TargetDate Funds Selecting Investment Plans

Post on: 16 Март, 2015 No Comment

Autopilot technology found in commercial airplanes has made flying less complicated and more convenient for passengers and pilots. Target-date funds attempt to create the same simplicity and convenience for investors who lack the time or desire to research their investment choices. But is it a wise choice for you? Are human pilots obsolete? Target-date funds automatically adjust the risk in your account based on how close you are to a specific future date, such as retirement. But you should know how to fly the plane before you fire the pilot.

While target-date funds have recently gained popularity, we dont advise this type of investment regularly. However, if you are going to use them, keep these tips and risks in mind.

A fund for the hands-off investor

Which do you invest more time in: planning for a vacation or planning for your financial future? We hope you spend more time planning for your financial future but, if you chose the former, you may like the set it and forget it mentality of target-date funds.

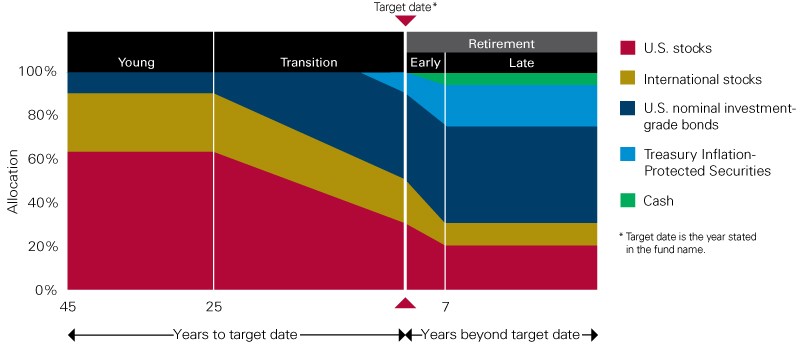

The structure of a target-date fund will typically place younger investors in a relatively risky allocation, which gradually becomes more conservative as they approach retirement. The theory is that younger investors can handle larger losses because they have more time to recover. As retirement approaches, allocation shifts to less volatile assets, such as a fixed-income securities. This automatic shift over time allows investors to plan ahead and spend less time worrying about it later.

Selecting a target-date fund

With any fund, you need to do research. Target-date funds are a relatively new idea, so it can be challenging to evaluate their limited past performance. Our investment advisors can help you research a companys past investment history and performance.

Once a fund is chosen, selecting the right date can be just as difficult as selecting the right fund. It is considered more risky to choose a target date identical to retirement because it leaves little room for error. For example, investors who selected a target date of 2010 may have had to delay retirement due to the markets prior losses. Significant losses in the years just preceding your target date can delay retirement considerably. Try selecting a target date five or ten years before you hope to retire. This allows you to make adjustments since the decisions you made twenty or thirty years ago may no longer align with your current plans.

Customizing a glide path

Glide path is the term used to describe how quickly and drastically allocation shifts from high risk to low risk. While nearly all investors agree that risk should decrease as retirement nears, there are varying differences in comfort levels from one investor to the next. What one investor considers a conservative plan, others may find too risky. Take the time to learn how risky your investments are and what your risk tolerance is.

Dangers of auto-pilot

No matter how much research and time you dedicate to choosing the right target-date fund, life and circumstances can creep in and it may not be a good fit a few years down the road. Perhaps you lose a job or have to dip into your savings and, as a result, what you once felt was an acceptable risk tolerance might come to feel unpredictable and frightening.

We encourage you to regularly visit with an investment advisor to better determine whether your current investments compliment your changing financial situation. With a target-date fund, it is not only you who becomes hands-off, but your advisor does as well. We believe a managed approach can meet better investment goals than an automated one.

While auto-pilot has drastically improved the airline industry, youll never see passenger planes without a pilot. A human can make decisions which computers or prearranged investing plans have not considered. Be wary of a vehicle touting complete automation.

Fund managers

Just like the best baseball players dont all play for the same team, the best fund managers dont all work at the same place. As such, you may be grouping your money with a poor performer when you use target-date funds. For example, your target-date provider may have a strong large cap fund manager but a weak small cap fund management team. This leaves your small-cap allocation at a disadvantage, because of the lack of fund management diversity, and not managed at its full capacity.