A Deeper Look At Arena s Belviq Pricing Arena Pharmaceuticals Inc (NASDAQ ARNA)

Post on: 16 Март, 2015 No Comment

Summary

- Lower price will drive new consumers and retain existing ones.

- More volume needed to get similar revenue.

- Build models and set expectations now, as it is to your advantage.

It has certainly been an interesting start to 2015 when you look at Arena Pharmaceuticals (NASDAQ:ARNA ). The equity closed out 2014 with a stock price of about $3.50, and as of this writing is trying to get to the $6 level. That represents a nice surge to start the year. It is my belief that the stock price surge was a combination of pipeline news and technical moves. Either way (or both), Arena investors are much happier now than they were just a few weeks ago.

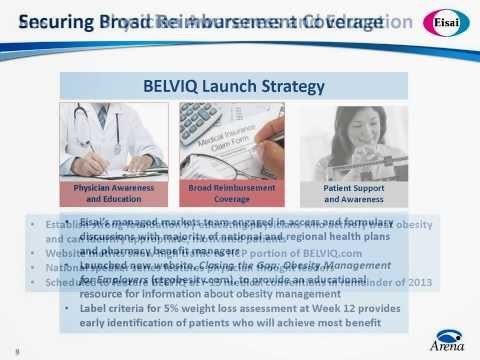

Part of the recent news flow for Arena has been an announcement of new pricing for the anti-obesity pill Belviq. While Eisai has not really released the full details on the new pricing, the concept is this. The maximum out-of-pocket expense for consumers will be $75. This will happen via increasing the scope of the discount program while preserving the wholesale price point of $199.50. In simple terms think of it as a rebate that feels automatic to consumers. The main reasons why this structure is important are as follows:

- The consumer has a simple process and is not chasing money.

- The wholesale price remains stable, which gives Eisai flexibility with the program. When insurance coverage gets better, the higher price point is still preserved.

- Eisai can book much more revenue by keeping the wholesale price high. Yes, the net revenue will shift, but the revenue line can still look better than it otherwise would have if the wholesale price was lowered.

- The heavy lifting in paperwork is now between Eisai and distributors and leaves the consumer out of the mix.

- Believe it or not, some consumers can not be bothered with discount programs of any sort and will simply pay the full price. This method allows Eisai to still get full price from some.

Ever since launch, I have carried a certain method to my assessment of scripts and revenue. Investors need to remember that Arena gets 31.5% of net revenue. In my models I have always carried net revenue at $110 per bottle, and thus Arena’s share is about $34.65 per bottle. The difference between gross revenue and net revenue has been some overhead costs of Eisai and the discount program. What investors need to understand is that the discount program is now shifting, and thus Arena’s revenue will shift as well.

The speculation is that the price of Belviq will now be a maximum of $75 out-of-pocket for consumers. Essentially the discount card went from $75 to $125 or more (depending on several factors). This will mean, in my opinion, that the maximum amount for net revenue will be about $75 instead of the $110 that we saw in the past. Realistically, there are other costs to consider. It will take time to assess how this all impacts Area, and we may not get any real flavor until a quarterly report. That being said, we need to start somewhere in terms of a model. I am now going to use $67.50 as a net revenue for Belviq. This would mean that the Arena share would go down to about $21.27 per bottle.

Before moving forward, let’s assess why this is happening and why the move can be a sound business decision. It is common knowledge that price point was a key hurdle for Belviq. The impressive launch of Contrave from Orexigen (NASDAQ:OREX ) at a low price point proved this. More proof is in a statement made by Arena CEO Jack Lief. Mr. Lief stated in a recent press release that 275,000 patients have tried Belviq. Since launch IMS estimates that about 586,000 scripts have sold. Symphony Health may have the number as high as 640,000. Either way, the numbers show that the average person has been on this drug less than 3 months. There are only two reasons why this would be the case. The first is that the drug is not working well enough. The second is that consumers do not want to pay the asking price. We know that the drug works for many, so the second reason is the most likely.

In concept, if the price is lowered, more consumers will come in. Additionally, more consumers that are already in may continue the drug longer. The idea is to make up for the price cut via more sales volume. This is something that investors need to consider closely and grasp. My old model anticipated 2015 sales at about 1,000,000 scripts for Arena revenue of about $35 million. With the new pricing, scripts will now need to be at 1,646,000 to achieve the same goal. Using real world numbers, 16,460 scripts under the new pricing deliver the same revenue as 10,000 scripts under the old pricing.

Previous to this news I had outlined my estimates for 2015. That model called for script sales to be at 1 million for 2015. At that time, some of my critics called for scripts of 1.5 million, 2 million, and some as high as 3.5 million. Clearly, with new pricing, the script volume will need to increase by about 65% in order to attain the same revenue. Those that were looking for 1.5 million will now want to look for 2.46 million. Those that were looking for 2 million will want to look for 3.3 million, and those that were looking for an astounding 3.5 million will want to model to 5.78 million. Personally, I like to deal in realistic projections rather than hyperbole. What we want to see is $35 million in sales revenue to Arena. That would represent 100% growth over 2014. The new level of scripts needed to obtain that type of revenue is 1.646 million.

Chart Source — Spencer Osborne

The next few weeks could be very interesting as this new price point rolls out. Investors that follow the equity closely will have a substantial advantage as things play out. Once the new pricing is announced and known to consumers and doctors, the number of scripts should jump nicely. This will provide a catalyst in the stock because most simply do not follow close enough to know that this jump is expected and needed. What savvy investors will be doing is seeing whether the jump is demonstrating enough sales volume to make up the revenue. This will take a few weeks to all simmer down, but the reality is that there will be perception that the revenue number will be as impressive as the jump in scripts. Because readers follow this more closely, you will know the correlations needed and be able to assess the revenue of the company ahead of everyone else.

A note of caution is this. We need to see sales levels increase substantially rather quickly. If 4 to 6 weeks has gone by and we are not seeing sales levels track upward by 65%, then we need to be more cautious. For 6 weeks and beyond, we will want to assess the refills and see if traction is gaining there as well. Some do not think tracking sales weekly is relevant. I find the information quite useful in that it keeps me well grounded on what to expect in the revenue line. Stay Tuned!

Disclosure: The author is long ARNA. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.