Recent trends in Foreign Direct Investment

Post on: 16 Март, 2015 No Comment

Recent deterioration in the current account has been partly driven by a weaker primary income balance of which Foreign Direct Investment is a key component.

On 20 January 2015, the Office for National Statistics (ONS) published the latest estimates of Foreign Direct Investment (FDI) to 2013. This allows a detailed examination of recent trends in FDI statistics by country, component and industry. These detailed data may help to partly explain the recent weakness in the primary income account.

Figure 1 presents the difference between earnings from foreign direct investment abroad (outward FDI earnings) and from foreign direct investment in the UK (inward FDI earnings). Since 2004, the difference as a percentage of nominal gross domestic product has been positive, indicating that on average, earnings from investment abroad has exceeded earnings from investment in the UK. The difference was around 3% between 2004 and 2011, with the exception of 2008, but has fallen notably in both 2012 and 2013.

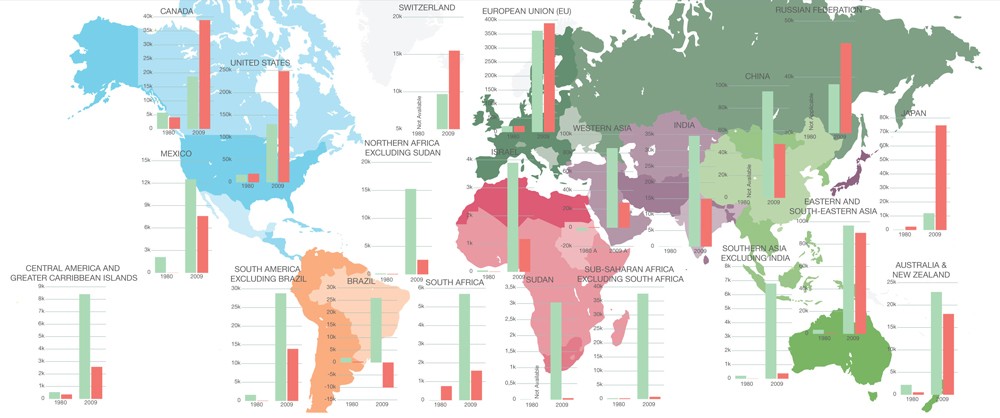

Prior to the fall in 2012 and 2013, Europe was the main contributor to the difference in earnings from investment abroad and in the UK. The Americas also contributed positively, except during the 2008−09 economic downturn, while the spread from Asia increased over the whole period.

Figure 1: Difference between outward FDI earnings and inward FDI earnings as a percentage of annual nominal GDP, 2004-13

Download chart

(18 Kb)

Since 2011, earnings from investment abroad and investment in the UK have converged. There are two significant contributory factors for this: changes in the stock of investment held by UK and foreign residents, and changes in the rate of return on these assets.

Figure 2 shows the stock of investment abroad (positive bars) and investment in the UK (negative bars), both historically dominated by Europe and the Americas. That said, in recent years other regions have accounted for a larger proportion of investment, particularly Asia, which may reflect strong economic growth in those areas.

The net position, shown by the black line, has been falling since 2011. This partly reflects investment into the UK growing at a faster rate than investment abroad. If the rate of return on both remains constant, this would result in earnings from investment in the UK growing at a faster rate than investment abroad, decreasing the positive investment position observed between 2004 and 2011.