Where to Invest 2012 Foreign Stock Funds & ETFs

Post on: 18 Июль, 2016 No Comment

Foreign Outlook, Strategies, Funds and Indexes for 2012

You can opt-out at any time.

Please refer to our privacy policy for contact information.

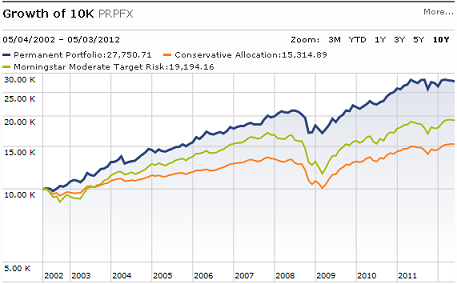

Where to invest in 2012 will be challenging, especially for foreign stock. As always, foreign (international, global, emerging markets) stock can play in important role in a diversified portfolio. How can investors balance risk and growth with foreign stock in 2012?

Factors Influencing Foreign Stock in 2012

2012 carries the same overall theme for international investing as 2011 — the sovereign debt crisis makes foreign stock a higher risk area for the year but investors can use a balance of caution and skill to minimize risk but maximize chances for better possible returns.

In 2009 and 2010, investors who were willing to stick their necks out after the terrifying credit crisis and Great Recession in 2008, were rewarded greatly for venturing into foreign stock. especially emerging markets (e.g. China, India and Brazil), at that time. Now, considering the immense uncertainty surrounding the European debt crisis and China’s economy looking more and more like recession, foreign investing carries greater potential market risk when compared to US (domestic) stock investing.

Strategies & Foreign Stock Funds for 2012

There are three basic strategic routes mutual fund investors can take with foreign stock investing in 2012:

- Choose Geographic Regions: This strategy carries the greatest potential market risk because even a knowledgeable and skilled investor can make large mistakes by concentrating significant amounts of a portfolio into just a few select countries or regions of the world. However, the investor choosing to concentrate in certain countries or regions is likely to be an aggressive investor willing to take such risk for the prospects of being rewarded with higher returns. For example, if an investor believes the European debt crisis will be contained in 2012, they could select a mutual fund or Exchange Traded Fund (ETF) that invests primarily in Europe. This investor will want to look at the mutual fund or ETF category called Europe Stock. Similarly, an investor could choose the Pacific Rim region, which includes China, Japan and Australia, or Emerging Markets, which includes China, India and Brazil.

Disclaimer: The information on this site is provided for discussion purposes only, and should not be misconstrued as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities.