ShortTerm Capital Losses

Post on: 28 Апрель, 2015 No Comment

For shares held six months or less.

This page explains the special rules that apply to certain short-term losses from sales of mutual fund shares. These rules may convert some or all of your short-term loss into long-term loss — or into a nondeductible loss.

Overview

When a mutual fund pays a dividend, the value of the fund goes down by the amount of the dividend. For example, if your mutual fund shares are valued at $29.75 immediately before a dividend of $1.50 per share, the value will be $28.25 immediately after the dividend. No problem there — that’s just the way stocks work in general. But it means a special rule is needed for certain capital losses on mutual fund shares.

Suppose you bought the mutual fund shares just before the dividend and sold them shortly afterward. In that situation you might be able to claim a short-term capital loss that was really just a reflection of the dividend you received. If the dividend was an exempt interest dividend or a capital gain dividend, the combination of the dividend and the short-term loss would give you an unfair tax advantage. The special tax rules for short-term losses in mutual funds are designed to eliminate that advantage.

Capital gain dividends

Consider what would happen if you bought shares in a mutual fund at $29.75 just before the fund paid a capital gain dividend of $1.50. You’ll treat that dividend as long-term capital gain even if you held the mutual fund shares only a day before the dividend. Then you sell the mutual fund at $28.25 — the value right after the dividend. Under the normal rules, you would get a short-term capital loss. And that could provide you with a significant tax advantage if you also have short-term capital gains.

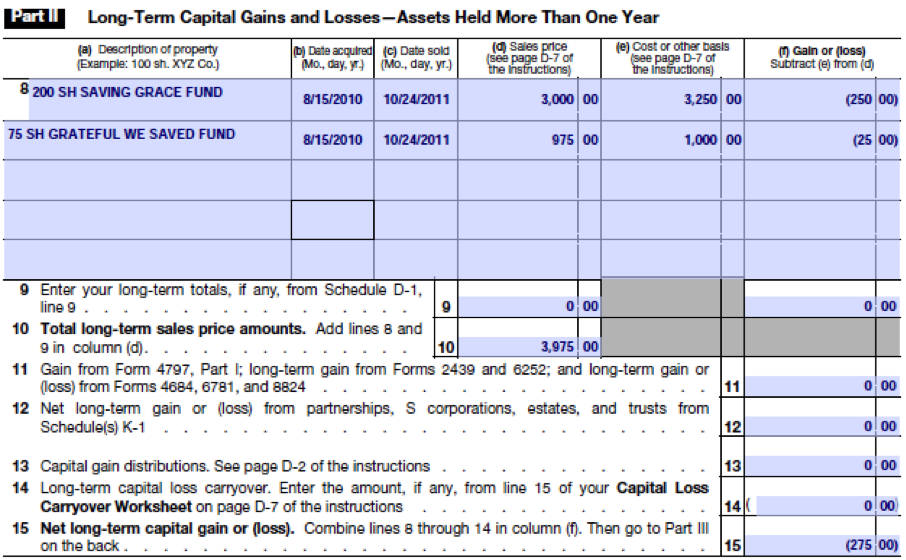

Example: Throughout the year you had $15,000 of long-term capital gain and $5,000 of short-term capital gain. Your short-term gain will be taxed at your regular marginal rate of 31%. Being a crafty investor, but unaware of the special rule we are discussing, you find a mutual fund that’s about to pay a capital gain dividend. You buy enough shares so you’ll receive a $5,000 capital gain dividend. Then you sell the shares for a $5,000 short-term capital loss. Now your totals for the year are $20,000 of long-term capital gain and $0 of short-term capital gain. The $15,000 long-term gain you had before is increased by the $5,000 capital gain dividend from the mutual fund, and the $5,000 short-term gain you had before is eliminated by the $5,000 loss on sale of the mutual fund shares. Your total amount of gain is still $20,000, but now it’s all long-term, meaning a lower rate of tax — if this special rule didn’t apply!

The rule applies only if you sell your mutual fund shares at a loss six months or less after you bought them. (It’s OK to sell less than six months after the dividend, as long as you held the shares more than six months.) Note that this doesn’t match up with the amount of time you need to hold the shares to have a long-term capital gain or loss. The idea is that if you’ve held the shares six months, that’s long enough so that your loss (if you have one) probably relates to genuine changes in the value of the mutual fund rather than the effect of a single dividend.

When the rule applies, you have to treat some or all of your short-term loss as a long-term loss. The amount that’s treated as a long-term loss is limited to the amount of the capital gain distribution or allocation you received. So if your loss is greater than the amount of that distribution or allocation, the remaining portion of the loss is treated as a short-term capital loss.

Exempt interest dividends

The same principle applies if you receive an exempt interest dividend and then sell shares at a loss. But in this case, your short-term loss becomes nondeductible.

Example: You buy shares in a municipal bond fund just before it pays an exempt interest dividend of $1,200. Then you sell the shares at a loss of $1,300. If you held the shares six months or less, you’re permitted to deduct only $100. The remaining $1,200 represents the exempt interest dividend you received.

This rule does not apply to nontaxable return of capital distributions. Those distributions reduce your basis in the mutual fund shares, so your loss calculation automatically takes this item into account. See Nondividend Distributions .

Related

- Capital Gains, Minimal Taxes (book covers material discussed in these pages)

- Your Investments (easy access to related IRS forms and publications:)

- Capital Gains and Losses (discussion forum)