Mutual Fund Classification Criteria

Post on: 14 Октябрь, 2015 No Comment

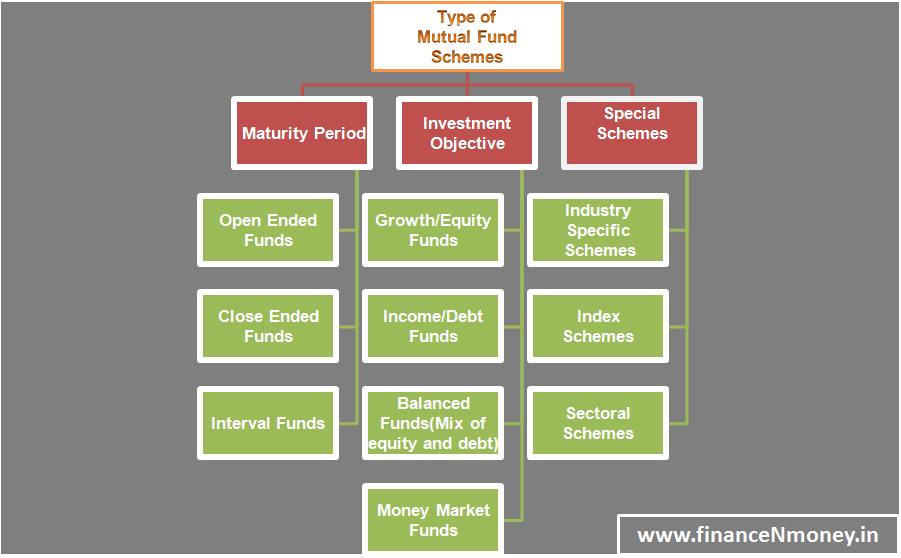

Mutual fund classification criteria are the factors used to categorize funds. There are many criteria that are commonly used to classify the various types of funds by what is generally referred to as type or category. These include types of securities, management style, average or median market capitalization, size measured in dollars, sector, industry, geographic coverage, and sometimes objectives.

With all these factors to consider, it’s easy to see that mutual fund classification could quickly run out of control, which is why the use of style boxes has become very popular as a means of simplifying fund classification. The use of style boxes to relate the basic nature of stock and bond funds is explained below.

The use of the classification criteria to categorize funds is explained in the next subsection, Mutual Fund Categories. If you’re already familiar with the classification criteria and their use for categorizing mutual funds, you can jump to a list of the various types of mutual funds. which has links to detailed descriptions of each type of fund.

Market capitalization is one of the primary criteria used to classify stock funds. Market capitalization refers to the total value of a firm’s outstanding common stock. A mutual fund’s median market cap would be the median of the capitalizations of all the stocks in the fund. Of course, this could cover a lot of ground and doesn’t tell you a lot by itself, you also need to know the breadth of a fund’s capitalization bracket. Market cap is one of the two criteria used in the 3×3 style box that has become a popular means of classifying funds.

The 3×3 style box is a graphical means of plotting market cap against investing style or, for bond funds, credit quality against interest rate sensitivity. The possible mutual fund classifications for stock funds are small, medium and large-cap managed by value, growth or a blend of value and growth, which results in nine possible combinations. For example: large growth or small value. The possibilities for bond funds are high, medium or low quality combined with low, medium and high interest rate sensitivity. For example: Intermediate U.S. Treasury bonds would be classified as high quality with medium sensitivity.

The 3×3 style box is a good place to start, as it will give you enough information to determine if a particular fund might be in the category you are looking for, but it leaves much to be desired. Very few funds that have been pigeonholed in this manner have been accurately described and adequately classified. This is primarily due to the fact that there are really four market cap brackets and stock mutual funds tend to span more than one market cap bracket.

A fourth market cap bracket needs to be added to the style box to differentiate between small-cap and micro-cap. Presumably, micro-cap is included in small-cap, but micro-caps are truly in a class of their own. And they can be broken down even further, as by Invetopedia, which is where I found the following definitions: Mega-Cap — over $200 billion; Big-Cap — $10 billion to $200 billion; Mid-Cap — $2 billion to $10 billion; Small-Cap — $300 million to $2 billion; Micro-Cap — $50 million to $300 million; Nano-Cap — Under $50 million.

There are only ten U.S. companies that fall in the Mega-Cap category, so it’s pretty safe to put them with the Big-Caps and refer to their bracket by the generally accepted term Large-Cap. In my opinion, for the purpose of classifying mutual funds, the upper end the Nano-Caps can safely be appended to the Micro-Cap category and the remainder probably are of no concern to us, as they would be so small that they probably couldn’t meet the listing requirements of any of the three major U.S. stock exchanges.

So, we’ve narrowed it down to four market capitalization brackets: large, mid, small and micro. However, we still need to address the issue of a fund spanning more than one bracket. This will require that you do a little additional research if you find a fund that looks like it might be a candidate for your portfolio. The spanning of multiple market cap brackets is discussed in the Mutual Fund Categories subsection.

The three types of investing style (value, growth and blend) also are inadequate for mutual fund classification. Aggressive growth needs to be recognized as a separate style, thus giving us four distinct styles that describe in part a fund manager’s investing strategy. You need to assure yourself that a fund is classified properly in terms of style and make the determination as to whether any particular fund that is classified as a growth fund could better be described as an aggressive growth fund. If the investment strategy stated in the prospectus is contrary to the style box, further investigation is warranted.

Now we’re up to a 4×4 style box, but it doesn’t include the geographic criteria. Mutual funds can be domestic (100% U.S.), international (0% U.S.), or global (anywhere worldwide). International funds need to be segregated by developed markets and emerging markets. World, a.k.a. Global, funds are usually restricted by their prospectuses as to the portion of the funds that can be invested in U.S. securities. As world funds cover both domestic and international securities, I’m going to leave them out of this discussion due to the lack of control over individual asset classes and the high probability of overlap between funds. World mutual funds are discussed in the subsections on International Stock Mutual Funds and International Bond Mutual Funds

A fund’s geographic coverage should be apparent in its name. If not, check the prospectus. Actually, it’s a good idea to check the prospectus anyway, just to make sure they are what they imply they are.

This expanded style box incorporates the three primary criteria for mutual fund classification discussed above and is what you should use when you are screening stock mutual funds for your portfolio.

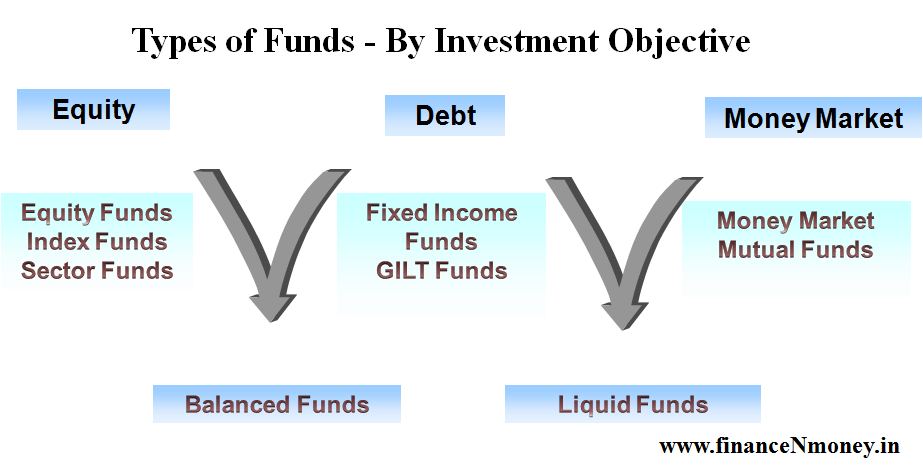

The types of securities a fund holds is also a significant factor in mutual fund classification. Very broadly, there are stock, bond, hybrid, balanced, commodity and money market funds. Where hybrid and balanced funds hold both stocks and bonds and money market funds are used as the cash component of your portfolio. But it gets much more complicated than that. For instance, if derivative securities are used extensively for any purpose other than plain vanilla hedging, a fund cannot be rightfully classified as just another stock or bond fund. Again, always read the prospectus, and stock and bond funds need to be further subdivided in your evaluation.

Stock funds can be broadly diversified across one or more market capitalization brackets, and some actually are. But many are specialized by market or industry sector, or they can be as narrow as a single industry. You will usually find the industry-specific funds lumped together with the sector funds. So, the term sector covers a lot of territory.

The size of a fund, as measured by the amount of money under management, is another criteria to be considered. This factor has varying implications for different types of funds.

A general stock fund that is broadly diversified across the large-cap and mid-cap brackets can be very large, as the fund has about 1200 stocks with market caps ranging from $2 billion to over $10 billion to select it’s investments from. Fairly large positions can be taken in the best of these companies without affecting the price of their stocks.

In contrast, a micro-cap value fund is relatively limited in size because it can’t take large positions in these small companies without affecting their stock prices. Even though there are over 2000 micro-cap stocks with market caps ranging from $50 million to $300 million, only a fraction of them will be good value plays at any given time, which diminishes the pool that a micro-cap value fund manager has to pick from.

Many sector funds and specialty bond funds also are limited in size due to having a relatively small pool of good investments to select from and are in many cases limited in the size of the positions they can take due to the size of the entities whose securities they are investing in.

You may find funds specializing in real estate included with the sector funds, which I feel is appropriate, or they may be listed as a class of their own, and that’s fine too. I don’t care how they’re classified, as long as I can find them. Real estate is an important asset class that needs to be represented in everyone’s portfolio. As with the other broad asset classes, real estate needs to be subdivided too. As with stock funds, real estate funds also cover a lot of ground.

There are funds that invest only in REITs (real estate investment trusts), funds that invest solely in companies that own and/or develop real estate, and funds that invest in real estate-related businesses, some of which may be only remotely related to real estate. REITs come in two flavors, mortgage and equity, both of which span the full spectrum of opportunities under their general headings.

Commodity funds also are usually listed with the sector funds. However, commodities are an entirely different animal and, as such, provide excellent diversification. Commodity funds are usually designed to replicate one of the commodity indexes.

Bond funds also need to be subdivided. In broad terms, there are corporate bond funds and government bond funds. But, as you may have guessed, it goes much deeper than that.

Corporate bonds are usually classed as investment grade and speculative, with the latter being referred to as high-yield or junk. Some state and local government bonds end up in the speculative category for one reason or the other.

Government bonds can be broken down into U.S. Treasury, U.S. T.I.P.S. U.S. Government agency (GNMA, FNMA and FHLMC), and municipal, which are issued by state and local governments and offer varying degrees of tax exemption. There are many bond funds that specialize in tax-free municipal bonds specific to a particular state.

There also are international and emerging market bond funds. These funds offer two more opportunities to diversify your portfolio.

This expanded style box incorporates the three primary mutual fund classification criteria discussed above and is what you should use when you are screening bond mutual funds for your portfolio.

Balanced funds hold some mixture of stocks and bonds, usually in the neighborhood of 60% stock and 40% bonds, with the stock component being domestic large cap and the bond component being a blend of intermediate U.S. Treasuries and high-grade corporate bonds. Balanced funds offer investors a prepackaged mini portfolio. However, the diversification they offer is grossly inadequate. And there are targeted balanced funds which target a specified year when the portfolio will be liquidated. You can expect the composition of targeted funds to gradually change from some blend of stocks and bonds to 100% bonds as the target date grows nearer.

Hybrid funds invest in both stocks and bonds and include balanced mutual funds. However, there also are hybrids that invest in both stocks and bonds whose strategy is something other than creating a balanced portfolio. For example, a growth and income fund might have substantial bond holdings for the purpose of boosting its income.

Finally, there are funds that invest in convertible bonds, which are bonds that can be converted to stock at any time prior to maturity or the end of the conversion period stated in the indenture, which ever occurs earlier, if the owner of the securities feels it is advantageous. These funds provide income and preservation of capital with the potential for capital gains.

That was a pretty thorough summary of the criteria used for mutual fund classification. The next subsection, Mutual Fund Categories. provides more detail on the individual criteria and some considerations in using them to find the best funds for your portfolio.

1 2 3 4 5

Section Intro Next Section