The Best EmergingMarket ETF for You

Post on: 29 Сентябрь, 2015 No Comment

Credit: epSos .de via Flickr.

It’s smart to diversify your portfolio with a selection of international stocks. Among those, emerging-market stocks hold the greatest growth potential. And the simplest way to own a broad swath of high-growth foreign stocks is through an emerging-market ETF.

Exchange-traded funds, commonly known as ETFs, are similar to mutual funds in that they contain a bunch of different securities. They’re also like stocks in that you can buy and sell them by the share at any time during the trading day.

So which emerging-market ETF is best for you?

What not to look for

The worst way to find the best emerging-market ETF is to look for one that has performed the best lately. The Market Vectors Egypt ETF is a good example: While it has surged about 60% over the past year, a closer look will reveal a 52% drop in 2011, which shows that it’s a volatile holding. A glance at recent world news, meanwhile, will remind you that Egypt isn’t a politically stable country at the moment, and indeed, much of the Middle East is in turmoil. Too often, misguided investors are drawn to stocks or funds that have soared recently. It’s important to remember that they can drop back down in short order, especially if they’ve gotten ahead of themselves.

It’s not safe to look for a high average annual gain over the past few years, either, as the ETF may have had a single blockbuster year that boosted its average return considerably. The Vanguard FTSE Emerging Markets ETF ( NYSEMKT: VWO ). for example, surged 75% in 2009 — a feat it’s unlikely to repeat often — while it lost value in 2011 and 2013. Emerging-market ETFs tend to be quite volatile — some more than others. But that’s not necessarily a problem, so long as you’re prepared for that volatility and don’t expect every year to offer double-digit gains.

What to look for

Fees are a major consideration, as they can make a big difference in your performance. The folks at ETF Database list 88 emerging-market ETFs with expense ratios (i.e. annual fees) ranging from 0.14% to 1.29%. If you pay an extra percentage point in fees, that reduces your returns by an entire percentage point, which adds up over time.

You can also look into the recent holdings of various ETFs at sites such as Morningstar.com. If you favor established large-cap companies over small up-and-comers, for example, the Schwab Emerging Markets Equity ETF ( NYSEMKT: SCHE ) holds roughly 600 securities, mostly large-cap companies. (It also boasts the lowest expense ratio, at 0.14%.) You can focus on particular regions, too, without being specific to a single country. The iShares Asia 50 ETF. for example, offers instant access to about 50 Asia-based companies. You can also peek inside broad emerging-market ETFs to see how their assets are allocated to various regions. That way, if you’re not confident in one region’s future, you can decrease your exposure to it.

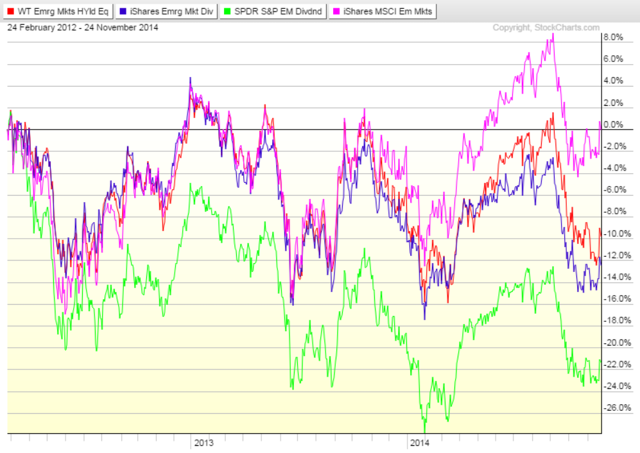

If you seek dividend income from your emerging-market ETF, yields recently ranged from zero to nearly 5%. The iShares Emerging Markets Dividend ETF ( NYSEMKT: DVYE ) yields about 4.6% — but it has underperformed the average emerging-market ETF over its short life of less than two years. That’s not necessarily a deal-breaker, but it’s worth noting. (Note, too, that its lower return is offset significantly by its dividend.)

Consider the size of any ETF you look at, too. When an ETF is fairly small — i.e. when its assets total a few hundred million dollars or less — beware of potentially large spreads between its bid and ask prices. Consider using a limit order if you want to buy in.

A fine contender

So what’s the best emerging-market ETF for you? That will depend on your needs and preferences. One ETF you should consider is the Vanguard FTSE Emerging Markets ETF. For one thing, it offers one of the lowest expense ratios around, at 0.15%. That’s a big advantage over competing ETFs, as it lets you keep nearly all your gains. Its dividend yield, recently near 2.5%, is much more substantial than the puny payouts of some peers. If you’re looking for broad global representation and are most hopeful about Asia’s growth prospects, this ETF again fits the bill. It has more than 900 holdings distributed around the world, with nearly 60% of its assets in Asia and roughly 20% apiece in Europe and the Americas. Most of its holdings are large-cap companies, too, offering some ballast. The ETF’s future counts much more than its past, but it has outperformed most of its peers in its lifetime. For long-term investors who are looking to diversify their portfolios and can stomach some volatility, this Vanguard ETF is a promising buy.

Top dividend stocks closer to home

The smartest investors know that dividend stocks simply crush their non-dividend-paying counterparts over the long term. Thus, our top analysts put together a report on a group of high-yielding stocks that should be in any income investor’s portfolio. To see our free report on these stocks, just click here now .