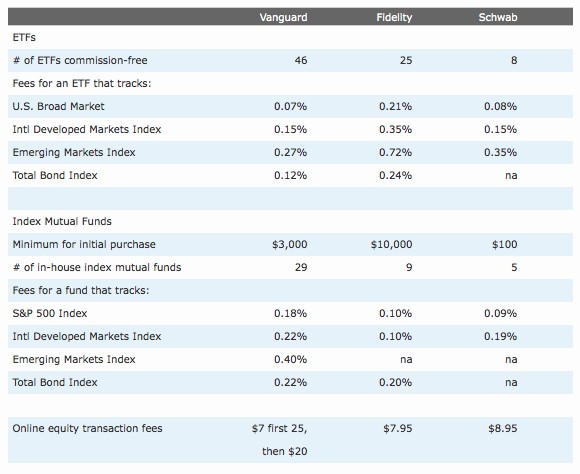

Cost Comparison Tool For Comparing Vanguard ETFs and Mutual Funds

Post on: 25 Октябрь, 2015 No Comment

While on Vanguards website I recently ran across a new and useful tool that help helps you calculate and compare costs for similar Vanguard ETFs and mutual funds. The tool takes into account trade commissions, the difference in expense ratio, redemptions fees, future purchases, and even the expected bid-ask spread.

For the unfamiliar, Ill be very simplistic and say that exchange-traded funds, or ETFs, are mutual funds that can be traded like individual company stocks. Due to the way they are constructed, ETFs tend to have lower expense ratios than their mutual fund counterparts, but you will need to pay a commissions each time you trade. There is also a little bit of added loss due to the bid-ask spread .

For example, you could compare the Vanguard Total Stock Market Index Fund (VTSMX) with the Vanguard Total Market ETF (VTI). Both invest in the exact same set of companies, and holds over 1,000 companies that track closely the entire U.S. market. VTSMX charges an annual expense ratio of 0.19%, or $19 on a $10,000 investment. VTI has an expense ratio of only 0.07%, a mere $7 for each $10,000 invested.

I tried an example where I start with $10,000 of either VTSMX or VTI, and say that I will add another $1,200 each quarter for another 10 years. I assumed $5 trade commission and a 8% annual return. Here are the results:

(fixed the numbers :P) The cost edge goes to the ETF in this case, with a cost difference of $300. Really, I dont see that as all that much over 10 years. But, as you get into larger amounts, the gap widens. If you continued the same example for another 20 years, the ETFs cost advantage would be $7,000.

For this reason, I feel like it is only a matter of time before I start moving all of my current all-mutual fund portfolio into ETFs. In fact, the majority of my funds already have an identical ETF counterpart.

Anyhow, you can play with this calculator and change the variables to see your situation. Note that Admiral shares are an option once you reach $100,000 per fund. Ive got a while before that

But in terms of the big picture, both of these funds have very low costs and would serve as a great cornerstone to a retirement portfolio. If you are just starting out, I think youll see the difference is very small; I really wouldnt stress too much about going either way.

Last updated: April 4, 2007