Chartered Financial Analyst (CFA) Certification Requirements Exam

Post on: 16 Март, 2015 No Comment

The Chartered Financial Analyst (CFA) designation is globally considered to be the premier investment management designation in the financial industry. The three levels of rigorous exams required in the CFA curriculum leave lawyers and CPAs as the only other professionals whose pre-certification requirements rival those of the CFA.

This prestigious credential is offered by the CFA Institute. formerly known as the Association of Investment Management and Research (AIMR). The designation originated in the United States in 1963 and has since spread across Europe, Asia, and the Pacific Rim. Today more than 90,000 certificants proudly display this credential behind their names in over 135 countries.

Who Should Earn the CFA Designation?

Any financial or investment professional who manages money for a living is a candidate for this credential. Financial, corporate, and research analysts; CEOs, consultants, risk management specialists, and investment bankers can further their careers by earning this designation. Although some private investment management practitioners also carry this mark, it is most commonly found in the institutional arena.

Benefits of Becoming a CFA

Salaries can be substantial, but range depending on profession and experience. For example, an entry-level analyst could make around $50,000, while a senior equity portfolio manager could start at $500,000 plus bonuses. CFAs are usually heavily favored by mutual fund companies seeking competent portfolio managers, and those without this designation often find themselves on the outside looking in.

This credential holds much more weight than other marks such as the CFP or CLU when it comes to evaluating an investment professionals ability to manage a portfolio. The CFA provides hands-on training to effectively manage either a personal or institutional investment portfolio. It also opens the door to a wealth of other analyst-related careers in the financial industry. Those who carry this credential are highly sought after by many types of employers including banks, mutual fund companies, insurance companies, and other established institutions.

The CFA Institute also provides many perks to its members, such as local educational and networking opportunities, exclusive investment publications, and many other sources of research that can be accessed either online, in print, or by podcast. Certificants are also provided with their own personal website that allows for further networking and educational opportunities.

CFA vs. MBA

Traditionally, an MBA was the requisite degree for investment professionals. However, as financial markets have become more specialized, the CFA credential has risen to prominence. This is because a CFA education and the experience requirement focus heavily on financial markets and the management and analysis of their instruments.

An MBA doesnt cover these topics to nearly the same extent, but instead covers a breadth of business topics applicable across different sectors. Potential CFA candidates should consider if they want to work in finance for years to come, or if they want to transfer their skills someday to a different arena. Unlike an MBA, the CFA designation does not have a wide playing field; it may be a near useless designation in some areas where an MBA would be highly valued.

What Does It Cost to Become a CFA?

CFA curricula for levels I, II, and III are available only through the CFA Institute and only on a self-study basis. Once a candidate registers for an exam, the curriculum for that level is delivered in electronic format, print, or both, and will include one mock exam. CFA candidates can expect to spend around $3,600 on course materials, administration, and exam registration fees. A CFA candidate should expect to retake at least one exam which means paying that exams registration fee twice. (There is no limit to how many times an exam may be retaken).

If supplemental study programs are elected via other vendors, they will further add to the cost of enrollment. Considering the CFA Institutes fees plus the cost to retake one exam and supplemental exam prep at $1,000 per level, a candidate could easily spend $7,500 to pass the levels I, II, and III exams.

That said, the cost to complete is highly individual and will vary substantially depending on when the student registers, how many tests they retake, and what type of supplemental study they choose, if any. Exam prep courses are offered in self-study and live classroom formats; costs range from around $300 to $1,600 per level and are determined by the provider, the format, and how comprehensive the course is.

Most candidates take between 2 and 5 years to complete program, but the average is four years. Theres no deadline by which to finish coursework and take exams.

CFA Responsibilities

CFAs are expected to make sound investment and portfolio management decisions when handling personal and institutional funds. CFAs must also be a member of the CFA Insitute, join a local CFA society, and pledge annually to a strict code of ethics that is governed by the CFA institute. Membership dues are $275 per year and local CFA societies will assess their own dues. CFAs are expected to update and improve their financial expertise by participating in continuing education activities.

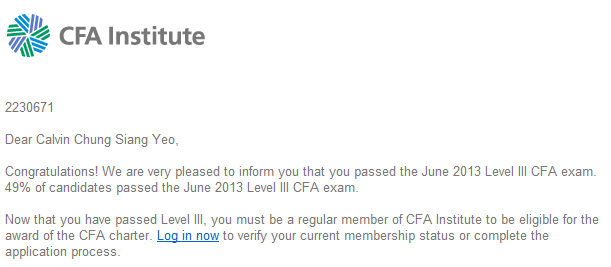

CFA Charterholder Requirements

The CFA designation is conferred upon those who complete all three levels of the CFA curriculum, meet a four-year professional experience requirement, become a regular member of the CFA Institute, and maintain that membership in good standing.

1. Educational Coursework

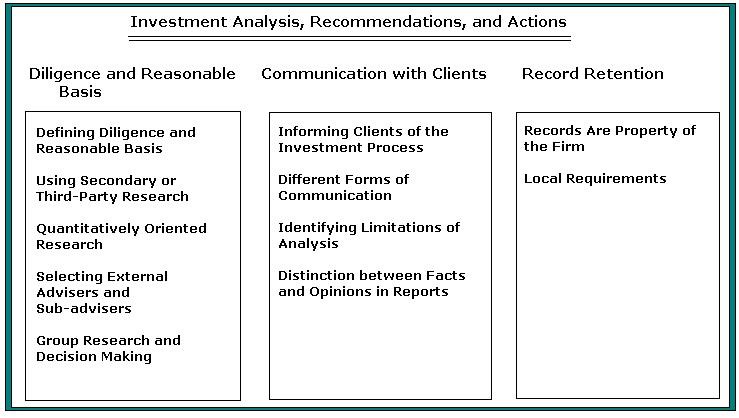

The CFA curriculum is widely considered the most grueling of all of the major financial designations except, perhaps, the CPA. It is divided into three levels which emphasize different aspects of portfolio management. Each level typically requires around 300 hours of study and preparation from the student. The CFA Institute recommends 15 20 hours per week for study. All three levels contain a strong emphasis on ethics and are updated regularly. In general, the three levels touch on the following topics:

- Ethics and Professional Standards

- Standards of Practice

- Quantitative Methods of Analysis

- Economics, Business Cycles, and Market Forces

- Currencies and Exchange Rates

- Monetary and Fiscal Policy

- Financial Reporting and Analysis

- Financial Ratios, Debt, and Taxation

- Corporate Finance, Mergers, and Acquisitions

- Individual Security Analysis

- Portfolio Analysis and Management

Level I Curriculum

The first level of the CFA curriculum exposes students to the basic concepts and functions of investment and portfolio management, along with an introduction to the securities markets, asset classes, and individual securities.

Level II Curriculum

In this level, students begin to apply the concepts learned in Level I to evaluate companies and industries, along with the various types of investment vehicles and securities.

2. Board Exams

The board exam for Level I of the CFA is administered twice each year, typically over the first weekends in June and December. Exams for the other two levels are only administered on the first weekend of June. Each test is taken on paper during a single day and consists of two three-hour sessions. Level I exam questions are straight multiple-choice. The Level II test is made up of vignette questions: an initial vignette of information must be referred to in order to answer a subsequent series of questions. Level III questions require short answers and also pose more vignette questions.

Grading and Results

3. Experience Requirement

Candidates must have at least four years of hands-on experience making investment decisions before they can apply for the CFA charter. Qualifying experience should consist primarily of statistical, analytical, or economic analysis of securities and their derivatives.

Teaching and supervising activities related to making investment decisions are also acceptable. However, to register for the CFA curriculum and exams, candidates need only to have a bachelors degree or a combination of relevant work experience and college experience, or they may be in the final year of their undergraduate coursework. Many candidates acquire the necessary experience while studying for the CFA exams.

4. Membership

To become a regular member, the four-year work experience requirement must be met. The applicant must also pass the level I exam, and be sponsored by two individuals: their supervisor and a regular CFA member. They also must find a local CFA society to join and pay membership dues.

Final Word

Many CFA certificants will tell anyone who asks them that earning this credential was the most difficult accomplishment of their lives. Self-study requires discipline and a constant commitment over a period of years. Plus, the potential to fail at least one exam is high. CFA aspirants need to be able to pick themselves up and continue on with the program in spite of such setbacks.

However, very few have any regrets about the amount of time and work they spent. Earning the CFA credential provides a valuable education and networking resources. Most importantly, it can open the door to jobs and opportunities that would otherwise be out of reach.