CIBC Investor s Edge

Post on: 17 Ноябрь, 2016 No Comment

How do I deposit money into my account?

You have several options.

Online: You can transfer money from your CIBC branch account to your CIBC Investor’s Edge account (and vice versa) online. This is the most convenient way to transfer funds.

Deposit Acceleration: You can also have your local branch deposit money into your CIBC Investor’s Edge account if you need access to the money in your brokerage account immediately. This would be necessary in cases where you want to place a trade and do not have sufficient funds and/or securities in your account to pay for the trade.

Mail cheques to:

CIBC World Markets

Sales Office Control

BCE Place, 10th Floor

161 Bay Street

What is deposit acceleration? When will I need to use it?

When can I make my first trade?

Before you can make your first trade, you must open an account with CIBC Investor Services. Also, full payment for your first trade must be deposited to your CIBC Investor’s Edge account before placing the trade. For details, see First Trade Rule in the Credit Policy.

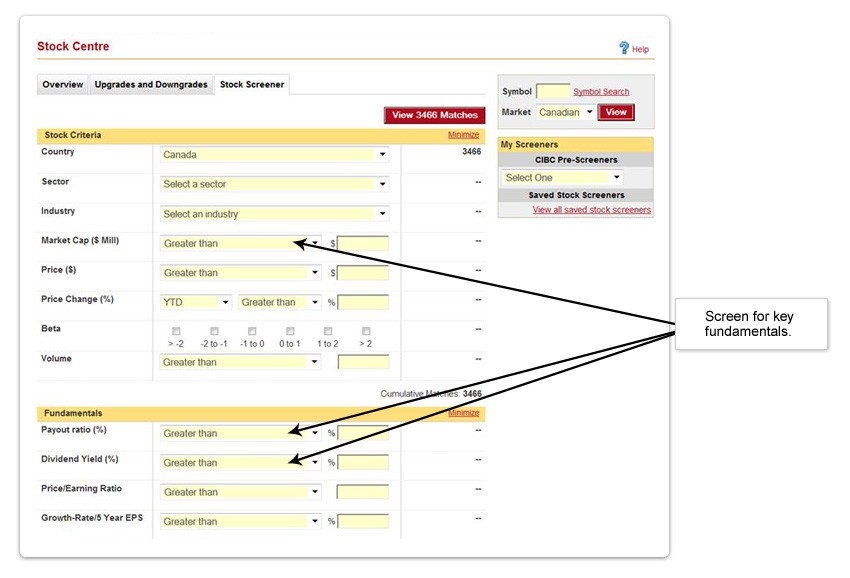

What types of orders can I place?

You can place market, limit, and stop-limit orders through CIBC Investor’s Edge:

A market order increases the likelihood that your trade will be executed but does not guarantee the execution of your trade at a specific price. As there may be no trading activity or insufficient trading activity to execute the trade there is no guarantee it will be filled.

A limit order guarantees a price at which your trade is executed, but does not guarantee that your trade will be executed.

Possible Risks

When entering a stop-limit buy or stop-limit sell order, you should be aware of the following risks:

- The placement of contingent orders, such as a stop-limit order, will not necessarily limit your losses to the intended amount, since market conditions may make it impossible to execute your orders.

- A stop-limit order will only capture fills at the limit price with the possibility of no fill (or a partial fill) if a security trades through that price.

You can also set the following parameters on your orders:

- Day order – This type of order simply expires if it hasn’t been executed by the close of trading on the day it was entered. Day orders entered after market close are valid for the following trading day only.

Who should I speak to if I have problems entering a trade?

If you experience a problem with a trade or any other service issue, call us. Click Contact Us at the top of our website for our contact information and hours of operation. An Investment Representative will be happy to assist you or answer any questions you may have.

What does it cost to trade stocks through CIBC Investor’s Edge?

Commissions vary according to how you place your trades with CIBC Investor’s Edge: by phone through an Investment Representative or online through our Internet-based brokerage service. Equity trades can be placed online or directly from your smartphone using the CIBC Mobile Brokerage App for a flat-rate fee of $6.95 per trade. There is a separate commission schedule for trades made through an Investment Representative over the phone. For full details, please visit the CIBC Investor’s Edge Fees and Commissions page.

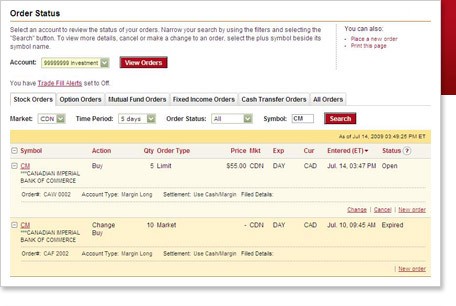

If an order is filled at different prices throughout the day, will I pay a commission for each lot purchased/sold?

Only one commission is charged if an order is executed in multiple lots on the same day. If it is filled over a number of days, you will be charged one commission each day a fill is completed.

What is the cut off time for placing mutual funds orders?

The cutoff time to buy or sell mutual funds through CIBC Investor Services is 3:00 p.m. ET. All orders placed after this time are handled on a best efforts basis and may be processed the following business day. Note: some mutual funds have an earlier cutoff time and some are priced weekly or monthly.

Can I trade options?

Yes, you can trade equity, index and bond options through CIBC Investor’s Edge. The following options are not available: currency option, gold and silver options, futures and commodities. For registered accounts, only buys of calls and puts and covered options are available.

Can I trade Canadian equity options?

Yes, however there are some restrictions:

- Your order will not qualify for a Minimum Guaranteed Fill. The stated quote size reflects only what is available in the order book of the Canadian Derivatives Exchange or Bourse de Montreal Inc.

- All or None (AON) orders will not be honoured. The trade request may be rejected or processed without the AON restriction.

- Market orders are now converted to limit orders at the price of the opposite side of the market.

Example: An order is entered to buy 20 contracts of CLS Jan 20 at market. Since five contracts are offered at $1.50 they will be filled. Under the new rules, the market order then becomes a limit order at $1.50 for the remaining 15 contracts and will sit on the bid while the offer moves to the next price.

Can I place an option order after 4:00 p.m. ET?

This is the schedule for different types of options:

- Canadian equity options cease trading at 4:00 p.m. ET

- Canadian index options cease trading at 4:15 p.m. ET

- U.S. equity options cease trading at 4:00 p.m. ET

- U.S. index options cease trading at 4:15 p.m. ET

To place an order for the same day for any of these options after 4:00 p.m. ET, and until that market closes, you must call us and place your order through an Investment Representative. Any option order placed online after 4:00 p.m. ET, will be automatically be submitted for processing on the next trading day.