A Guide To Dow S&P 500 And Other Index ETFs

Post on: 29 Август, 2015 No Comment

June 13, 2012 1 Comment

These days, some of the most popular trading assets are index ETFs, like a Dow ETF or S&P 500 ETFs. Traders love these securities because they offer the advantages of a fund with the flexibility of stocks in that you can trade them on an exchange just like a stock. Throw in the advantages of using index ETFs as a way to capitalize on the market and you have a tool that can be very profitable to a trader.

Here, I’ll explain what an index ETF is, the various types of index ETFs on the market, and why – and how – you can make money in the market off of them.

What Are Index ETFs?

The term ETF stands for exchange-traded fund . which is an investment fund that contains assets (like stocks and bonds) and is traded on an exchange. In other words, you can buy and sell ETFs just like you can regular stocks. But, an ETF is not a stock; it actually holds other stocks, or commodities, or whatever the case may be.

The fund part of exchange-traded fund comes from the same concept behind a mutual fund; instead of buying shares of only one stock, you’re actually buying shares in a pool of assets that include several different stocks. Often these have something in common, like belonging to the same industry, but sometimes they don’t. You can have an ETF that tracks the performance of the tech industry, for example, or one that is tied to a specific commodity, like gold or silver. There are several types of ETFs, each with its own unique benefits.

An index ETF is an ETF that is tied to an index . or a way to track a particular part of the stock market’s performance. For example, the S&P 500 is a well-known index that tracks the performance of 500 large-cap stocks (stocks with a market capitalization of over $10 billion). The thought is that if this index goes up, the market as a whole is probably performing well; if it goes down, the market – and economy – could both be suffering.

Another cool thing about an index ETF is that you can actually trade the performance of a major index. For example, let’s say you expect the Dow Jones Industrial Average to increase over the next quarter. One ETF you could possibly buy is the SPDR Dow Jones Industrial Average ETF (DIA) . which tries to mimic the yield and price performance of the Dow Jones. If the Dow Jones goes up, so does the value of your holdings – and you profit as a result.

What assets make up the fund? If you look at the holdings of DIA, you’ll see that they are weighted . In other words, some holdings make up a higher percentage of the index’s worth than others. IBM is the top-weighted stock in the index fund, with 11.77% of the worth. Next is Chevron with 6%, McDonalds with 5.45%, and Caterpillar Inc. with 5.35%.

Looking at the holdings gives you an idea of what stocks determine the value of the index fund.

Types of Index Funds

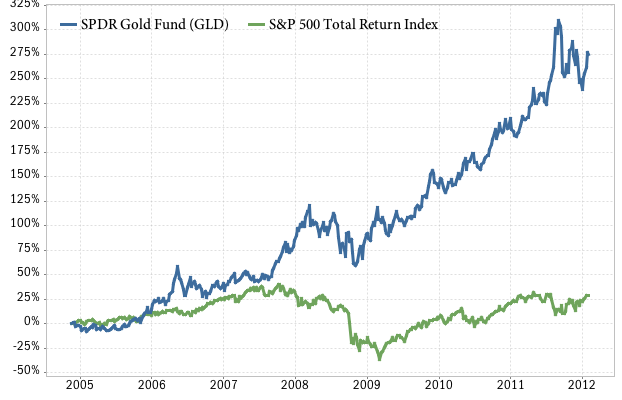

There are several types of index funds out there for your choosing. Some are stock index funds, like DIA and others that track sectors, industries, and even broad market indices (like DIA or an S&P 500 fund). Others are commodity indices, which track, broadly, the value of gold, silver, oil, aluminum, or other commodities.

Index funds vary based off how they produce a return. For example, most index funds are positively correlated to the value of whatever they are tracking. If gold goes up, so does a gold index fund. Some, however, are negatively correlated. which means they go up if the underlying asset goes down, and vice-versa.

You can also find index funds that vary based on the rate of return. These are called leveraged funds , or leveraged ETFs. The ProShares Ultra S&P 500 Fund (SSO) . for example, tries to deliver results equal to twice the performance of the S&P 500 Index. This means you can gain twice the amount of profit from your trade, but can also lose twice as much.

Why Trade Index ETFs?

Index ETFs have many advantages and benefits that make them attractive to traders. One big benefit is diversification. Instead of picking just one or two stocks – or even an industry – you can diversify risk by trading the entire market.

You can also use index ETFs to actually trade an index, something that you can’t normally do with just stocks or bonds or commodities. Plus, index ETFs are cheaper to trade than index mutual funds because they have lower expense ratios , or the percentage of your investment you have to pay in order to trade that asset. Also consider the fact that index ETFs are more tax efficient than index mutual funds.

Index ETFs also give you a chance to balance your portfolio, hedge against losses, and limit your exposure to a particular sector or industry. If you think the market overall is headed in the right direction, but the industrial goods sector is headed south, you can short an ETF for that sector while buying shares of a stock market index ETF and holding them for long-term gain.

Other popular pages you may want to check out: