What Is Spread Betting

Post on: 14 Сентябрь, 2015 No Comment

Charles K. McNeil, a mathematics teacher who became a securities analyst and later a bookmaker in Chicago during the 1940s, has been widely credited with inventing spread betting. However, despite its American roots, spread betting is not currently legal in the United States.

Jumping forward roughly 30 years, on the other side of the Atlantic, City of London investment banker Stuart Wheeler founded IG Index in 1974, pioneering the industry by offering spread betting on gold.

At the time, the gold market was prohibitively difficult to participate in for many, and spread betting provided an easier way to speculate on it.

What is Spread Betting?

Spread betting is a derivative strategy, where participants do not actually own the underlying asset they bet on, such as a stock or commodity. Rather, spread bettors simply speculate on whether the asset’s price will rise or fall using the prices offered to them by a broker.

Key characteristics of spread betting include the use of leverage. the ability to go both long and short. the wide variety of markets available and tax benefits.

What is a Spread?

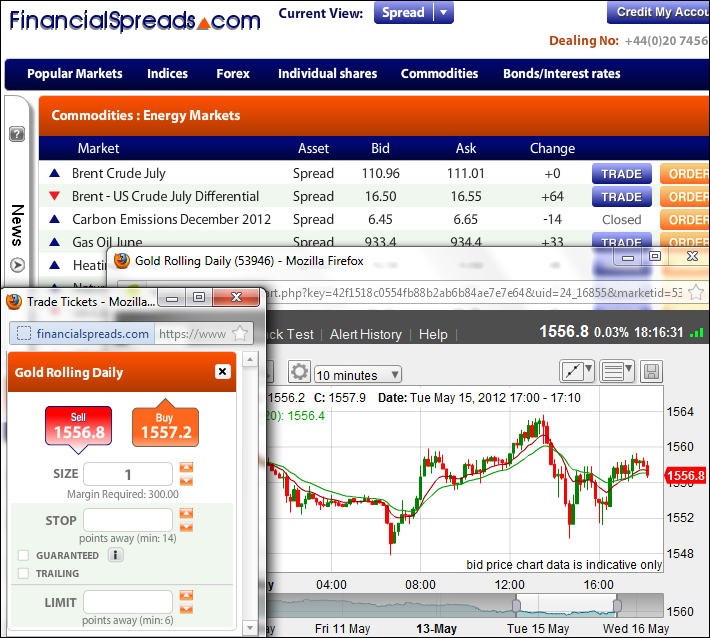

As in stock market trading, two prices are quoted for spread bets — a price at which you can buy and a price at which you can sell. The difference between the buy price and sell price is referred to as the spread. The spread betting company profits from this spread, and this allows spread bets to be made without commissions, unlike stock market trading .

A Basic Stock Market Trade vs. a Spread Bet

Here we’ll cover a practical example to illustrate the pros and cons of this derivative market and the mechanics of placing a bet. First we’ll take an example in the stock market, and then we’ll look at an equivalent spread bet.

For our stock market trade, let’s assume a purchase of 1,000 shares of Vodafone (LSE:VOD ) at £193.00. The price goes up to £195.00 and the position is closed, capturing a gross profit of £2,000, having made £2 per share on 1,000 shares. Note here several important points. Without the use of margin, this would have required a large capital outlay of £193k. Also, normally commissions would be charged to enter and exit the stock market trade. Finally, the profit may be subject to capital gains tax and stamp duty .

Now, let’s look at a comparable spread bet. Making a spread bet on Vodafone, we’ll assume with the bid offer spread you can buy the bet at £193.00. In making this spread bet, the next step is to decide what amount to commit per point, the variable that reflects the price move. The value of a point can vary. In this case we will assume that one point equals a one pence change up or down in the Vodaphone share price. We’ll now assume a buy or up bet is taken on Vodaphone at a value of £10 per point. The share price of Vodaphone rises from £193.00 to £195.00 as in the stock market example. In this case the bet captured 200 points, meaning a profit of 200 x £10, or £2,000.

While the gross profit of £2,000 is the same in the two examples, the spread bet differs in that there are usually no commissions incurred to open or close the bet and no stamp duty or capital gains tax due. In the U.K. and some other European countries, the profit from spread betting is free from tax.

However, while spread bettors do not pay commissions they do suffer a bid offer spread. which may be substantially wider than the spread in other markets.

Keep in mind also that the bettor has to overcome the spread just to break even on a trade. Generally, the more popular the security traded, the tighter the spread, lowering the entry cost.

In addition to the absence of commissions and taxes, the other major benefit of spread betting is that the required capital outlay is dramatically lower.

In the stock market trade, a deposit of as much as £193k may have been required to enter the trade. In spread betting, the required deposit amount varies, but for the purpose of this example we will assume a required 5% deposit. This would have meant that a much smaller £9650 deposit was required to take on the same amount of market exposure as in the stock market trade.

The use of leverage works both ways, of course, and herein lies the danger of spread betting. While you can quickly make a large amount of money on a relatively small deposit, you can lose it just as fast. If the price of Vodaphone fell in the above example, the bettor may eventually have been asked to increase the deposit or even have had the position closed out automatically. In such a situation, stock market traders have the advantage of being able to wait out a down move in the market, if they still believe price is eventually heading higher.

Managing Risk in Spread Betting

Despite the risk that comes with the use of high leverage, spread betting offers effective tools to limit losses .

- Standard Stop Loss Orders — Stop losses orders allow reducing risk by automatically closing out a losing trade once a market passes a set price level. In the case of a standard stop loss, the order will close out your trade at the best available price once the set stop value has been reached. It’s possible that your trade can be closed out at a worse level than that of the stop trigger, especially when the market is in a state of high volatility.

- Guaranteed Stop Loss Orders — This form of stop loss order guarantees to close your trade at the exact value you have set, regardless of the underlying market conditions. However, this form of downside insurance is not free. Guaranteed stop loss orders typically incur an additional charge from your broker.

The Bottom Line

Continually developing in sophistication with the advent of electronic markets, spread betting has successfully lowered the barriers to entry and created a vast and varied alternative marketplace.

The temptation and perils of being over leveraged continue to be a major pitfall. However, the low capital outlay necessary, risk management tools available and tax benefits make spread betting a compelling opportunity for speculators .