The World s Top Bank Tells Investors to Shun Gold (GLD)

Post on: 1 Апрель, 2015 No Comment

For the second time this year, Goldman Sachs slashed its forecasts for gold prices for both 2013 and 2014, adding to the pressure on gold prices lately. So far, 2013 has seen the Dow Jones Industrial Average up nearly 11%, the S&P 500 up nearly 9%, and gold prices down more than 5%. Even with the global and U.S. economies continuing to show signs of weakness, gold prices have moved very little since late 2011. Given the negative view that Goldman is taking of gold, the bank now suggests shorting the commodity. While I don’t see things for gold as being quite that weak, significantly reducing your exposure to gold seems prudent.

Goldman’s case against gold

In the current round of price reductions, Goldman lowered its average price per ounce outlook for 2013 from $1,610 to $1,545. The investment bank now sees the price contracting to $1,350 in 2014, which is a significant reduction from the $1,490 price target it once held. For the rest of the year, Goldman sees plenty of negative pressure. While there are risks for modest near-term upside to gold prices should U.S. growth continue to slow down, we see risks to current prices as increasingly skewed to the downside as we move through 2013. In fact, should our expectation for lower gold prices continue to prove correct, the fall in prices could end up being faster and larger than our forecast.

One of the potential catalysts for the above-mentioned increased decline is an accelerating deterioration in investor confidence. A great number of gold investors piled into the commodity on a speculative basis to not miss the expected move. As prices continue to stagnate and fall, investor capital is likely to look for greener pastures more and more quickly. As speculative positions are unwound and more stop-losses at triggered, the move lower could be sharp.

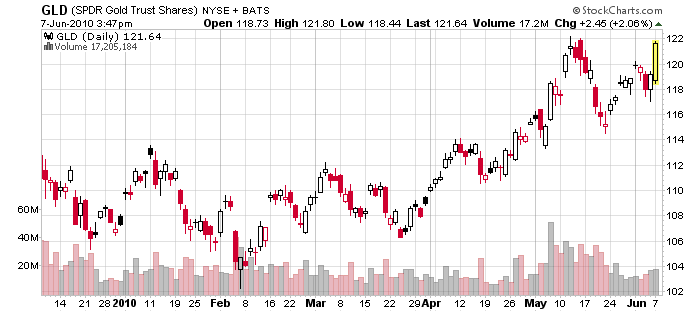

Spikes lower are actually a hallmark of commodities. Prices usually trend gradually higher, or even sideways, but when moves lower happen, they tend to be violent and expensive. This is one of the reasons so much risk is often associated with commodities trades — the move lower can occur before you have a chance to get out. Owning shares of ETFs such as the SPDR Gold Trust ( NYSEMKT: GLD ) can mitigate some of this risk, but large speculative positions in GLD may have contributed to gold’s run, making the relative protection of the ETF somewhat diminished.

Is there safety in miners?

For an extended period, gold miners such as Barrick Gold ( NYSE: ABX ) have underperformed the pure commodity play. Over the past year, Barrick is down more than 40%, while GLD is down about 7%. Over the long term, you would expect this relationship to normalize, meaning miners should outperform at some point. When this happens, however, there’s no guarantee that either investment will be headed higher — the miners may simply fall by less. The potential inflection point that gold presents might be a catalyst for a reversal for the miners, but that remains speculative. Until a shift is apparent, the miners provide no more safety than gold itself.

Ultimately, gold looks weak, and Goldman’s added negative pressure is unlikely to help. Even if you prefer to maintain an allocation, reducing it would seem appropriate.

During the financial crisis, Goldman Sachs did so well pivoting to avoid the worst of the fallout that it had to downplay its success to duck public ire and conspiracy theories. Today, Goldman is still arguably the powerhouse global financial name, and yet its stock trades at a valuation of less than half what it fetched prior to the crisis. Does this make Goldman one of the best opportunities in the market today? To answer that question, I invite you to check out The Motley Fool’s special report on the bank. In it, Fool banking expert Matt Koppenheffer uncovers the key issues facing Goldman, including three specific areas Goldman investors must watch. To get access to this report, just click here .

Fool contributor Doug Ehrman has no position in any stocks mentioned. The Motley Fool recommends Goldman Sachs. Try any of our Foolish newsletter services free for 30 days. We Fools don’t all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy .