401(K) Losing Value

Post on: 22 Октябрь, 2015 No Comment

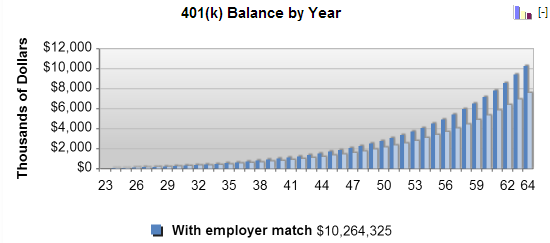

This past week my workplace was abuzz with conversations regarding how much money people lost in their 401(k) plans. Im sure similar conversations were going on just about everywhere. With the recent difficulties in the market place and the worldwide economy. its almost inevitable that you lost some money in your retirement accounts. Ive lost quite a bit! But Im not overly concerned about it right now (partly because I have about 30 years until retirement). I know that corrections and even major drops like this will happen. I plan on staying the course and continuing to invest for my retirement. I

What you should do with your 401(k) in this market

Dont panic. Panic is never a good thing. Panic causes people to make irrational and often detrimental decisions. Look at your situation and assess your options.

Look at your asset allocation . If your retirement holdings are properly allocated, you are in a good position to weather the storm. Generally, the closer you are to retirement, the more conservative you want to be with your investments. The further out you are, the more flexibility you have in regard to risk. You may find that you need to make a few adjustments after the dust settles, but maintaining a good allocation will make it easier to get your portfolio back on track.

Dont withdraw your funds. Even though you may have lost money in your account, its better to leave your money in your 401(k) plan, otherwise you may face stiff early withdrawal penalties that will compound your current losses. Rebalancing your portfolio now and moving assets from equities into fixed return assets could be a case of selling low which is the wrong thing to do.

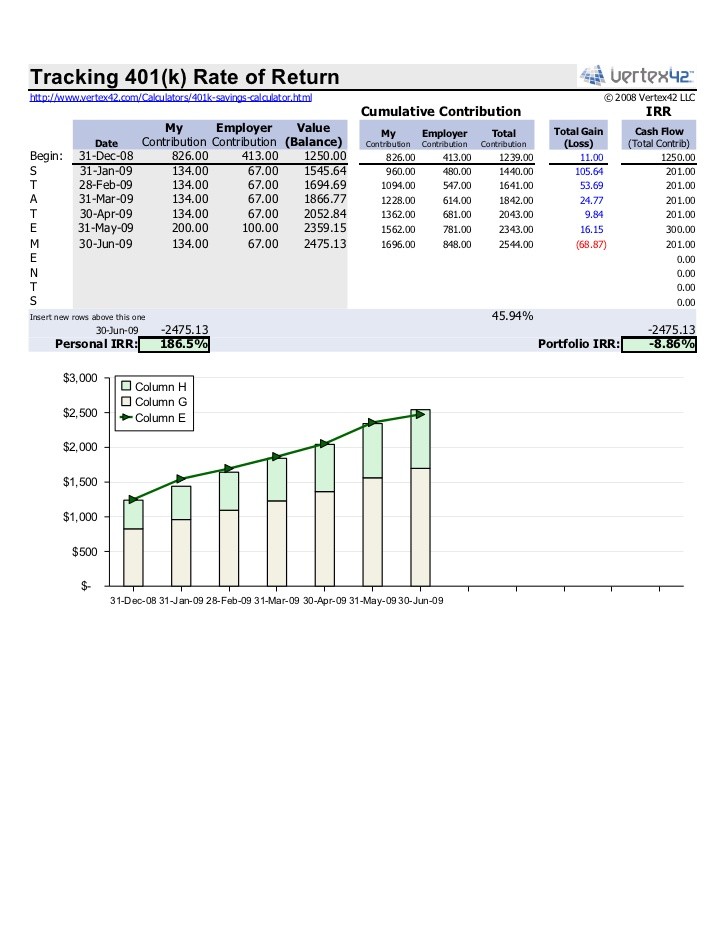

Continue your contributing to your 401(k). If you are uncomfortable putting your money into the stock market right now, then consider making your contributions into a cash or money market fund if you have one available. You can also consider maintaining your contributions in their current funds. Remember, with dollar cost averaging you will buy more shares when prices are low which is a good thing when it comes time to sell. Its true that the markets may continue to drop, but you never now when or how much. The more money you get in at lower prices, the more money you can potentially make when the markets increase.

Im holding steady

Ive lost quite a bit of money in the last few weeks and it hurts to look at accounts that are 40% lower than they were just a couple months ago. But Im looking at my 401(k) account (and my IRAs and other accounts) for what they are retirement accounts. I have 30 years before I will be eligible to make withdrawals and I know that between now and then the markets are bound to recover. My job now is to make sure I stick to my game plan and maintain a solid asset allocation. The more money I pump into my retirement accounts now, the easier my life should be when I reach retirement age. And I know that old me will thank young me for sticking to the game plan, even when it looked like the sky was falling.