What Affects the Bitcoin Price

Post on: 9 Март, 2016 No Comment

The Bitcoin price is the monetary cost of a bitcoin. The term price, as used here, is not to be confused with value which is a perceived regard for Bitcoins benefits and usefulness. The Bitcoin price is expressed as an exchange rate in relation to another currency. So, for example, the Bitcoin-to-Dollar exchange rate may be $1,750 for one bitcoin, written as $1,750 BTC/USD.

By design, a total of 21 million Bitcoins will be created over 100 years according to a logarithmic release function. At the time of writing, just over 13 million bitcoins are in circulation, meaning that an additional 8 million bitcoins will be mined over the next 95 years. Given this timescale and the decelerating rate of increase of the coinbase, the supply of bitcoin can, for practical purposes, be assumed to be constant.

With increased usage and wider adoption of Bitcoin, the demand for bitcoins is always increasing. With a constant supply and increasing demand, the only factor in the equation that can budge is the price of bitcoin by going up. Hence, assuming increased demand, the Bitcoin price gradually increases over the long-term.

The Many Functions of Bitcoin

Bitcoin has many functions and uses, but we will only consider those that are salient to price fluctuations:

- Bitcoin Payment Network Bitcoin as a currency

- Bitcoin Storage and Transfer Bitcoin as a store of wealth and medium of value transmission

- Bitcoin Exchange Rate Bitcoin as a market instrument and commodity

Bitcoin Payment network

Bitcoins are transacted on an ongoing basis and around the clock. At the time of writing an average of 62,000 Bitcoin transactions are conducted daily with an average volume of $50mil per day .

Of course, transactions over the Bitcoin network do not directly affect the market price of Bitcoin. In the sense that an active Bitcoin network reflects a healthy protocol enjoying plenty of usage and demand, there is an indirect influence. Only where bitcoins interface with other currencies at exchanges is there a direct impact on the price of Bitcoin.

Buying Bitcoin

Every bitcoin exchange transaction that involves the purchasing of bitcoin via another currency, whether fiat or cryptocurrency. has the effect of pushing the bitcoin price up. Because the bitcoins are changing hands from the exchanges wallet to the buyers wallet there is an accompanying Bitcoin network transaction. However, it is the exchange transaction that counts toward an uptick in the Bitcoin exchange rate. Routine purchases are made daily, for various purposes, and typically increasing toward month-end:

- Company salaries

- Wallet balance replenishment

- Buy-and-Hold investment purchases

- Incidental purchases destined for paying merchants

- Purchases intended for transmission

Selling Bitcoin

Every exchange transaction that involves the selling of bitcoin, i.e. exchanging for fiat or another cryptocurrency causes a downtick in the price of Bitcoin. Let us consider the last example listed above, namely usage of the Bitcoin network as a means of money transmission.

Someone working in the US, and paid in US Dollars, wants to send money to their family in Zambia. Instead of using the illustrious Western Union, they opt for the Bitcoin payment network. No queues, no forms to fill in, no proverbial rubber gloves, and no extortionate fee. They purchase bitcoin via an exchange that offers BTC/USD. send the bitcoins to a relatives Bitcoin address, and 30 minutes later the relative in Zambia redeems some (or all) of the bitcoin for Kwacha via a local exchange offering BTC/ZMK .

The original bitcoin purchase would have caused an uptick (no matter how small) in the BTC/USD exchange rate. Half an hour later, the redemption sale via a Zambian exchange would cause a downtick in the BTC/ZMK exchange rate.

The above example also serves to illustrate the effect of money flow that causes some currencies to increase at the expense of others. Here are some more routine bitcoin sales that put a downward pressure on the Bitcoin exchange price:

- Merchants who accept Bitcoin

- Miners cashing out to pay bills and expenses with fiat

- Redemption of transmission bitcoin (as discussed above)

- Partial or full conversion of bitcoin salaries to fiat

It is frequently alleged that Merchants convert any and all bitcoin they receive straight to fiat due to Bitcoins volatile intraday price swings. This seems a sound strategy, although it must be pointed out that no single financial policy applies to every business. It may very well be the case that some companies receive astute investment advice and either hold bitcoin amounts or channel them into investment funds. This would have the same effect as long-term bitcoin storage. Hoarding effectively keeps bitcoins out of circulation and leads to price appreciation as increasing demand for a limited supply of bitcoin raises cost per unit.

In the case where merchants convert bitcoin receipts straight to fiat there is, indeed, a downward pressure on price. However, it is balanced by the upward pressure caused by consumers (or their bitcoin paying employers) purchasing bitcoin with the aim of eventual spending. If this market force were not constantly equilibrating the Bitcoin price, then the absurd implication would be that one of Bitcoins primary aims, namely that of being a payment network, is also its undoing.

Bitcoin Market Instrument Trading

The speculative market for trading the Bitcoin price chart is sizeable. Bitcoins performance as a market instrument is spectacular and qualifies the cryptocurrency as a Super Commodity. No speculative instrument has ever achieved the phenomenal growth of Bitcoin. From Bitcoin’s exchange rate of $0.08 in June 2010 to its all-time high near $1,150 in November 2013, it had grown 1.4mil percent in less than three-and-a-half years .

Whereas the exchange transactions discussed in the section above represent recurring monthly or daily expenses, their relative volume is miniscule when compared to the millions of bitcoin being bought and sold in the speculative Bitcoin market every month.

Buy-and-hold investors have been included in the category above (rather than here) merely because their buying and selling of bitcoin is infrequent. The present category does include, however, the early adopters a group that includes Satoshi Nakamoto and most of the earliest Bitcoin miners. Their bitcoin holdings are sizable and their special status as founders of the Bitcoin network entitles them to profit-taking for buying houses, cars and other sizeable purchases typically only available via fiat payment.

The players exerting influence on the Bitcoin price in this category are:

- Retail exchange traders

- Early adopters cashing out to fiat

- Institutional entities such as investment funds and ETFs.

Of Bitcoin and Big Brother

Due to an unfortunate accident of history, the central banks and government have become bed-fellows. As a result, their activities and interests are intertwined, and their agent of exerting control and wielding power became money. It stands to reason that any useful money not directly controlled by them is a Problem .

It is, therefore, only natural that the most out-of-touch Old World authorities make Orwellian statements and decrees to try to make the threat go away. The smarter authorities go the opposite way by embracing Bitcoin, encompassing it in their legal frameworks. creating tax codes for cryptocurrency and then encouraging its use .

The prospect of regulation by regional authorities or parastatals seems to make most Bitcoin users quake in their bitboots, but they should best remember that the Genie is Out of the Lamp already. Official statements and announcements of the following kinds often result in strong price movements:

- Government and Central Bank Statements

- Talk of Regulation by parastatal bodies

- Incomprehensible Legalese

- Talk of Taxation

Does News Move the Bitcoin Price?

News announcements frequently coincide with price movements in the market. There is some debate as to whether the relative positivity or negativity of a news announcement causes a corresponding upward or downward movement in price. Evidence suggests that market participants are catalyzed into action by news announcements but that the direction of price movement is mostly unrelated to the actual content of the news and determined by the social mood at the time.

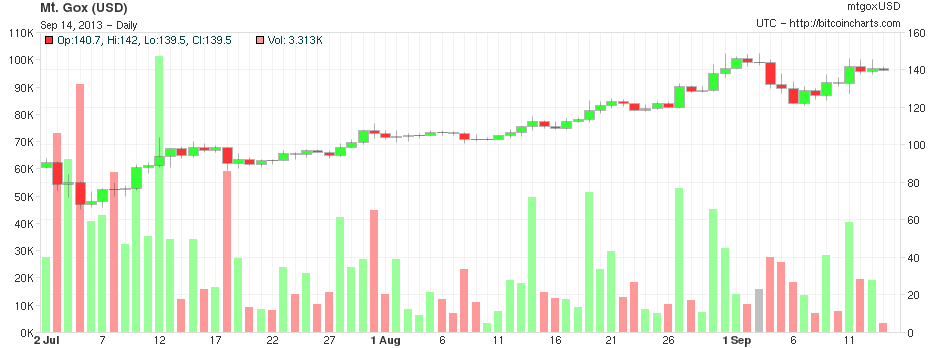

Notice, in the following chart, how eBay considering Bitcoin apparently ignites a rally. yet Dell the worlds largest IT retailer actually accepting Bitcoin payment leads to a sell-off .

Summary

The pushes and pulls on the Bitcoin price are diverse. Some are slow but steady, like the gradually rising Supply/Demand curve for a stable bitcoin supply base. Others are violent and sentimental, such as the speculative trades that see the buying and selling of tens of thousands bitcoin via exchanges every day.

Bitcoins price chart shows a long-term rising average price despite the often opposing forces exerting their influence on the market. Merchants and consumers each balance the others predominant buying or selling tendency.

Banks and governments are for the most part reacting inappropriately to the Bitcoin disruption. Some are embracing the innovation while others are stuck in hubris.

Some aspects of Bitcoin, such as Contracts, have not been explored and promise to add additional value, and, hence, price increases in the future.

Images from Shutterstock.

Updated: September 26, 2014 at 5:15 am CET.