Leading Economic Indicators Predict Market Trends

Post on: 30 Апрель, 2015 No Comment

Economists typically group macroeconomic statistics under one of three headings: leading. lagging or coincident. Figuratively speaking, one views them through the windshield, the rearview mirror, or the side window. But how can an investor determine the direction of the economy in this blizzard of data?

Coincident and lagging indicators provide investors with some confirmation of where we are and where we’ve been, but here we’ll take a look at the leading economic indicators. They’re a good place to start, because they help us understand where the economy is heading.

Market Indexes

In order for an economic indicator to have predictive value for investors, it must be current, it must be forward-looking and it must discount current values according to future expectations. Meaningful statistics about the direction of the economy start with the major market indexes and the information they provide about:

Although these measures are crucial to investors, they aren’t generally regarded as economic indicators per se. This is because they don’t look very far into the future — a few weeks or months at most. Charting the history of indexes over time puts them in context and gives them meaning. For instance, it is not terribly useful to know that it costs $2 to purchase one British pound, but it may be useful to know that the pound is trading at a five-year high against the dollar.

Index of Leading Economic Indicators

Ironically, the Conference Board’s Index of Leading Economic Indicators (LEI) really isn’t leading data. Upon release, the data is almost two months old, and most of the 10 component reports have been released prior to the LEI itself. It purports not to signal a change in market direction until the index has moved in the same direction, up or down, for three consecutive months, which it rarely does. It is widely viewed as a better harbinger of recession than expansion. However, it has predicted a number of recessions that did not occur, having once prompted American economist Paul Samuelson to suggest that economists have correctly predicted nine of the last five recessions.

Weekly Data

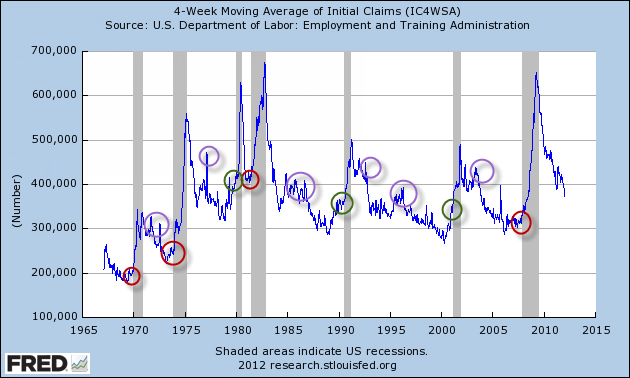

The Jobless Claims Report . is a report released weekly by the Department of Labor. In a weakening economy, unemployment filings will trend upward. They are generally analyzed as a four-week moving average (MA), in order to smooth week-to-week variance. However, this report has a built-in bias in that self-employed persons. part-timers and contract employees who lose their jobs don’t qualify for benefits and thus are not counted.

Money supply. an abstract, technical calculation of how much money is sloshing around in the economy is released by the Federal Reserve. An upward trend suggests inflation. However, in a digital world in which vast sums of money can be transmitted across the globe in an instant, this indicator has lost much of its importance over the last decade.

Monthly Data

Several of the monthly data reports present data that is several months old, and can be characterized as leading from the rear, in something of an I-told-you-so fashion:

The New Residential Housing Construction Report . commonly referred to as housing starts is a report released by the Census Bureau and the Department of Housing and Urban Development (HUD). This report breaks out building permits issued, housing starts and completions. It is an important leading indicator in that construction activity tends to pick up early in the expansion phase of the business cycle. However, it lacks qualitative information in that it ignores the sizes and prices of the homes it counts.

The Existing Home Sales Report is released by the National Association of Realtors. Whereas the housing starts report focuses on supply, this report focuses on demand. Together, the two assess the overall health of the housing sector. The data contained in this report is typically two months old, owing to the length of time involved in closing home sales. It is useful in predicting consumer spending, and is directly affected by factors, such as mortgage interest rates and the seasonal nature of the real estate business.

The Consumer Confidence Index (CCI) is released by the Conference Board and is one of a handful of reports that measure respondents’ perceptions and attitudes. It is inexact and imprecise, but surprisingly accurate in projecting consumer spending. which accounts for 70% of the economy. The survey sample size (5,000 U.S. households out of roughly 120 million) is small, and thus economists use a multimonth moving average to examine the report.

The Business Outlook Survey is released by the Philadelphia Fed and surveys purchasing managers at 5,000 manufacturing companies in Pennsylvania, Delaware and New Jersey, collecting better, same or worse readings on a host of measures. Its limitations — a small sample size, limited geography and a manufacturing focus — do not prevent it from accurately gauging the key Purchasing Managers Index (PMI) report it precedes. Month-to-month variance in the readings is due in part to the small sample size.

The PMI is released by the Institute for Supply Management, formerly the National Association of Purchasing Mangers. The report collects better, same or worse information from a mere 400 purchasing managers throughout the country and compiles it into a index. Despite its small sample size and focus on manufacturing, Wall Street watches it closely given its historical reliability in predicting growth in gross domestic product (GDP).

The Durable Goods Report (DGR) is released by the Census Bureau. As a barometer for the health of heavy industry, it surveys manufacturers of goods with a life expectancy of more than three years. Such purchases by businesses signify capacity expansion; sales at retail suggest rising consumer confidence. High month-to-month volatility requires the use of moving averages and year-over-year comparisons to identify pivot points in the economy.

The Factory Orders Report also comes from the Census Bureau; it is more detailed and less timely than the DGR. Its main shortcoming is that it fails to account for price changes that can greatly affect inventories during both inflationary and deflationary times. The report contains data for the two months prior to its release, making it another leading from the rear indicator.

Mutual Fund Flows is a measure issued monthly by the Investment Company Institute. This indicator aggregates net flows for stock, bond and money market mutual funds, but it is largely ignored for several reasons, including that this report omits individual stock purchases and sales, and does not differentiate between systematic investing (i.e. 401(k) contributions) and market timing actions. It is also a contrarian indicator in that many individual investors react to events by, in effect, buying high and selling low. Money market fund flow is reported separately by the Federal Reserve.

The Beige Book

The Beige Book (officially the Summary of Commentary on Current Economic Conditions ) is released eight times per year by the Federal Reserve. It includes a collection of discussions from each of the 12 Fed districts, along with a summary statement, all of which are presented in the non-committal, measured tones known as Fed speak. Analysts and investors attempt to discern the meaning of the report, much like reading tea leaves. The report foreshadows Federal Open Market Committee ( FOMC) actions at the following meeting, although the bond market predicts these actions with a statistical measure that is virtually foolproof.

The Bottom Line

Leading economic indicators can give investors a sense of where the economy is headed in the future, paving the way for an investment strategy that will fit future market conditions. Leading indicators are designed to predict changes in the economy, but they are not always accurate s o reports should be considered in aggregate, as each has its own flaws and shortcomings.