How Inflation Risk Principal Risk and Interest Rate Risk Threaten Your Investments

Post on: 31 Май, 2015 No Comment

Understanding 3 Types of Investment Risk

You can opt-out at any time.

Many times whenever I am strategizing with a client or prospective client, I will hear the specific phrase, “I do not want to take any risk.” Unfortunately, risk exists in every investment regardless if you want to take it or not. The question becomes, which type of risk are you most comfortable with taking. Here are some common risks associated with different types of investments.

Principal Risk

Principal risk seems to be the risk most people refer to when they imply that they do not want to take any risk. The loss of principal exists with just about any investment that is not protected with some type of insurance or government backing. Investing in stocks. mutual funds, and commodities are some of the investments that carry principal risk

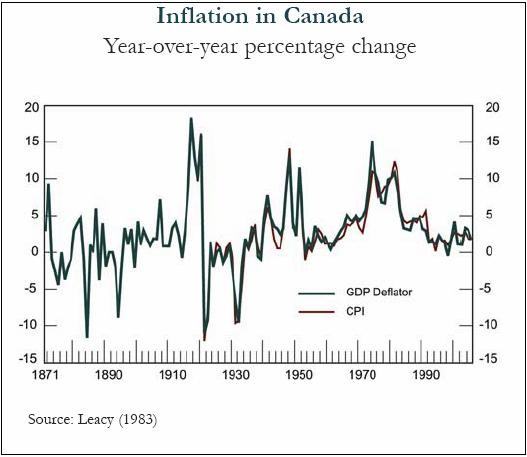

Inflation Risk

Inflation is what eats away at the buying power of your dollar. Here is an easy way to look at the effect of inflation and the inflation rate. Let’s say that that you could buy a particular car today for $25,000 and in 5 years the same car brand new might sell for $28,250. Let’s also suppose that today you put $25,000 in a 5 year CD earning 2% interest. Your CD would be worth roughly $27,500 in 5 years. Today your $25,000 would be enough to buy the car. However in 5 years, your $25,000 will have only grown to $27,500 and the price of the car grew to $28,250. Inflation is what occurs when your dollars can’t buy enough of the same product in the future as they can today. This risk occurs in investments whose return is lower than the current inflation rate and is often associated with, but not limited to lower yielding bonds, CD’s or other fixed income products.

Purchasing almost any type of fixed income instrument such as bonds carries a certain degree of interest rate risk. For example, let’s say you own a bond that pays 5% per year and matures in 10 years. Now let’s say that in 2 years someone else could buy the same type of bond you own but because interest rates rose, they are now receiving 7%. Naturally, people would want bonds paying 7% not 5%. So two things occur; one the price of the 5% bond would drop. So if you sold your bond prior to maturity, you would receive less money for it. Second, if you held your bond until maturity, you would be receiving a lower interest rate than you would have if you waited to buy a bond yielding 7%. This type of risk occurs when someone owns a fixed income product like a bond or CD and gets one rate today and the rate is higher in the future for the same product.

There are several other types of investment risk, but these three are common investment risks and I will write about other investment risks in future articles.