When To Sell Stocks Managing The Trade Selling For Profits

Post on: 31 Март, 2015 No Comment

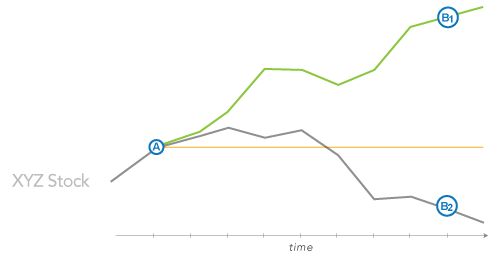

For some traders and investors, one of the most difficult thing to do is knowing when to sell a stock. It is often said that knowing when to buy a stock is easier than knowing when to sell. You dont want to sell too soon as the stock may continue to move upward. You dont want to sell too late, as you may incur large losses or lose most of the profit that has been gained.Breakout Theory, has solved much of this problem through risk management strategies, and optimum stop loss placement. However, there are other instances where you may want to sell in order to lock in more profits or get out before the stock hits your stop loss.

Other Trading Methods

Where To Place A Stop Loss

Sell at 30% Profits

When trading stocks, you may want to sell at a 25% to 30% gain. There was a study done on growth stocks. After some research it was found that stocks have a tendency to trend a 25% move then settle down forming new patterns and bases, then breakout again to run another 25-30%. After a stock has made a run of this magnitude, it would be a good time to sell.

Find Selling Points by Observing Last Trend

Another key to knowing when to sell a stocks is to look at charts and find the last breakout, then calculate the % gain after the breakout to the end of the trend. It is interesting to see that stocks seem to repeat their trend cycles. For example if you bought Apple stock and it ran 30% then hit your stop, the next breakout will most likely run another 30%. The advantage to this may be an extra 10% profit rather than letting your stops get hit.

Use VSTOP Indicator to sell stocks

Bigger markets have bigger trends. If you are trading ETFs, Forex, Precious Metals like Gold or Silver, it is often recommended that you go with the trend and let your stops get hit. Below is a chart of the gold etf. The vstop indicators is the red line. When, the stock breaks below the red line, the trend is over. The vstop is an excellent indicator that will signal you when to sell. For more information on the vstop indicator click here.

Candlestick charts can signal when to sell stocks

In the Chart above of the Gold ETF (GLD) there is a candlestick pattern known as a Harami Bearish Candles. It can be identified as a LARGE GREEN CANDLE followed by a SMALL RED CANDLE. This is one of many candlestick patterns. This is a sell signal. As you can see in the chart, you would have sold earlier and preserved a little more profit than if you just let your stops get hit. Learn To Read Candlesticks click here.

Sell Stocks When Theres Abnormally High Volume

Another sell signal is known as a high volume churning action of the traded security. When there is volume spikes or churning in the stock price, like 300 times the normal trading volume with little upward movement, this may signal the end of a trend, and selling would be a good idea. Below is a chart of Apples stock, with this type of action.

What is significant in the chart above is volume. Average shares traded daily is about 14 million. On the volume spike day, there were 75 million shares traded. Thats about a 400% increase from normal. Also, accompanied by the volume is the price action which MADE NO SIGNIFICANT UPWARD MOVEMENT. Price action and volume of this type is known as churning, and signals a reversal or end of the trend. This is a great signal for knowing when to sell a stock because, again you are selling BEFORE your stops get hit. Learn more about stock volume click here.