Principal Protected Notes

Post on: 30 Июнь, 2015 No Comment

Investment Products that Combine Protection with Potential

a CIBC Principal Protected Notes (PPNs) offer principal protection, growth potential and diversification. Available with a wide variety of underlying assets (stocks, mutual funds, indices, commodities, currencies and interest rates), terms and features, CIBC offers notes that can meet your specific needs.

Want to buy CIBC Principal Protected Notes?

Contact your broker for available CIBC Principle Protected Notes. Get additional information on PPNs.

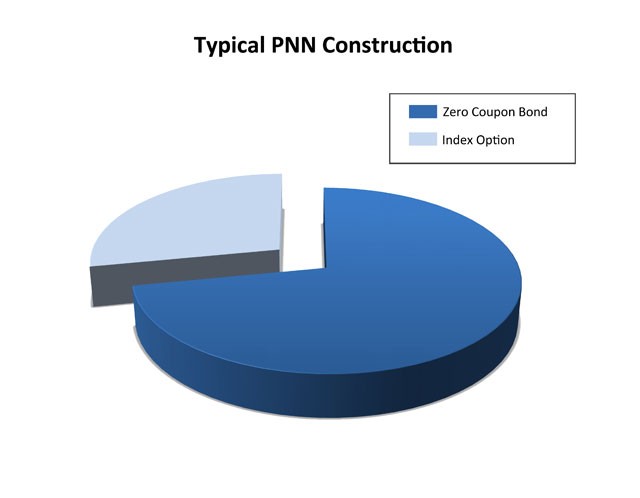

CIBC PPNs are innovative financial products that combine key investment characteristics of both stocks and conventional bonds. The distinguishing feature of these investments is that the principal amount — your original investment — is 100% protected as long as the PPN is held to maturity.

Benefits at a glance

Safety

- Regardless of performance, your full principal amount will be repaid at maturity

Growth potential

- The return of your CIBC PPN depends on the performance of the underlying assets. (It is possible that no interest may be payable)

Accessible

- Terms range from 3 to 8 years

- Available in a wide range of payment structures linked to a variety of underlying assets including stocks, mutual funds, indices, commodities, currencies and interest rates

- Some CIBC PPNs may also have caps, participation rates and/or other limiting features

Eligible:

- 100% RRSP and TFSA eligible

Is it right for you?

CIBC PPNs may be suitable if you:

- Prefer the safety of conventional bonds and GICs but seek higher potential returns

- Wish to participate in the potential growth of equity or commodity markets, without the risk of losing your initial capital investment

- Seek the potential to receive interest payments linked to the performance of the underlying assets

- Would like to include fixed-term investments as part of your portfolio

- Believe in a buy-and-hold investment strategy

- Generally prefer investments that do not require active management

CIBC PPNs may be an attractive investment alternative to both direct equity investing and traditional fixed income products. For more information, visit the CIBC PPN website.

CIBC PPN deposits are not insured by Canada Deposit Insurance Corporation. For a complete listing of CDIC eligible CIBC Deposits see CDIC Deposit Insurance Information .

Registered trademark of CIBC