sustainable building, including rating systems, local codes and policies, and building techniques. It also helps them more fully appreciate what sustainable features are in demand, and how best to bring a green home to market.

Ms. Stinton adds that, “Because this part of the business is changing so rapidly, we’re always looking for new ways to help members stay current. We offer webinars, articles, and research on topics such as LEED, Energy Star, lighting, water conservation, and indoor air quality. We also pass along tips on how to market and brand sustainably built homes.” The net result is that agents with a Green Designation are better equipped to help you sell your green home or evaluate the one you’d like to buy. When interviewing agents, Ms. Stinton advises that you inquire about their green building education, selling experience, and marketing expertise.

Make Sure the Home Is Properly Appraised.

Another important step to insure that you realize proper value on your green home involves the appraisal.

An appraisal is an informed opinion of a home’s value. It includes details about the property being sold, and side-by-side comparisons (“comps”) with three similar neighboring properties. It will also note serious property issues and flaws, and evaluate the health of the local real estate market.

Importantly, if a property appraises lower than the sale price, a loan might be denied. For those whose homes include green features, this is significant, as many appraisers do not know how to properly evaluate a green home.

According to Dave Porter, founder of PorterWorks Sustainable Solutions and the creator of the Green Valuation Specialist designation program, “When it comes to green building, it’s not always easy to find an appraiser who gets it.” As Porter explains, “That’s because lenders get paid a flat fee based on the size of the loan. They don’t make any more money for the additional time it takes to properly review and evaluate the performance of a green home.” So unless pushed by the consumer, most lenders will not bother to find an appraiser who fully understands how to evaluate a home’s sustainable features.

Though this situation is changing, it remains, more often than not, an obstacle to proper valuation and something about which green homeowners and buyers need to be aware. Porter’s advice is to ask the lender to employ an appraiser with the appropriate knowledge and credentials. This includes special designations or certifications offered by the Appraisal Institute – or through companies like Porter’s. He notes, “These programs make sure that the appraiser understands the difference between LEED Platinum 2012 and LEED Silver 2009…or Energy Star 2012 and Energy Star 2006.”

He also suggests that, if you’re going green, you inquire about energy efficient and energy improvement mortgages. These loans not only help buyers qualify for incremental money for sustainable repairs and upgrades, but they also increase pressure on lenders to assign an appraiser with the proper qualifications.

From Porter’s perspective, energy savings is the masterstroke. As he points out, “If an appraisal can demonstrate that your 2000 square foot house costs just $200/month to heat and cool … and compare that to another 2000 square foot house that costs $500 to heat and cool, then those savings should be acknowledged and factored into the loan calculations. Saving $300 a month over 20 years adds up…to $72,000. Those savings should definitely have an impact on how the house is appraised and the loan is evaluated.”

Porter indicates that an accurate appraisal of a sustainable home should emphasize comparable in-market sales, comparable energy savings, and the nature and cost of any meaningful sustainable improvements that have been made. His hope is that, before long, states will require appraisers to account for these very important home enhancements.

Right now, however, the emphasis is on comparable sales, so it’s still up to the homeowner or the buyer to “fight the good fight” specifically when it comes to dealing with lenders. To Porter, they represent the ‘missing link’. Once those who control the money demand appraisals that allow for sustainability, improvements will happen quickly.

So what’s the key takeaway from all of this? For homeowners and buyers, the post-bubble housing market has changed. For some, the changes are welcome. For others, they’ve been challenging at best. But as we move further into this new, post-bubble economy, it’s increasingly clear that homes that are smaller, more sustainable, and highly efficient are in greater demand – especially when the home’s performance is well documented.

Still, as Amanda Stinton points out, “There is no silver bullet. At the end of the day, every area is different, and the priorities of a region will dictate what sells.” She recommends that sellers (and buyers) do a little research to learn more about what’s trending in their market. That’s ultimately the best way to protect your interests in today’s rough and tumble, post-bubble real estate market.

* The U.S. Census Bureau pegs average pre-bubble home appreciation at 5% per year.

** The information in this article is intended solely to help homeowners and homebuyers better appreciate the value of sustainable building in today’s real estate market. It does not profess that adding sustainable features to a home guarantees a certain price or value. Rather, it proposes that, all things being equal, when you make your home more sustainable and, ideally, are able to document its performance, your home holds greater value to prospective buyers.