Articles & News Porters Five Forces Analysis

Post on: 7 Январь, 2016 No Comment

If you’ve ever listened to Warren Buffett talk about investing, you’ve heard him mention the idea of a company’s moat. The moat is a simple way of describing a company’s competitive advantages. Company’s with a strong competitive advantage have large moats, and therefore higher profit margins. And investors should always be concerned with profit margins.

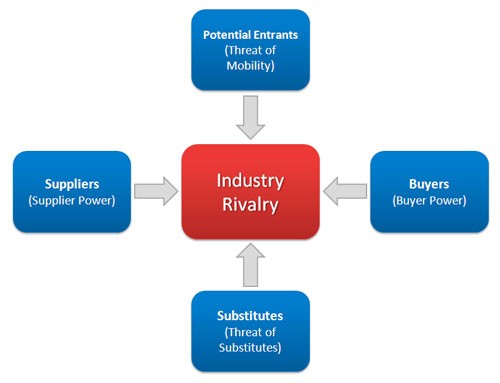

This article looks at a methodology called the Porter’s Five Forces Analysis. In his book Competitive Strategy, Harvard professor Michael Porter describes five forces affecting the profitability of companies. These are the five forces he noted:

These five forces, taken together, give us insight into a company’s competitive position, and its profitability.

Rivals

Rivals are competitors within an industry. Rivalry in the industry can be weak, with few competitors that don’t compete very aggressively. Or it can be intense, with many competitors fighting in a cut-throat environment.

Factors affecting the intensity of rivalry are:

New Entrants

One of the defining characteristics of competitive advantage is the industry’s barrier to entry. Industries with high barriers to entry are usually too expensive for new firms to enter. Industries with low barriers to entry, are relatively cheap for new firms to enter.

The threat of new entrants rises as the barrier to entry is reduced in a marketplace. As more firms enter a market, you will see rivalry increase, and profitability will fall (theoretically) to the point where there is no incentive for new firms to enter the industry.

Here are some common barriers to entry:

Substitute Products

This is probably the most overlooked, and therefore most damaging, element of strategic decision making. It’s imperative that business owners (us) not only look at what the company’s direct competitors are doing, but what other types of products people could buy instead.

When switching costs (the costs a customer incurs to switch to a new product) are low the threat of substitutes is high. As is the case when dealing with new entrants, companies may aggressively price their products to keep people from switching. When the threat of substitutes is high, profit margins will tend to be low.

Buyer Power

There are two types of buyer power. The first is related to the customer’s price sensitivity. If each brand of a product is similar to all the others, then the buyer will base the purchase decision mainly on price. This will increase the competitive rivalry, resulting in lower prices, and lower profitability.

The other type of buyer power relates to negotiating power. Larger buyers tend to have more leverage with the firm, and can negotiate lower prices. When there are many small buyers of a product, all other things remaining equal, the company supplying the product will have higher prices and higher margins. Conversely, if a company sells to a few large buyers, those buyers will have significant leverage to negotiate better pricing.

Some factors affecting buyer power are:

Supplier Power

Buyer power looks at the relative power a company’s customers has over it. When multiple suppliers are producing a commoditized product, the company will make its purchase decision based mainly on price, which tends to lower costs. On the other hand, if a single supplier is producing something the company has to have, the company will have little leverage to negotiate a better price.

Size plays a factor here as well. If the company is much larger than its suppliers, and purchases in large quantities, then the supplier will have very little power to negotiate. Using Wal-Mart as an example, we find that suppliers have no power because Wal-Mart purchases in such large quantities.

A few factors that determine supplier power include:

It’s important to analyze these five forces and their affect on companies we want to invest in. The Porter Five Forces Analysis will give you a good explanation for the profitability of an industry, and the firms within it. If you want to know why a company is able, or unable, to make a decent profit, this is the first analysis you should do.

About The Author

Chris Mallon is the editor and publisher of the Undervalued Weekly, a free personal finance and investment newsletter, published once a week. To sign up for the Undervalued Weekly, send e-mail to underval@hot-response.com. or sign-up through the website at www.dynamicinvestors.net/index7.html ; chrismallon@dynamicinvestors.net

RELATED ARTICLES 5 Ways To Protect Your Bond Portfolio From Rising Interest Rates

The Federal Reserve recently raised its target federal funds rate for the first time since March 2000. This could be just the tip of the iceberg, though, as many experts believe rising inflation and a strengthening economy will spur continued rate hikes for the foreseeable future. The Switzerland of Asia Shines

In many respects, Singapore is the Switzerland of Asia. Understanding The Real Rate of Return!

There is one indicator more than any other which determines the health of an economy and it is the Real Rate of Return. Furthermore this is the simplest of all indicators to understand because it determines the safety of assets. Next time you hear the TALKING HEADS discussing the nuances of the markets, filter what they say through your own understanding of the Real Rate of Return. Before You Start Investing

There maybe several reasons why you to want to invest your money. You may want to retire early, want to build your own business in the future, or to pay for your kid’s education. Should everyone start investing outside their retirement accounts right away? The answer to this question is that it depends on your financial situation. First, you must have a basic understanding in financial management. What would happen if you lose your job, accumulate large medical expenses, or losing money on your investments? Do you still have money to pay your bills? Do you have to sell your investments that you have worked so hard for, with a loss? No one knows what the future will bring. Therefore, you must have a safety net to fall back on in an unexpected event. This article contains 5 concepts that you should follow before you start investing outside of your retirement accounts. Seecrets on Investment: Tired of Making Huge Losses in the Stock Market. Part 1

Over 80% of all individual investors lose money in any given span of ten years. This figure is likely to be higher, given most people’s reluctance to reveal their losses. This article provides a broad outline of this financial landscape. It reflects the author’s personal views as an individual investor and author of a stock charting software with the experiences learned from the University of H.K. (hard knocks). Do not consider this article as any form of financial advice. Financial advice are available from licensed individuals and companies as required by law in your respective country. Short Selling for Investors

Shorts. Let’s see. If there are shorts there must be longs. Which is best? Longs or shorts? Is Starting A Business For Me? What To Consider Before Starting A Business

Do you have the right temperament? Investing and the Fear of Regret and Greed

People tend to feel sorrow and grief after having made an error in judgement. June 2005: Weather Forecasts for Weather Traders

If Johannes Kepler, the renowned 17th century astronomer and discoverer of the planetary laws of motion, could speak from the heavenlies, he might have a few words of wisdom to share with the National Weather Service. Although Kepler’s name is not normally associated with meteorology, he was quite the weather forecaster in his day. His first claim to fame, by the way, was not due to his discovery of those planetary laws, but because of his accurate long-range weather forecast of the severe winter that put Styermark, Germany on ice in 1593. Foreign Investing — US Investors Still Missing Out?

Investors are still too slowly realizing what the academics have long pointed out ?- adding foreign stocks to your portfolio will, over the long term, increase your returns and lower the overall risk of your portfolio. Making Every Penny Count

More and more workers are leaving their jobs and taking their 401 k retirement plan funds with them. While some are rolling their funds over into IRAs or other qualified plans; many are taking their distributions in cash. Once an employee has left the job, any payments of earned vacation, sick or other leave made after leaving the job were not considered for inclusion in deferrals to Solo 401k, 401(k), or 403(b) plans. These plans’ definition of compensation excluded any post employment earnings as the IRS excluded it from the definition. As far as these plans’ were concerned, it’s as if the money was never earned. Seven Investment Terms Everyone Should Know

For those who have never given their financial future a second thought, the term Financial Planning could be a scary one. Investments can be a smart way to invest money for your future, but it can be confusing for those who have no experience in the financial business. Before you consult a financial planner it is wise to become familiar with some of the terminology that you are likely to hear from him or her. Volatile Oil

The Light Crude Continuous Contract fell from $67.70 a barrel on Monday to $62.75 on Thursday, and closed at $65.79 on Friday. Consequently, oil stocks followed the sharp move in oil prices last week. Fundamentals of Option Pricing

When one begins to consider an option, it is very important to figure out how the premium is calculated. Option premiums depend on a variety of factors including the time left to expiry as well as the price of the underlying security. There are two parts to an option premium: intrinsic value and time value. Consequently, several different factors have an influence on intrinsic and time value. Stock Market Leaders and Laggards

Leaders are stocks that breakout immediately when the market confirms a new rally. In the first several weeks, strong stocks with leadership ability will breakout on volume above their 50-day average. Some of these stocks will breakout on the largest volume ever. Typically, newer stocks that have come public in the past few years will have the most strength for sizable gains. Is Your Mutual Fund the Right One for You?

Mutual Funds are considered to be one of the best investments one can get hands on. They’re very flexible and cost-effective. An excellent investment for people with restricted knowledge, time or, money. Reasons For Joining An Investment Club

Whether you’re a novice investor or an experienced stock picker an investment club may be beneficial to growing your investment portfolio. This article explains what an investment club is, why you should have an investment program and finally why you should join an investment club. Going Against the Conventional Investment Wisdom

First of all, I want to give everyone the disclaimer that I am not a registered financial advisor and I don’t play one on TV. Therefore, I cannot legally provide financial advice and I will not do so. This is for informational purposes only and I’m not recommending any of my personal investment strategies to anyone else. Now, with that being said, I will outline some techniques I use for my personal investment strategy, without going into a whole lot of specifics. I generally go against the conventional investment wisdom that you are accustomed to hearing, although I do use both a conservative and a not-so-conservative strategy. Brain Snappers and Other Wall Street Nonsense

The last time you spoke with your broker did he use any of the following words? Diversification, Price-to-earnings ratios, discretionary trading, lifting a leg (he’s talking to you not your dog), leverage, divergence, fee-based compensation, escalator clause, tactical asset allocation and other mesmerizing words to place you in stupefying shock. For Entrepreneurs A SIMPLE Plan May Be Best

Q: I own a small decorating business and I’ll be the first to admit that I don’t know anything about taxes or retirement plans. I’d like to set up a 401(k) or an IRA or some other kind of retirement plan for me and my three employees. What are the various retirement plan options available for a small business owner and in your opinion, which would work best for me? — Wanda S.