DST Systems Why Enterprise Value Based Valuation Metrics Are Superior To P

Post on: 18 Май, 2016 No Comment

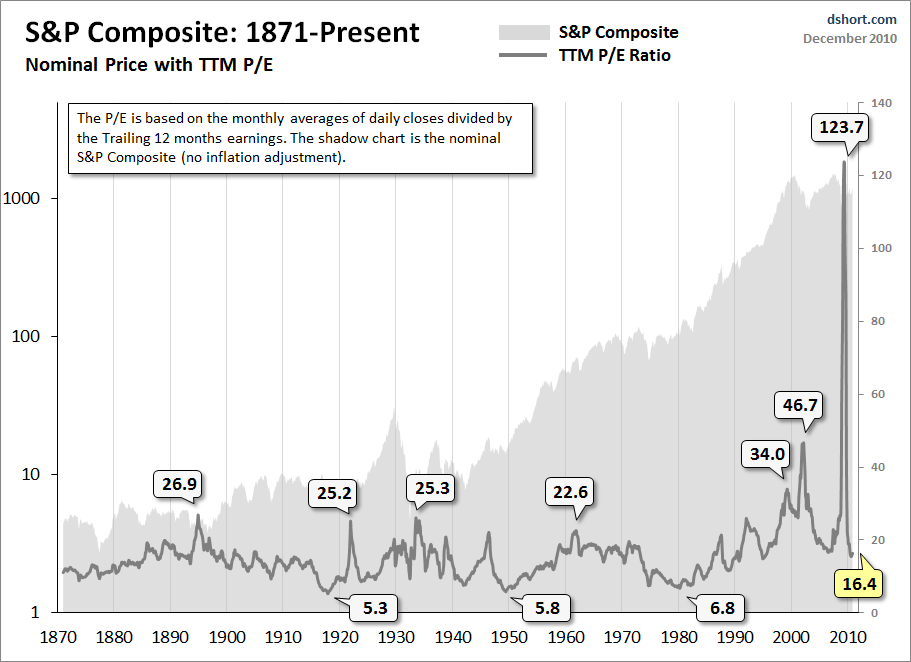

Many investors claim that dividends and earnings are the most important factor in determining a company’s stock price. There is a correlation between earnings and dividends against stock prices. However, it’s not foolproof. I believe Enterprise Value based metrics such as Enterprise Value to Free Cash Flow and Enterprise Value to EBITDA are superior valuation methodologies than P/E ratios and dividend yield when looking at potential investment candidates.

(Note: Enterprise Value is a company Market Cap plus Debt less Cash.)

The problem with the P/E Ratio is that it only values the underlying equity of a company. Enterprise Value is superior to the P/E ratio because it values the company based the entire capital structure. Hence, a company with debt can look deceptively cheap on a P/E basis. A cash rich company with no debt can look deceptively expensive because the P/E ratio does not capture the cash on a company’s balance sheet. Enterprise Value based metrics captures a large debt or cash position while the P/E ratio does not.

The Proof is in the Numbers

A recently published study by Wesley Gray and Jack Vogel titled Analyzing Valuation Measures: A Performance Horse-Race over the past 40 Years proves this fact. (The study looks at the performance of stock from July 1, 1971 to December 31, 2010. The performance numbers below assume an annual rebalancing.) In its equal-weighted portfolios, the most attractively valued quintile of P/E stocks returned 15.23% per year. The most attractively valued quintile of EV/EBITDA based stocks returned 17.66% per year. The superiority of EV/EBITDA over the P/E ratio is also illustrated by the spread between the highest and lowest valued quintiles of each group. The spread for the EV/EBITDA ratio was 9.69%. (i.e. The most undervalued quintile outperformed the most overvalued quintile.) The spread for the P/E ratio was 5.82%. I think this comprehensive study supports the superiority of EV/EBITDA over the P/E ratio.

Why Free Cash Flow is a Better Measure of Profitability than EPS

Free cash flow is superior to earnings as it removes any potential accounting gimmicks and as a result I believe is superior in determining a company’s value. There are countless examples of companies who were ‘profitable’ based on earnings but if you calculated a company’s free cash flow they were not generating economic or cash profits. Enron is a prime example. From December 31, 1990 to December 31, 2000, Enron went up at a 28.3% annualized rate and went up 11-fold. On an earnings basis, it was profitable every year during this period and earnings per share more than doubled. The year it went bankrupt they reported an all-time high in net income of $979 million or $1.19 per share. You could have bought this company at one times earnings a month before it went bankrupt. However if you analyzed the company’s free cash flow Enron was not profitable.

Below is a chart of Enron’s stock price against its earnings per share (Note: the quarterly EPS numbers are interpolated from the annual EPS.) for its last 10 years before bankruptcy. Enron’s stock price followed its earnings trajectory until the bitter end.

click to enlarge

A free cash flow calculation revealed the company was only profitable in two of the last 10 years before it filed for bankruptcy. Below is a table that illustrates Enron’s earnings per share and free cash flow per share during its last decade:

A free cash flow investor never would have invested in Enron and would have protected his precious capital from one of the greatest debacles in investment history.

There are many examples why I think free cash flow is a superior profitability metric than earnings. One example is to look at the record of successful investors over time and how they talk about their investment philosophy. The very successful investors look at free cash flow. Mason Hawkins, Bruce Berkowitz and Warren Buffett are three such examples. Bruce Berkowitz has an outstanding track record despite his abysmal 2011 performance when he loaded up on financial companies. His long-term record is still among the best since the end of 1999. When discussing his investment philosophy, Bruce always says he, Counts the cash. This means he looks at how much cash a company is generating or its underlying free cash flow.

Mason Hawkins, in his quarterly mutual funds reports for the Longleaf Funds, regularly references free cash flow in the discussion of their holdings. He regularly talks about a company’s free cash flow yield. He has been managing money since the mid-1970s and has beaten the market indices by a substantial margin by following a free cash flow and value based investment strategy. (Note: Both managers have stumbled lately. One of their biggest problems I believe is they manage too much money. It is my opinion once managers get over a billion or two in asset under management it gets hard to duplicate previous stellar performance.)

Warren Buffett, who is arguably the world’s greatest investor in history, in 1986 revealed for the first time his valuation method and what he referred to as ‘Owner Earnings’. He stated that the value of a company is simply the total of net owner earnings to occur over the life of the businesses, discounted at an appropriate discount rate. He defined owner earnings as:

These represent reported earnings plus depreciation, depletion, amortization, and certain other non-cash charges. less the average annual amount of capitalized expenditures for plant and equipment, etc. that the business requires to fully maintain its long-term competitive position and its unit volume. Our owner-earnings equation does not yield the deceptively precise figures provided by GAAP, since capital expenditures must be a guess — and one sometimes very difficult to make. Despite this problem, we consider the owner earnings figure, not the GAAP figure, to be the relevant item for valuation purposes.

What Warren Buffett defined is identical to free cash flow. I find it ironic that in 1987 the Financial Accounting Standards Board (FASB) mandated that public companies produce a third financial statement entitled ‘Statement of Cash Flows’ when reporting financial data. Is it a coincidence that FASB added this statement a year after Warren Buffett revealed the most important metric he looks at when determining whether an investment is attractive? I don’t know. But I think it shows the importance of free cash flow.

Of the three financial statements a company reports: Income Statement, Balance Sheet and Statement of Free Cash Flows, the Statement of Free Cash Flows is my favorite. However, I look at all three and make sure they roughly mimic each other. If they do not, that is probably some shenanigans going on with the company’s accounting

Another example of the importance of free cash flow is illustrated in Chapter two, Market Myths, of G. Bennett Stewart’s book The Quest for Value. I think this is one of the better unknown pieces written on investing and illustrates the importance of free cash flow. In it he reviews the significant flaw with earnings as a point in determining a company’s value and how earnings and dividends ‘Do Not Matter’. On page 40 he says:

How can it be true, as I claim, that the cash generated over the life of a business (adjusted for risk) is what determines share prices when most investors seem to be preoccupied with such traditional accounting measures as earnings, EPS, and earnings growth? The answer is that prices in the stock market, like all other prices, are set at the margin by the smartest money in the game, leaving the majority of investors as mere price-takers.

In his book, written in the late 1980s, Stewart cites Mason Hawkins as an example of an investor that has had phenomenal success follow a free cash flow based valuation strategy. He cites the fact that over the past 12 years Hawkins had only underperformed the S&P 500 Index once and had one of the best five year track records according to the consultant CDA Investment Technologies.

A final reason why free cash flow is superior to earnings is that earnings can be much more easily manipulated. Free cash flow is very difficult to manipulate. A couple examples are:

Capitalizing an asset on the balance sheet that should be expensed. (Earnings will be overstated compared to free cash flow.)

Processing a sale but not collecting the cash and generating an increase in accounts receivable on the balance sheet. (Earnings are overstated compared to free cash flow.)

DST Systems (NYSE:DST ) — Deceptively Cheap

An example of the superiority of Enterprise Value over the P/E ratio can be captured in many real life examples. One such real life example is DST Systems. DST Systems provides back office systems for mutual fund and insurance companies to run their back office. The company has a solid business and a history of generating strong free cash flow, returning it to shareholders through stock buybacks and is very cheap. (Note: Over the past 10 years the company has repurchased 63 percent of its shares outstanding. Over long periods of time when shares are repurchased below their intrinsic value management can create substantial shareholder value.)

Below is a table comparing DST Systems’ EPS and FCF per share. As the table shows both have been consistently positive. The earnings are somewhat erratic as any gains on the sales of investments are included in the years in which EPS spikes. Free cash flow removes these one time items. It is a good sign that free cash flow per share has trended upward over the past decade.