How to Invest in Gold Using IRAs Annuities ETFs Mutual Funds and Even Life Insurance

Post on: 19 Октябрь, 2015 No Comment

NEW YORK (MainStreet ) — Although William Storum is an attorney, he invests in gold to protect himself from governments printing too much money and incurring too much debt .

[Governments] have huge liabilities on their balance sheets and governments over promised their populations, so money printing, which is debt growth, is pretty much baked into the system, said Storum, who has written a book called Going for the Gold (Book Publishers Network 2014).

Read More: How to Get in on the Gold Rush

Compare Today’s Low Refinance Rates

Just a month ago, Storum purchased a basket of gold and silver bullion when the discount was close to 9% of net asset value in a closed end fund.

Previously, when the market for gold was bullish, I’ve sold closed end funds for close to the same percentage premium, Storum told MainStreet .

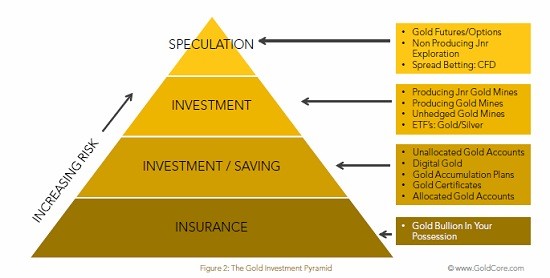

Bullion, stocks, mutual funds, royalty and streaming companies, ETFs, ETNs, annuities and life insurance are all ways to gain a position in the centuries old currency.

For example, Pacific Life offers both a variable annuity and variable life products that maintain a precious metals portfolio.

“Carrying some precious metals in your overall wealth building plan is a solid idea using dollar cost averaging,” said John Jamieson, owner of wealth strategy company Perpetual Wealth Systems. “You will end up buying more ounces when the price is low.”

Dollar cost averaging is a strategy that involves buying a fixed dollar amount of a particular investment on a regular schedule regardless of the share price.

“Just buying a big glob of gold and not investing any more money over time at the height of the market, you are in danger of having that money just sit and produce no profits,” Jamieson told MainStreet.

Although investing in physical gold within an IRA is possible, it can be complicated.

“The gold has to be stored in a secured facility,” Storum said. “When you get your hands on that physical gold, it’s considered a distribution from your IRA, which could involve a 10% penalty if you’re under age 59½ for an early distribution plus any applicable federal and state income taxes.”

Read More: Six Tips to Sell Your Gold

When workers own their gold and gold-linked investments in a Roth IRA, they forego a tax deduction on contributions but won’t pay tax in the distribution, Storum said.

Financial advisor Rich Davis recommends diversifying among hard assets. “An investor looking for value needs to buy silver up to as much as 5% of their portfolio,” Davis told Mainstreet. “I am also a firm believer in private equity investments directly into precious metal mines.”

That would involve buying a mine.

“If you own the mine your average price per troy ounce can be lower than market,” Davis said. “If you do not own the mine, then silver is a much better price for the money.

For the average investor, the Vanguard Precious Metals and Mining fund can provide access to investments within the precious metals and mining industries. Since inception in 1984, the fund has returned 4.68% compared to 3.80% for the benchmark.

“It is simple to own gold in an ETF because you can’t access it readily so you minimize the risk of inadvertently triggering a taxable distribution,” Storum said.

Read More: Best Ways to Invest in Gold

For a small fee, investors who hold the Merk Gold Trust ETF can exchange shares tax-free for physical bullion and bullion coins, but before storing gold at home, experts advise purchasing homeowners insurance .

“If you own a few gold coins, use a well-hidden and attached safe,” Storum said. “Safety deposit boxes also work but they’re not insured. Look into bonded and secured storage facilities, but make sure your gold is held in an allocated account if you are holding a substantial amount.”

“It will cost you a small premium above the current gold price and you can review spreads online,” said Storum. “But avoid numismatic coins and beware of the firms who pay for high priced ads or use loss leaders.” Numismatic coins are those sold by professional dealers.

—Written for MainStreet by Juliette Fairley