Wall Street Loves Alternative Investment You US News

Post on: 1 Май, 2015 No Comment

Some exotic investments fail to live up to the hype.

Why not try some of this? brokers and fund managers have been saying to clients disappointed over their dismal account statements.

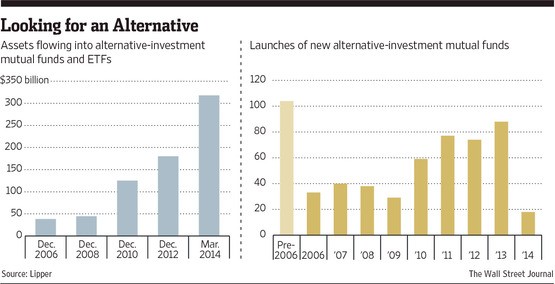

Because plain-vanilla investing has turned sour over the past half decade, Wall Street investment houses have responded with more flavors—so-called alternatives to volatile equities and low-yielding fixed income.

Financial services companies say new products and strategies open a whole new field of investing opportunity. Indeed, they are offering to the mass affluent investments that once were available exclusively to ultra-rich clients and ultra-smart university endowments.

They may have been a bit over-hyped, says Cheryl Costa, a principal and financial planner with Forteris Wealth Management. People have enough trouble understanding regular mutual funds and some of these alternatives are not very well understood, so you really have to tread carefully.

Putting your cash with an exclusive managed fund getting outsized returns in highly specialized markets (platinum futures, say) surely is an alternative to everyday stocks and bonds. But it might not be a smart long-term move.

Here is a look at a few of the most common alternatives by performance from worst to best in first half of the year.

Energy investments. Almost $1 billion flowed into energy funds, Lipper reported. The Power Shares DB Crude Oil Index has dropped 13 percent so far this year. Oil has been tracking the stock market’s declines, and even adding to them, since both equities and oil prices tend to be hurt by slow demand. And, unlike stocks, oil isn’t bouncing back. That is not the way to diversify.

General commodity futures. The past decade has been very good for commodities, and particularly precious metals. Broad-basket commodity funds were the top choice for people investing in alternative funds this year, Lipper reports, with $3 billion-plus in new money going there. But general commodities funds have been one of the year’s weakest categories, gaining just 1.3 percent year-to-date based on Morningstar’s total returns.

Funds of hedge funds. The much-hyped original alternative investment category, hedge funds try to out-think the market with brainy strategies. This was a laggard category in the first half of this year with a return of about 1 percent, based on BarclayHedge data. Also, funds of hedge funds may boast low expense ratios, but the actual costs are higher since the hedge funds pass along management fees and take a share of profits. Just investing directly in stock and bond funds the first half would have yielded much better returns than the funds of funds.

Market neutral. These are funds designed to have a low correlation with other portfolio holdings or with the overall market, such as merger arbitrage and long/short funds, according to Forteris. Investors have piled over $3.5 billion into long-short and market neutral equity funds this year, Lipper said. Long-short funds have managed to gain nearly 3 percent this year, but that is far below 10 percent total returns of large-cap domestic funds, from which investors have withdrawn $650 million this year.

Gold funds. In the dash to alternatives, people have invested nearly $1 billion in fresh cash into gold funds this year. It’s been a wild ride, but the SPDR Gold Trust is up nearly 5 percent for the year after a double-digit drop in the spring. Some are proclaiming the recent recovery as a new leg up in the bull market for gold, which doubled over the past five years while the S&P 500 has barely managed to break even. The dollar’s high sensitivity to currency moves will be a big factor. If the U.S. currency falls, dollar-denominated gold will rise.

Real estate. This has been a brilliant alternatives play this year, with the average real estate investment trust (REIT) climbing 17 percent, based on the MSCI US REIT index. But it also shows the difficulty of investing in alternatives. REITs have been powering higher the past three years—a horrible period for real estate values in general. That’s because the reluctance of people to buy homes has boosted the rental market. REIT income is derived largely from rent payments on residential and commercial properties. People who expect REITs to continue to recover as property values rise could be disappointed. For homeowners, the value of your own home’s equity might provide all of the real estate diversification you need during the recovery.