11 New Leveraged ETFs Coming Soon From Direxion

Post on: 1 Май, 2015 No Comment

New Innovative Leverage Funds in the Direxion Pipeline

You can opt-out at any time.

Please refer to our privacy policy for contact information.

As of today, there are quite a few 2x and 3x leveraged ETFs on the market, but one of the top ETF providers, Direxion Investments, is bringing a new innovation to the leveraged exchange traded fund category with 1.25 x leveraged ETFs. The financial firm has filed for 11 new ETFs that will have a 1.25 leveraged correlation with their underlying benchmarks.

- Direxion Daily 7-10 Year Treasury Bond Bull 1.25 X Shares ETF

- Direxion Daily 20+ Year Treasury Bond Bull 1.25 X Shares ETF

- Direxion Daily FTSE Developed Markets Bull 1.25 X Shares ETF

- Direxion Daily FTSE Emerging Markets Bull 1.25 X Shares ETF

- Direxion Daily Mid Cap Bull 1.25 X Shares ETF

- Direxion Daily Small Cap Bull 1.25 X Shares ETF

- Direxion Daily Russell 1000 Growth Index Bull 1.25 X Shares ETF

This list of the new 1.25 leveraged funds also includes some inverse ETFs, as well as style ETFs, bond funds and developed and emerging market ETFs. However, as of now, the launch dates and tickers for each of these ETFs are not yet public. And it has not been confirmed if the funds will all roll out at once or if they will have different launch dates. Once the details of that information becomes available, I will let you know right away. In the meantime, if you want to see similar funds you can always check out the.

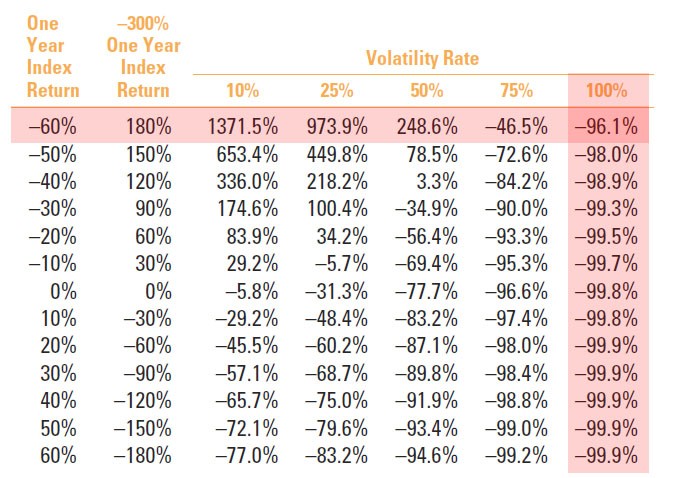

And for those investors who are new to leveraged (and inverse) ETFs, please keep in mind that these products are for advanced trading strategies and not for the novice investor. Yes, they can give an investment a leveraged return on the daily performance of the benchmark (important to note that it is daily performance), but these types of funds can also carry increased risk. So be sure you understand how these funds work before making any trades.

You can learn more about leveraged and inverse funds by reading these articles.

And even after reading up on these products, still conduct your due diligence. Make sure you research any funds that you may target for investment. Watch how the funds react to different market conditions, understand how they will impact your portfolio, and take a look under the hood and see what is actually in the fund. Many of these funds contain derivatives such as options and futures. So it’s important to understand how these products work as well.

As I said, these are not your momma’s ETFs, so understand the risks before you dive in. And if you have any questions, be sure to consult a financial professional such as your broker or a financial advisor.

As for Direxion Investments, they are an industry leader in the world of ETFs and have been providing exchange traded products since 1997. They currently have over 50 funds in their current lineup along with the above eleven ETFs coming soon.

And they not only carry ETFs, but they offer over two dozen mutual funds as well. So they are well diversified in their financial assets and you can get full details about the company and all of their offerings on the official Direxion Investments website .