Beware of the Differences Between S P 500 Index Funds CBS News

Post on: 30 Июль, 2015 No Comment

Last Updated Nov 6, 2009 1:27 PM EST

Index fund expenses play a critical role in the returns their investors earn. That would seem to be a self-evident fact, but it appears that a not-insignificant segment of index fund investors do not understand that relationship.

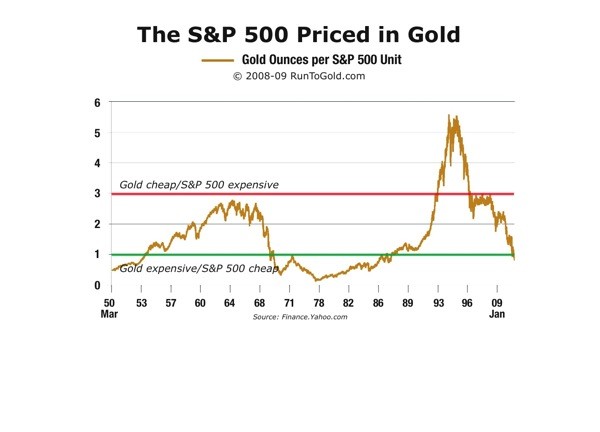

Index funds are essentially commodities. Just as it makes little sense to believe that one bar of gold will provide a better return than another, it is illogical to think that the gross returns (before expenses) of one S&P 500 index fund will materially differ from another. The fund managers seek to add no value. They simply buy and hold the 500 stocks that compose the S&P 500 index, and earn the return that the index provides.

Indeed, the range of expense ratios for S&P 500 index funds is amazing. According to Lipper data, the average S&P 500 index fund carries an expense ratio of 0.62 percent. The cheapest option, a Vanguard institutional fund, charges a mere 0.025 percent annually. At the other end of the spectrum, the Rydex S&P 500 fund levies a 2.28 percent annual fee.

(How on earth a board of directors could ever justify approving a fee that is nearly four times the average fund’s expense ratio is mind boggling. And the fact that investors would actually choose to invest in such a fund is, in a word, discouraging.)

The range of 500 index fund expense ratios recently came up in a debate that Morningstar hosted between two law professors on either side of the Jones v. Harris Associates case. William Birdthistle and John Coates .

Asked to square his contention that mutual funds compete on price with the wide range of fees charged by 500 index funds, Prof. Coates speculated that these investors weren’t being fooled into overpaying for their index funds, but rather, they might choose to invest in a higher cost fund simply for the convenience of having all of their assets with one fund manager. (Prof. Birdthistle correctly pointed out that this logic flies in the face both of reality, in which the vast majority of investors own funds run by many different fund firms, and a point Coates had previously made about how simple it is to move money from one fund to another.)

Coates went on to trivialize the differences in index fund fees, saying they amounted to a tiny fractions of a penny. over time.

I’m not sure what kind of a math background most Harvard Law professors have, but the differences amount to much more than that. For example, the two funds that Morningstar used in the example Coates spoke to were the Vanguard 500 Index fund and the BlackRock S&P 500 index fund, which charge expense ratios of 0.16 percent and 0.60 percent, respectively.

If the market provides an annual return of eight percent over the next 40 years, the investors in the Vanguard fund would earn 7.84 percent, and the BlackRock fund investors would earn 7.4 percent. An investment of $10,000, then, would grow to $205,000 in the Vanguard fund, while the same amount would grow to $174,000 in the BlackRock fund — a $31,000 gap that represents a bit more than tiny fractions of a penny, and a significant price to pay for the convenience of holding one’s assets with a single fund manager.

The good news is that, by and large, investors who choose index funds tend to know just how important expenses are, and have overwhelmingly chosen lower cost options over the higher cost rip-offs. But the $3.8 billion invested in S&P 500 index funds with above-average expenses provides a good deal of evidence that many investors are not so wise, and the funds’ managers will be profitably content to have their investors remain that way.

2009 CBS Interactive Inc. All Rights Reserved.