Wash Sale Rules for Traders

Post on: 1 Декабрь, 2016 No Comment

Generally, the wash sale rule applies to traders the same way it applies to investors. The difference is that traders have a much harder time keeping records relating to wash sales because they engage in so many transactions.

The wash sale rule basically says that if you sell a stock or securities at a loss and buy replacement stock or securities 30-days before, or 30- days after the sale of substantially identical stock or securities, you can’t deduct the loss. This rule does not apply to gains—only to losses. Naturally, the IRS wants to tax all of your gains. The best way to show the impact of the wash sale rule is through an example:

On October 20, 2003 you purchase 1000 shares of Microsoft at $35 a share. On December 15, 2003 you sell the 1000 shares in Microsoft at $15 a share and realize a $20,000 loss. On January 5, 2004 you buy back 1000 shares of Microsoft at $15 a share. Unfortunately, because of the wash sale rules, your $20,000 loss in 2003 is disallowed.

If you wind up with a wash sale, add your disallowed loss to the basis of your replacement security. Your new basis is the purchase price of the replacement, plus the loss you couldn’t take, plus fees related to the security’s purchase. This means your loss is postponed; it’s not gone forever. In the above example, your basis in the Microsoft stock you repurchased on January 5, 2004 would be $35 a share ($15 purchase price + $20 loss on the sale) and not the $15 a share you purchased it at.

The definition of replacement stock is not obvious either. The IRS says it can’t be “substantially identical” to the security you sold. It’s easier to differentiate stocks in different corporations than it is mutual funds, as no stock in one company is substantially identical to the stock of another company, even within the same industry. After all, each company differs from others in numerous ways.

With mutual funds though, replacement purchases get sticky. If two different funds track the same index and share virtually identical performance, they’re considered substantially identical. Eliminate this problem by buying a mutual fund that moves in the same direction as the one you sold, but one that tracks off a different index.

When you sell the replacement security at a profit later, your basis will be higher, so your gain will lower. The end result? Less tax on a smaller gain. If you sell lower than your replacement security basis, your loss will be larger than it would be if based on the repurchase price alone, so you eventually get the recovery. All is not lost; the wash sale rule operates to defer recognition of the loss, not disallow it forever.

When you make a wash sale, your holding period for the replacement stock includes the period you held the stock you sold. This rule prevents you from converting a long-term loss into a short-term loss.

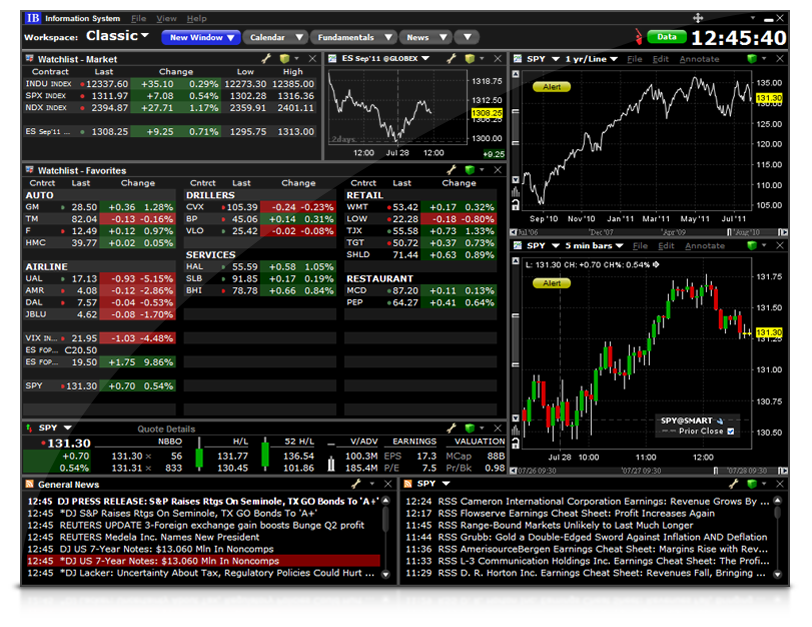

Most investors run into the wash sale rule only occasionally. If you’re an active trader, you’re likely to have a large number of wash sales each year. All is not lost; there are several ways to avoid having to deal with the wash sale rules that I will cover next.

Two Ways to Avoid Wash Sales

If you make hundreds or thousands of trades each year, it’s nearly impossible to comply with wash sale record keeping rules. But active traders have several ways to eliminate this problem.

The first way to avoid the wash sale rule is to simply wait for 31 days after you sold the stock or option before you buy it back. The second way, which is only available to traders and not investors, is to elect the mark-to-market accounting method. Full details of the mark-to-market election are beyond the scope of this article, but it’s worth pointing out that a trader who makes the mark-to-market election isn’t subject to the wash sale rule.

There are some other important things you need to know if you’re thinking of making this election. If you make the mark-to-market election:

All your trading gains and losses will be treated as ordinary gain or loss, not capital gain or loss.

Any stock or other trading asset you hold at the end of the year is marked to market. This means you report gain or loss as if you sold it at the close of business on the last trading day of the year for its fair market value.