Bond ETFs EmergingMarket Bonds Mean High Risk High Return For Dummies

Post on: 1 Май, 2015 No Comment

Although emerging market bond ETFs have been around for only a few years, emerging-market bond mutual funds have been in existence for much longer. The T. Rowe Price Emerging Markets Bond Fund (PREMX), for example, has a 15-year average annual return of 11.45 percent. But there has been volatility, for sure: In 2008, the fund lost nearly 18 percent of its value.

U.S. high-yield (“junk”) bonds tend to be highly volatile, and they tend to move up and down with the stock market. In other words, they dont provide much of the diversification power or soft cushion that bonds are famous for.

Foreign junk bonds are different. These bonds, issued by the governments of countries that may not be entirely stable, are just as volatile as bonds issued by unstable U.S. corporations, but they do not tend to go up and down with the U.S. stock market (although they certainly may at times. and did so in 2008).

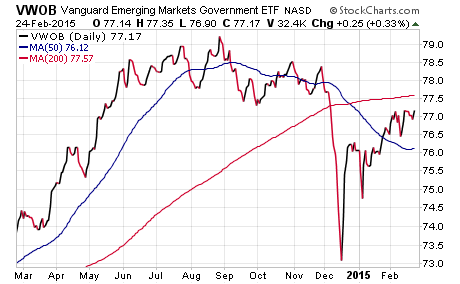

For reasons of diversification, investors with fairly good sized portfolios may want to consider allocating a modest part of their portfolios to emerging-market debt. You would do well to think of your holdings in emerging-market debt as more of a stock-like investment than a true bond investment. After all, youre likely to see stock-like volatility and long-term stock-like returns with these investments.

iShares JP Morgan USD Emerging Markets Bond Fund (EMB)

Indexed to: The JPMorgan EMBI Global Core Index, which is made up of about 80 bond issues, all U.S. dollar denominated, from various emerging-market nations

Expense ratio: 0.60

Current yield: 4.57 percent

Average credit quality: BBB

Average weighted maturity: 11.5 years

Top five countries: Russia, Brazil, Turkey, Philippines, Mexico

Russells review: The expense ratio is a bit high, but there isnt a lot of choice in this arena. The iShares fund is a perfectly good way to tap into this asset class.

PowerShares Emerging Markets Sovereign Debt Portfolio (PCY)

Indexed to: The DB Emerging Market USD Liquid Balanced Index, which tracks the returns of approximately 22 emerging-market sovereign bonds

Expense ratio: 0.50

Current yield: 5.53 percent

Average credit quality: BBBBB

Average weighted maturity: 14.7 years

Top five countries: Turkey, Columbia, Qatar, Bulgaria, Indonesia

This fund is slightly cheaper than the iShares emerging-market fund. And the yield is higher too. But the dicey mix of nations and lengthy average maturity also make this fund considerably more volatile. (Ah, that old risk and return thing again!) In 2008, this fund lost 18.79 percent; EMB, in contrast, lost 2.09 percent in that sorry year.