Money Market Funds Market Accounts

Post on: 1 Апрель, 2015 No Comment

Money Market Funds v. Money Market Accounts

By: BankingMyWay.com Staff

By Jeff Brown

The Securities and Exchange Commission has announced a sweeping reexamination of money market mutual funds, to make sure investors’ money is as safe as they expect it to be.

If problems are that serious, should investors favor money market accounts held at banks over money market funds run by mutual fund companies?

Unless you’re exceedingly nervous, safety probably isn’t the biggest factor in choosing between the two types of funds. Both are pretty safe.

Since neither type pays much interest these days, convenience is the chief factor in deciding where to put your money. Both types are best used only for short-term holdings, as places to stash cash you might need quickly.

FDIC insurance makes money market accounts safer. But money market funds have a nearly spotless safety record as well. The SEC is reacting to troubles at the Primary Reserve Fund last September. While money market funds are designed to use conservative investments to keep share prices at $1, some bad investments by that fund have driven the share price down to 91.7 cents.

“Breaking the buck” is extremely rare. Nearly $4 trillion is invested in money market funds, and despite the financial crisis, no other funds have run into serious trouble since September.

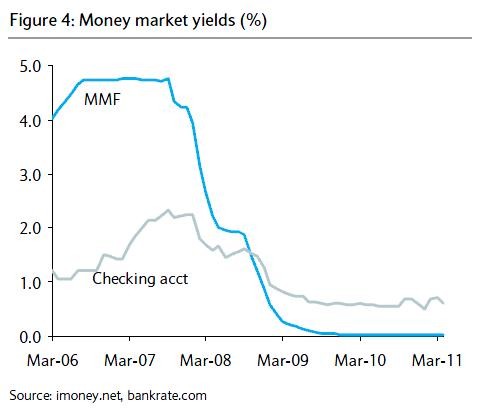

Typically, one of the most important factors in choosing between a fund or an account is the yield, or interest rate paid on your holdings. Funds are currently paying around 0.19 percent, according to Money fund Report. which offers a fund-search service.

Meanwhile, money market accounts are about twice as generous, averaging 0.51 percent, according to the BankingMyWay.com survey. Using the BankingMyWay.com shopping tool. you can find some that pay a bit more. Park Avenue Bank (Stock Quote: PABK ), pays 1.6 percent, for example, while AIG Bank (Stock Quote: AIG ) pays 1.8 percent.

But it doesn’t pay to obsess over yields. At 0.51 percent, a money market account would earn $5.10 a year on a $1,000 deposit, versus $1.90 for a fund yielding 0.19 percent.

If earning money safely is your chief goal, and you can tie your money up for a while, look at certificates of deposit (CDs). The 12-month CD averages 1.36 percent, according to the BankingMyWay.com survey.

As for the account-vs.-fund choice, if you own other types of mutual funds, a money market fund at the same firm would provide a convenient place to hold cash paid out by the other funds or generated by fund sales. And it’s a useful place to park new savings you’re not ready to invest.

If you choose a new investment at the same fund company, the payment can be made immediately by drawing from the money market fund. Paying for the same investment through a bank’s money market account could involve several days delay.

But if you’re using a money market for spending money, a money market account at a bank might be better. It will allow you to quickly shift funds to a checking account, giving you access with checks or an ATM debit card. And you could quickly get at the money for automatic payments on your mortgage or car loan.

You could do all this with a savings or checking account, but neither would earn as much as a money market account, according to the BankingMyWay.com savings survey .

Before settling on a money market fund or account, read all the fine print. To get the highest yield, you may have to maintain a minimum account balance. And sometimes there are restrictions on the number of withdrawals you can make per month.

Use the Compare Savings Rates calculator to see what you would earn in funds or accounts with differing yields.