Making Monetary Policy During a Financial Crisis Boston Fed

Post on: 13 Октябрь, 2015 No Comment

Making Monetary Policy During a Financial Crisis

The University of Chicago Booth School of Business and Brandeis International Business School

New York, New York

February 27, 2009

I am pleased to participate in this important forum again this year, and welcome the opportunity to discuss monetary policy during the current financial crisis. Thank you for inviting me to be here with all of you and with Charles Plosser and Rick Mishkin.

As you know, what began as a problem involving securitized subprime mortgages in the United States has become a problem of global reach and historic proportions. The problem grew in scope and severity as investors became skeptical of financial statements, and as the ability to value and trade a wide variety of financial instruments became severely impaired.

Problems in financial markets spilled over into the real economy and contributed to deteriorating economic conditions. The U.S. economy lost 1.8 million jobs over the past three months. With the economy likely to shrink significantly in the first half of this year, the unemployment rate rising higher than 8.5 percent is, unfortunately, very likely.[Footnote 1]

Unlike in some previous periods of financial disruption, this time around most countries are well aware of the precarious financial circumstances and have taken action to mitigate the problems. While the responses have varied, in most countries the monetary authorities have eased interest rates, the regulatory authorities have taken actions to shore up financial intermediaries, and the fiscal authorities have adopted more expansionary or stimulative policies than previously were planned.

In combination, these actions along with lower energy prices will, I hope, provide a foundation for positive economic growth in many countries in the latter half of this year. However, I believe that below-potential growth is likely to persist until financial markets and financial institutions can resume more normal functioning. So in addition to the other steps being taken to stimulate the economy, we need to be sure that actions to support the stability of the financial system are taken without delay and, in the slightly longer term, that regulatory frameworks are thoughtfully reformed.

Monetary Policy During the Crisis

Figure 1 highlights a striking feature of this financial crisis the rather rapid movement, at least by central banking standards, to a federal funds rate only a little above zero. The Federal Reserve has moved with commendable speed in lowering the interest rate target to address problems in financial markets and the real economy.

Of course, one year ago many observers were critical of the Federal Reserves rapid interest rate cuts. Total inflation was above the comfort zone of many, as rapid increases in oil and commodity prices were occurring despite unsettled financial markets. In retrospect, it is fortunate that the Federal Reserve moved as quickly as it did. While the rapid reduction in interest rates did not prevent a recession, it has mitigated the depth of the downturn and cushioned the economy against some of the shocks experienced over the past year.

However with the federal funds rate bounded by zero, the forecast one of continued weakness, and challenges in the transmission of funds-rate changes into borrowing rates in the marketplace the Federal Reserve has turned to some alternative approaches to monetary policy. I would like to take a moment to highlight some key steps we have taken in this regard, and some of their implications.

First, the Federal Reserve has taken pains to make clear in communications that it will take all necessary actions to stabilize the economy. At the same time the FOMC has increased transparency by providing longer-range forecasts of growth, inflation, and unemployment given the current structure of the economy, the presence of appropriate monetary policy, and an absence of unexpected shocks.[Footnote 2] Chairman Bernanke addressed this topic in his speech at the National Press Club last week.[Footnote 3]

The added transparency should help the Fed attain its goals of full employment and price stability. Currently, significant excess capacity in the economy risks lowering inflation and inflation expectations. Since short-term interest rates are effectively zero, reductions in inflation expectations imply a higher real interest rate and, effectively, tighter monetary policy. So the additional clarity on the long-run intentions of monetary policy (as reflected in the longer-range forecasts) might keep inflation expectations well anchored[Footnote 4] and real interest rates low enough to help get the economy moving again.

An important consideration involves what the long-run goal for inflation should be, given recent experience. Twice this decade, short-term interest rates have approached zero, and the probability of possible deflation has risen significantly. In light of this experience, some might conclude that the implicit inflation target has been too low. A fruitful area for future research would be to re-consider the likelihood and the cost of hitting the zero lower bound, and what that cost implies for setting inflation targets.[Footnote 5]

But now I would like to spend a bit of time discussing a second, alternative approach to monetary policy that the Fed has been pursuing. Since the fall of last year the Federal Reserve has rapidly increased its balance sheet, from $880 billion in July 2007 to $1.9 trillion as of last Wednesday, February 18. While this expansion of the balance sheet is unprecedented, and gives some observers pause, it is worth taking the time to understand the sources of that growth, the goals behind that growth, and how the Federal Reserve balance sheet can be expected to eventually return to a more normal size, due to market developments and Federal Reserve actions.

Expansion of the Federal Reserves Balance Sheet

Figure 2 shows the composition of the Feds balance sheet. While this period of financial turmoil began in August 2007, much of the initial activity by the Federal Reserve involved traditional monetary policy reducing the federal funds rate. Then in 2008, the Federal Reserve began what became a series of actions that expanded our usual discount window function. While the discount window had traditionally been available to depository institutions, in the spring of 2008 investment banks gained access to the discount window through the Primary Dealer Credit Facility (PDCF).

The largest expansion of the balance sheet occurred in the wake of the Lehman Brothers failure, as a series of actions were taken in response to the increasingly fragile state of financial markets. The three most significant areas of growth were discount window lending, foreign swap lines, and actions taken to stabilize financial markets.

The discount window lending I am referring to includes traditional discount window loans, primary dealer discount window loans, and lending in the Term Auction Facility (TAF). The largest category of lending in this group is the TAF, which as of February 18 had $448 billion in loans outstanding. This Fed lending has been critical to the reduction in market interest rates that are charged in the interbank lending market.

These TAF loans are arranged through an auction process, and like regular discount window lending, are loans to banks that are in satisfactory condition and are also backed by collateral subject to significant haircuts, to mitigate risk to the Federal Reserve. In considering how we get to a more normal-sized balance sheet, it is important to note that TAF lending is likely to fall once financial conditions become more normalized, although the Fed could also hasten the reduction by holding smaller auctions or charging a higher minimum stop-out rate.

The second area of substantial balance sheet growth involves central bank liquidity swaps. These are loans made to foreign central banks so they can provide dollar funding to their banks in much the same manner as the U.S. Federal Reserves TAF. Why we are doing this? Because global dollar markets are interlinked, and dollar markets overseas affect our own domestic financial conditions. Our counterparties are the other central banks, not individual financial institutions, and the swaps are essentially loans.

As the interbank dollar-lending market has stabilized and given that the rates on the loans by foreign central banks are often set to make them less attractive as markets stabilize this lending has fallen from a peak of $583 billion on December 17 to $375 billion on February 18. This second area of balance sheet growth also is likely to decline naturally as more normal market functioning resumes.

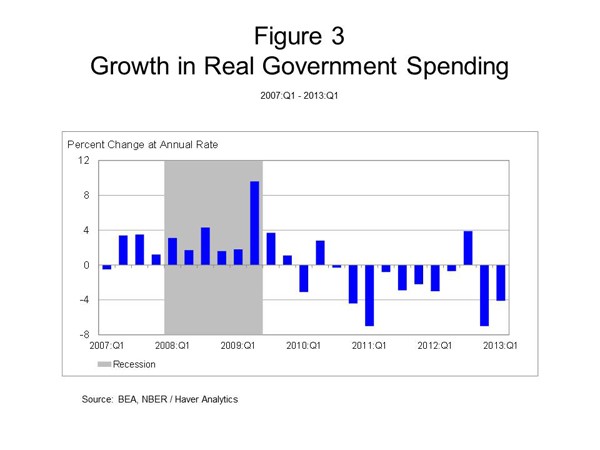

The third area of substantial balance-sheet growth involves the Federal Reserve liquidity facilities designed to provide market support (see Figure 3 ). These facilities are designed to improve conditions in short-term credit markets. Some, like the Commercial Paper Funding Facility (CPFF), provide an alternative funding source to the market when interest rate spreads become very elevated. With this facility in place, when interest spreads are high firms have an incentive to issue commercial paper directly to the Federal Reserve. When interest spreads are low, issuers will get a better rate by going to the market, thus unwinding the facility and shrinking the Federal Reserves balance sheet.

Other facilities like the Asset-backed Commercial Paper Money Market Mutual Fund Liquidity Facility (AMLF) serve as a back-up for holders of existing short-term credit instruments. Both the CPFF and AMLF experienced substantial lending when the programs were first made available, but loan activity has declined as market conditions have improved.

In general, the various programs that have expanded the Federal Reserves balance sheet should be less attractive to market participants as financial conditions improve. Figure 4 shows that of late, the rate on asset-backed commercial paper has fallen dramatically, and many issuers can receive better terms by issuing commercial paper directly to the market. Figure 5 shows that the prime money market funds have tended of late to have a net inflow of funds, which has helped stabilize short-term credit markets because money market funds are a key investor in these markets.

Two new programs should provide additional help to markets. First, the Term Asset-Backed Securities Loan Facility (TALF) is designed to provide a financing vehicle for credit instruments that have been disrupted by poor functioning in securitization markets. This facility, which will commence operations soon, should make credit more available for student loans, consumer credit, commercial real estate, and small business loans.

A second program involves the large-scale purchases of mortgage-backed and agency securities. For a variety of reasons, mortgage rates had not fallen in response to the decline in the federal funds rate, as is usually the case. As shown in Figure 6 . conventional mortgage rates that had been around 6 percent have declined since the announcement of the program. Mortgage rates have been between 5 and 5.25 percent recently. Of course, an additional policy action that could potentially be undertaken by the Federal Reserve would be to expand this program, to help further lower the market rates on home financing.

In conclusion, I offer just a few summary thoughts. Over the last year and a half or so, the Federal Reserve has been proactive and innovative in trying to address problems in financial markets and the broader economy. While traditional monetary policy had focused on targeting the federal funds rate, now that this rate has approached the zero-bound the Federal Reserve has focused on other ways to lower the cost of credit in the marketplace, which had not fallen commensurate with the decline in the federal funds rate. Federal Reserve programs have intended to offset disruptions to interbank lending, short-term credit financing, the ability of money market mutual funds to meet investor redemption requests, and housing finance to benefit all participants in the economy.

It is very important to note that the largest components of the expansion of the Federal Reserve balance sheet are likely to become unappealing to market participants as financial conditions improve and interest rate spreads decline. Thus, much of the Feds balance-sheet expansion should be reversed as we see the return of more normal trading.

As a student of the Japanese financial crisis, allow me to make one final point. The so-called quantitative easing that focused on increasing reserves in Japan during the 1990s, while well-intentioned, in hindsight suggests that merely increasing reserves when financial intermediaries are capital-constrained is unlikely to have much impact.[Footnote 6]

In contrast, the Federal Reserve programs I have described today are intended to reduce the unusually large spreads created by financial disruptions, so that the cost of credit for a variety of borrowers returns to the level we would expect with more normalized functioning of credit markets. The Federal Reserves recent monetary policy actions, combined with the fiscal stimulus package that the government recently enacted, should in my view help pull the economy out of the severe recession we have been experiencing.