5 Steps to a Perfect Retirement Plan with 401k IRA and Roth Accounts

Post on: 1 Апрель, 2015 No Comment

T his is the thirtieth day in our 31-Day Money Challenge. Over 31 days well publish 31 podcasts, each designed to help you move closer to financial freedom. Yesterday was all about mortgages. In todays podcast, we cover the basics of retirement accounts (401k, IRA, and Roth accounts).

Sponsors. The 31-Day Money Podcast is sponsored by Betterment and Personal Capital. Betterment and Personal Capital are two tools I use to make investing easier, less expensive, and more effective.

401k vs IRA vs Roth Retirement Accounts

Lets review.

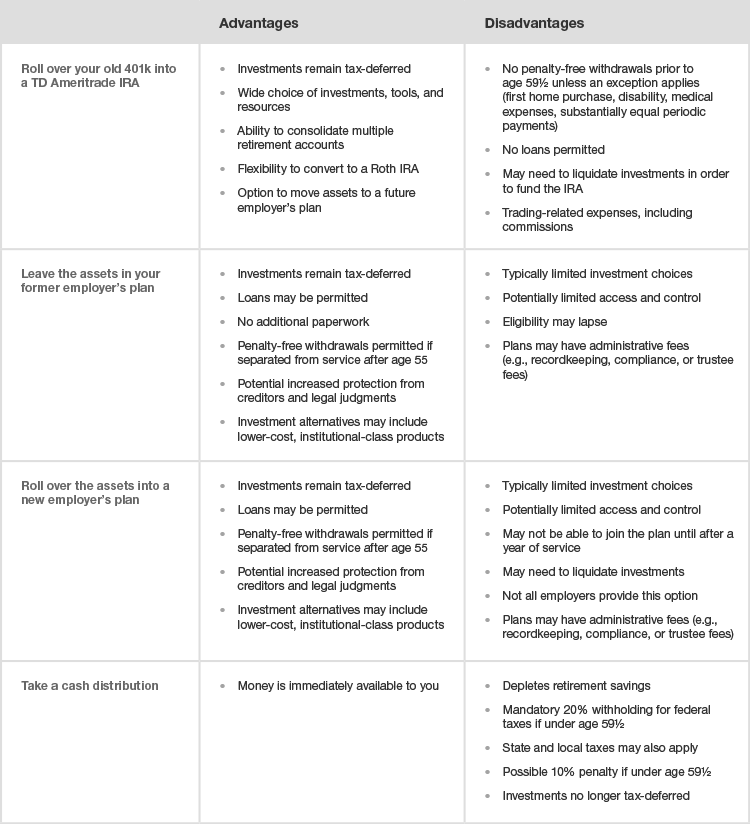

401k and 403b Workplace Retirement Plans. If an employer offers one of these retirement plans, it enables employees to contribute pre-tax dollars toward retirement. In 2013 and 2014, the maximum annual contribution is $17,500. Those 50 or older can contribute a total of $23,000. Taxes are generally assessed for any amounts withdrawn from the account, and a 10% penalty is imposed for certain non-qualified withdrawals, including those that occur before the account owner reaches 59 1/2. Investment options are typically limited to those made available by the plan.

Roth 401k. Contributions are made on an after-tax basis. While there is no tax advantage at the time of the contribution, money in a Roth 401k grows tax free. The same contribution limits that apply to a traditional 401k also apply to a Roth 401k. Unlike a Roth IRA (see below), there are no income limitations. Anybody can contribute to a Roth 401k if the employer makes this type of retirement account available.

Deductible IRA. For those with earned income, contributions can be made to an IRA up to the annual limits. In 2014, the contribution limit is $5,500, or $6,500 for those 50 or older. Whether the contribution is deductible depends on a number of factors: your modified adjusted gross income, whether you or your spouse have access to a workplace retirement account, and your filing status. IRS Publication 590 (pdf) provides tables to help you determine whether your IRA contributions are deductible.

Roth IRA. A Roth IRA works much like a Roth 401k, but with a few exceptions. First, there are income limits that prevent some from contributing to a Roth IRA. Those limits are outlined in IRS Pub 590. Second, for those who do qualify for a Roth IRA, the contribution limits are the same as those for a deductible IRA. While those that qualify can contribute to both a deductible IRA and a Roth IRA in the same year, total IRA contributions cannot exceed the $5,500 or $6,500 limits.

Finally, note that the above limits change from year to year.

Where to Invest First

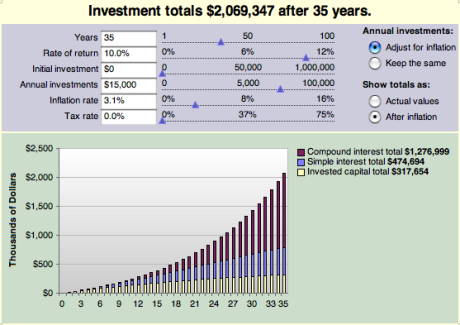

With all of the above options, saving for retirement can feel overwhelming. Heres a 5-step program to determine what retirement account options are best.

Step 1: Take full advantage of an employer 401k match

The first step is the easiest. For those with a 401k that offers an employer match, this is the first place retirement savings should go. Theres no reason to pass up free money.

Step 2: Invest in a Roth retirement account, but only if.

For those that qualify for a Roth IRA or have access to a Roth 401k, the next step is to consider these types of retirement accounts. The primary factor to consider is tax rates both when contributions are made and in the future when withdrawals are taken during retirement. If the tax rates are identical, there is no advantage to a Roth over pre-tax retirement accounts in terms of retirement savings (Roth accounts have certain estate planning advantages to consider). The real advantage of a Roth comes when tax rates are lower when the contribution is made then they are when money is withdrawn during retirement.

Of course, its impossible to know with certainty what tax policy will be decades from now or what our individual financial circumstances will look like. As a general rule, however, those in the lower federal tax brackets are in the best position to benefit from a Roth. Why? Because they are more likely to see their tax rates move higher during retirement. Theres no guarantee that this will be the case, but its a reasonable option. Those in the higher tax brackets are less likely to benefit from Roth retirement accounts.

Step 3: Contribute to your 401k limit, but only if.

If at this point the 401k contribution limit has not been reached, the third step is to consider maxing out an available 401k. Many recommend first contributing to an IRA. The primary reason for this advice is that many 401k plans have high fees and offer very expensive mutual funds. While this is certainly true, theres no reason to assume that your 401k has bad investing options. So check your 401k first to see what it does offer. If a 401k does offer low cost investing options that fits with your investment plan, max out your 401k. If it doesnt, or if you still have additional money to save for retirement after contributing the maximum to a 401k, move to step 4.

Step 4: Maximize your IRA contributions if they are deductible

The benefit to an IRA is that you have total control over your investments. An IRA can be opened at Vanguard to take advantage of its low cost funds, Betterment, or even one of several low cost online brokers. For those that didnt open a Roth IRA in step 2, contributing to a deductible IRA (assuming you qualify), is an excellent option. It does involve a little more work than contributing to a 401k, but once its set up, monthly contributions can be automated.

Step 5: Reconsider your 401k

If you skipped over your 401k in step 3 because of its investing choices, now is the time to reconsider this option. At this point you have already taken advantage of any employee match. Youve already consider Roth accounts. And for those that qualify and who didnt take advantage of a Roth, you have already maxed out a deductible IRA. What remains is the 401k. If you can find some investment options that are reasonable, max out your 401k as the final step.

As you can tell, there are a lot of judgments that go into these decisions. While Ive outlined my approach above, there really is no one single right answer. The key is to do you homework, evaluate your circumstances, and make a reasonable decision that works for you and your family.