Wealthy to lose tax breaks on second homes

Post on: 25 Сентябрь, 2016 No Comment

Tax breaks for second home owners are to be scrapped under proposals to raise more funds from the most wealthy.

Councils are now legally obliged to provide a council tax discount of 10% to 50% on owners’ second properties. Ministers plan to end this benefit in a move that would affect nearly a quarter of a million people, forcing them each to pay hundreds of pounds more a year in council tax.

Councils will have the option to offer discounts to second home owners, but it is understood that local authorities across the political divide have been lobbying for the change and ministers believe it is unlikely many would forgo the chance of a new revenue stream.

The policy is part of a crackdown on underused homes announced by the Liberal Democrat local government minister, Andrew Stunell, at the party’s conference in September. The move has also been championed by Lib Dem chairman Tim Farron and is understood to be widely supported by senior Tories, including the prime minister, who faced accusations of betraying the middle classes when he admitted second homes were not splendid for the economy.

A Whitehall source said: These homes distort the housing market and make it harder for local people to get on the housing ladder. Second homes currently receive a discount of up to 50% on their council tax bill, leaving local people struggling to pay the bills in their solitary home subsidising the bills of people wealthy enough to own two homes. Secondary homes tax breaks have cost councils almost 90m since April 2010.

The proposal is, however, likely to face a backlash from some in the Conservative party who claim that those who will be hit hardest are not the most wealthy but the middle classes who have saved to buy a holiday home.

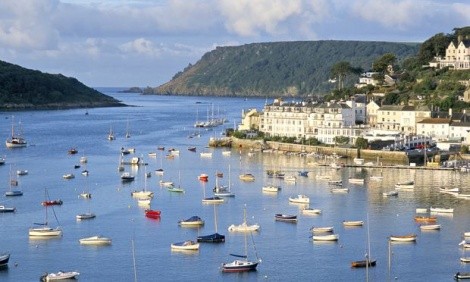

Second home ownership has grown sharply since the 1990s, particularly in rural and coastal areas such as Cornwall, Norfolk and Cumbria. Savers have turned to second homes as safer investments, particularly because of the risky returns in the stock market and low interest rates on Isas and bank accounts.

But Lib Dems have argued in government that the explosion of second home owners has priced local people out of the market. The local authorities with the most second homes are Cornwall (14,095), Westminster (7,152), Kensington and Chelsea (6,737), Birmingham (6,431), North Norfolk (4,763), Camden (4,120), South Hams, Devon (4,115), Tower Hamlets (4,074), Scarborough (3,979) and South Lakeland (3,845).

Other proposals to be announced include scrapping the mandatory council tax discounts for empty homes – now as high as 100% for the first six months a property is not used. However, this change would not affect owners who have moved out because of ill health or the relatives of people who have died, leaving their home empty.

It is understood that if all the long- term empty properties were brought back into use as affordable housing, waiting lists could be cut by a sixth. The largest numbers of empty homes are in Leeds (14,057), Birmingham (13,155) and Manchester (12,300).

The Whitehall source said: Allowing councils to charge full council tax on second homes and empty homes could be worth up to 100m in extra funding each year, which could be used to protect local services and keep council tax bills down for other people. On top of this, the empty homes premium could generate up to 50m each year to bring more empty properties back into use.

The government also plans to allow a council tax empty homes premium of up to 50% on any home left vacant for two years or longer.

In future, councils will also be able to spread council tax charges over 12 months, instead of 10 months now, to make it easier to pay. A source said the plan was to give taxpayers more flexibility and ensure that their monthly payments will be somewhat smaller.