4 Ways Fidelity Can Capture the ETF Market

Post on: 16 Март, 2015 No Comment

The fund giant has several tools at its disposal for it to better challenge its chief rivals in a highly competitive space

You heard it here first: The latest launch of 10 new Fidelity sector ETFs wont be a game changer.

Although Fidelitys MSCI-linked sector ETFs are nearly 80% below the industry average for passive sector ETFs, according to the Boston-based fund giant, it still has a notoriously lackluster approach toward the ETF business.

If it doesnt make drastic changes, it will lose one of its most significant battles yet.

To help them reverse the curse, Ive come up with a bold and controversial roadmap for Fidelity that involves four key steps. I believe Fidelity can rediscover its mojo, but only if it makes a serious attempt at following them.

1. Commission-Free Trading on ALL ETFs

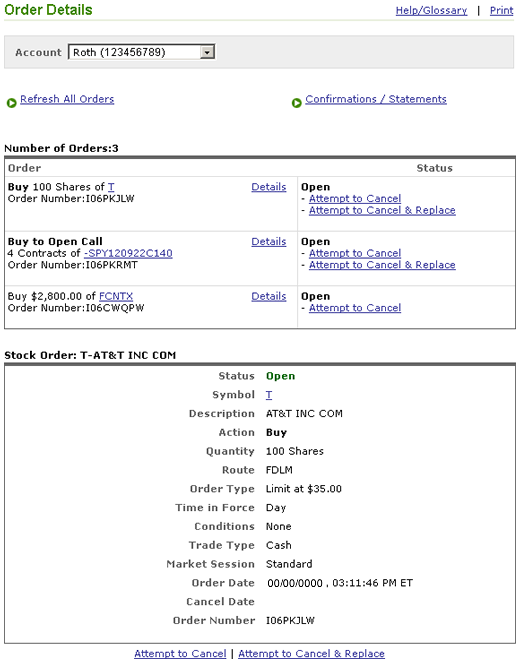

The ability to buy and sell ETFs online without paying any trading commissions is one of Wall Streets boldest moves yet at gathering assets. The only problem is that Fidelity is competing against other major brokerage firms that each offer their own menus of commission-free ETF trading.

How can Fidelity blow away the competition? By expanding its commission-free platform to include all ETFs. (Yes, you read that correctly all ETFs!)

Frankly, the only way to beat todays hypercompetitive ETF landscape is with a hyper-radical solution.

2. Focus on Core Asset Classes

Its puzzling why Fidelity has (mis)focused its attention on niche parts of the ETF market, like sector funds, when it should be aggressively expanding its Fidelity branded ETFs in asset categories.

Why arent there any Fidelity broad-market U.S. stock ETFs? Where are Fidelitys self-branded international stock ETFs? What about Fidelity bond ETFs? Whats taking so long?

Investors need help today at building low-cost diversified ETF portfolios. And Fidelity in its current state cant solve those needs, because it lacks self-branded ETFs across all major asset classes.

3. Introduce Fidelity ETF(k) Retirement Plans

Fidelity is already the nations largest 401(k) administrator.

Why doesnt it leverage that enviable position to launch an all-ETF 401(k) plan that attacks and totally disrupts the retirement plan market?

Rolling out its own lineup of broadly diversified or core portfolio ETFs would work well within the context of 401(k) plans, because these Fidelity-branded ETFs could become the menu of investment choices for 401(k) participants.

Ultimately, Fidelity has two choices: Watch competitors poach its mutual fund 401(k) business with low-cost ETF(k) plans or poach its own mutual fund 401(k) business with a proprietary ETF(k) solution and keep the assets from fleeing elsewhere.

I challenge Fidelity to launch an ETF(k) plan and do what Charles Schwab (up until now) has not been able to do.

4. Partner and Acquire

Great companies recognize they cant always build and innovate from within. Sometimes theres a lack of talent, or a lack of technology, or maybe a lack of will.

In that case, great companies align themselves with partners that can help them to win the game. In other cases, an outright acquisition can help reverse an innovative slump and jumpstart business.

Fidelity needs to re-examine what independent and innovative companies within the ETF marketplace can help it to build a sustainable advantage. And as for the question of how much it will cost Fidelity, the better question is this: How much will it cost them if they dont?

Perhaps no asset manager here or abroad has more to lose than Fidelity. Its operating profits fell 31% last year and its ho-hum approach isnt working.

Its impossible for Fidelity to make a significant impact in the ETF marketplace with a low-brow or conservative strategy. And the company should immediately fire any management consultants or executives who suggest otherwise.

The only way for Fidelity to ever become a serious ETF contender is to force the industry to play by its rules. And the only way anyone will ever play by Fidelitys rules is if the firm makes a purposeful, deliberate choice to enact big,bold moves that totally upend the ETF marketplace.

***

Ron DeLegge is the Editor of ETFguide.com, founder of the ETF(k) Retirement Group at LinkedIn, and publisher of the ETF Advisor Pro newsletter.