The Difference Between Yield and Total Return

Post on: 31 Июль, 2015 No Comment

You can opt-out at any time.

Please refer to our privacy policy for contact information.

The primary purpose of most bond funds is to provide investors with income. But those who focus exclusively on a bond fund’s yield are only seeing part of the picture. Investors must also consider the fund’s total return. which is the combination of yield and the return provided by principal fluctuation.

The Two Components of Bond Funds’ Return

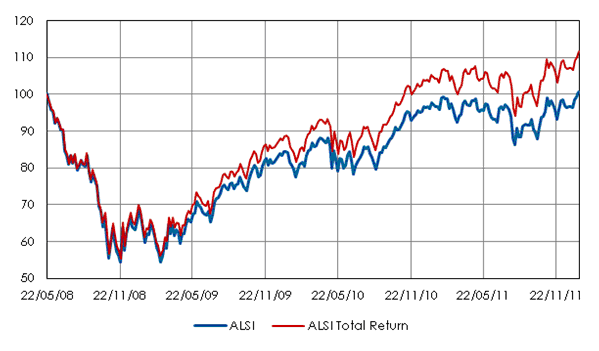

Yield is the income that a fund pays on either a monthly or quarterly basis. The investor can either take this income in the form of a check or reinvest it back into the fund to buy new shares. There are various ways to calculate yield, which can be a source of confusion to many investors, but these different numbers are explained in my article, What is a Distribution Yield? However, the bottom line is that if a fund’s share price didn’t change and it paid a 5% yield in a given year, the fund’s total return would be 5% for that year.

Unfortunately, it doesn’t work that cleanly in real life. In addition to the return provided by yield, the daily fluctuations in the share price (or “net asset value”) also make a contribution to return. In a given year, these fluctuations can cause the total return to be higher or lower than the fund’s yield. If a fund that yields 5% also has a 5% increase in its share price, its total return is 10%. If the same fund experiences a 5% decline its share price, the total return is 0%.

Depending on the type of fund, these fluctuations can have varying degrees of impact on return. For instance, high-yield and emerging market bond funds tend to have much greater volatility than a short-term bond fund that invests in higher-quality securities. Before investing in a fund, investors need to be sure they are comfortable with the potential volatility. While a fund that invests in high yield bonds may have a much more attractive yield than one that invests in higher-quality securities, the amount of principal fluctuation may not be appropriate for certain investors, such as those with a very low risk tolerance or who may need the money in a very short amount of time.

How do Capital Gains Distributions Affect the Fund’s Return?

Each year, many funds pay out capital gains on the money they have made from buying and selling securities. This is a complicated issue, but you can learn more by reading How are Mutual Funds Taxed? Still, here are some important highlights to keep in mind:

1) Capital gains result in an equivalent reduction in the fund’s share price; i.e. a fund with a $10 share price that pays a 20-cent distribution will see its share price drop to $9.80. As a result, the total return is the same regardless of the size of the distribution.

2) Investors can either reinvest the proceeds by buying more shares, or they can take the distributions as income. Either way, however, a person who holds a fund in a taxable account may have to pay taxes on the distribution – which means that your after-tax total return will be reduced in kind.

3) The total returns quoted in the media and on fund companies’ websites assume the reinvestment of all dividends and capital gains.

4) Unless you need the money to pay expenses, it’s preferable to reinvest distributions since it allows the power of compounding to work in your favor.

The Bottom Line

Investors need to take care not to confuse yield with total return. Just because a fund has a reported yield of 7% doesn’t mean that’s what you can expect to make in a given year – in fact, your actual return is likely to be substantially different.

Learn more:

Disclaimer. The information on this site is provided for discussion purposes only, and should not be construed as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities. Always talk to a financial and tax advisor before you invest.