Is Emerging Markets Debt A Good Investment

Post on: 31 Август, 2015 No Comment

Highlights

- Mutual funds are all over the map with respect to emerging markets debt.

- Sovereign debt can be denominated in dollars or the local currency; both pose risks.

- This year most sovereign debt is issued in local currencies, corporate debt in dollars.

Emerging markets debt is the new black, thanks to high yields and sound economic fundamentals of many emerging markets countries. The average one-year return for the category is 17 percent as of Sept. 30, according to Morningstar.

The emerging markets, or EM, bond category offers an average 12-month yield of nearly 5 percent, and that has yield-starved investors taking notice.

But it’s not all happy harvesting of outsized yields. Emerging markets debt comes with added risks.

Risk versus reward

Emerging markets bonds are issued by either a corporation or the government of a developing country. The category of emerging markets debt is literally all over the map, which can be a challenge for mutual fund investors. Singapore is vastly different from Chile, which is different from South Africa. And then there’s China.

More On Investing Abroad:

investing

All four countries, and many others, show up in various mutual funds. Some funds may even pull in countries that haven’t quite made it to the emerging markets threshold. These countries in Latin America, Asia, Europe and Africa are known as frontier markets.

Understanding the strategy you’re signing up for is the first challenge for investors. There are distinct subgroups within the emerging markets class. There is sovereign debt — that is, debt issued by a national government and denominated in dollars — corporate debt issued in dollars and sovereign bonds issued in local currencies.

They are all investment-grade (indexes) at this point. They have different weighted average ratings, but they range between BBB- and BBB+, so you’re getting investment grade in the index, says Blaise Antin, managing director and head of sovereign research at TCW, an investment firm and independent subsidiary of Societe Generale.

Currency adds a wrinkle

Emerging markets bonds issued in local currencies are pretty popular with investors: They accounted for 66 percent of all EM bond trading in the first quarter of the year and 70 percent in the second quarter, according to the Emerging Markets Traders Association. About 81 percent of all EM government liabilities are issued in local currency, according to a 2011 report from TCW, Emerging markets insight: Investing in emerging markets local currency bonds.

Using local currency benefits the country by avoiding exchange-rate risks, so the number of EM governments issuing bonds in their own currency has been on the rise.

For example, the governments of Brazil or Turkey are looking to develop its local market so that it can issue increasing share of its debt domestically and therefore not take any currency risk, Antin says.

While most EM government bonds are issued in local currency, most of the corporate bonds issued in 2012 have been in dollars.

We’ve had about $200 billion U.S. issued by emerging market issuers in the dollar market this year. Of that, about two-thirds have been issued by corporates. So roughly $130 billion or a little more by corporates in the first half of the year, and $60 (billion) to $70 (billion) by sovereigns, Antin says.

Mutual funds investing in emerging markets bonds can hold sovereign debt as well as corporate debt, or they may specialize in one or the other.

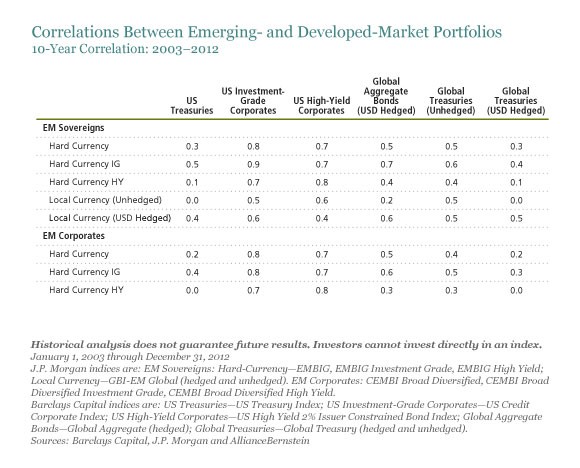

Bonds denominated in local currencies add diversity to a fixed-income portfolio, but they also introduce a new form of risk. Shifts in the exchange rate between two countries can affect the valuation of investments denominated in other currencies.

When the dollar is doing poorly against local currency, the funds get a boost. If the tides shift the other way, investors can find themselves with the short end of the stick.