Using Open Interest To Find BullBear Signals_1

Post on: 28 Декабрь, 2015 No Comment

How does it all work?

It is a bit complex. The great thing is we keep it all simple!

The purpose of this Signal is to not to try to buy at the bottom and sell at the top (though that would be nice). It is also not to enter and exit multiple times in a year (not more than 3) (This is due to many mutual funds will not allow multiple entries and exits).

The goal is to capture a majority of the uptrends while avoiding a majority of the downtrends. See the historical charts below to see how it has performed.

The basic explanation of how it works is the price must close above the apex volatile trendline, and the trendline must close above the 50 day moving average (see charts below). A stop is set and moved up once it can be moved above the entry. It is continually moved up to lock in additional gains. Seasonality, Technical Indicators, Statistics, and Fundamentals all play a role.

Again we keep it simple so you don’t have to worry about the overcomplexity. We do all the analysis and post in a couple simple sentences & video the most current signal and stop inside the subscription site and send out the alerts in email and mobile text private labeled to your subscribers for you.

The entire signal is based on the SPX and then applied to all funds simultaneously. When a signal is given the following days price is used to track the performance in the mutual fund analyzer for all the funds since funds can only be entered exit on the close of the day. So the dates shown below reflect the signal being sent out one day earlier to allow for the following days price to be used (i.e. Bull signal on 3/5/2010 was given on 3/4/2010).

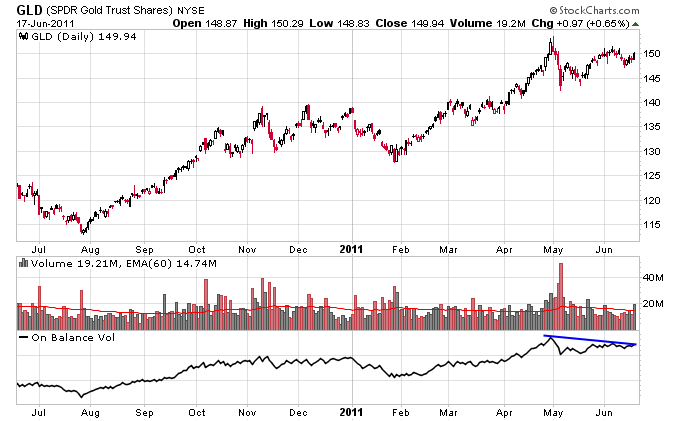

2011 Chart (A Volatile Year With A Plan. )

One of the choppiest years in history with massive swings but in the end a flat year. In fact the flattest year on record for the S&P 500 Index.

Subscribers were able to navigate an extremely volatile year with a solid plan despite the ongoing turmoil in Europe (Portugal, Italy, Ireland, Greece, & Spain), N. Korea Leadership Change, and with the US Congress Budget Gridlock Battles.

A Bull Signal on 3/28/2011 (A little lower buy then the beginning of the year!) & A Bear Signal on 8/3/2011 (Right before a double digit percentage drop in the market)!

A Bull Signal on 12/30/2011 (A lower buy entry than where we exited on 8/3/2011) & A Flat Signal on 12/30/2011 (Plus those who followed the non-seasonal trailing stop caught the big up move in early 2012))!

2010 Chart (Despite the Flash CrashAnother Great Year!!)

A Bull Signal on 3/5/2010 (A little lower buy then the beginning of the year!) & A Bear Signal on 5/5/2010 (Right before the flash crash)!

A Bull Signal on 8/3/2010 (A lower buy entry than where we exited on 5/5/2010) & A Flat Signal on 12/31/2010 (Caught a solid up move for the New Year choppiness))!

2009 Chart (The Bailout Causes a Bull MarketAnother Great Year. )

A Bull Signal on 4/6/2009 (A little lower buy then the beginning of the year!) & A Bear Signal on 12/30/2009 (We caught a majority of the uptrend)!

2008 Chart (Its Not What You MakeIts What You KeepAnother Great Year. )

A Bull Signal on 4/1/2008 (A little lower buy then the beginning of the year!) & A Bear Signal on 5/27/2008 (Very small positive but nevertheless a profit one to come back within full throttle for 2009)!

Most people would have loved to see a positive number in 2008 So overall Another Great Year!)

2007 Chart (The Financial Crisis BeginsWe Have Another Great Year)

A Bull Signal on 4/11/2007 (Avoided a lot of volatility from the beginning of the year!) & A Bear Signal on 06/08/2007 (We caught a majority of the uptrend and avoided a big down move)!

A Bull Signal on 9/19/2007 (Avoided a lot of volatility from the beginning of the year!) & A Bear Signal on 10/17/2007 (We caught a small move and then avoided a major down move)!

2006 Chart (Another Great Year)

A Bull Signal on 6/3/2006 (We avoided the flat and somewhat volatile first part of the year!) & A Bear Signal on 12/29/2006 (We caught a majority of the uptrend)!

2005 Chart (A Great Year and A Good Start!)

The first SPX signal was given in 2005 when it was created.

A Bull Signal on 5/24/2005 (We avoided a very volatile first part of the year and entered slightly lower than the beginning of the year!) & A Bear Signal on 08/09/2005 (We caught a majority of the uptrend that buy and hold would have capture but avoided the volatility)!

A Bull Signal on 11/11/2005 (We avoided a major down move!) & A Bear Signal on 12/30/2005 (We captured a small trend and avoided the stagnant following 6 months)!