I have $50 000 which I would like to invest and earn a return of at least 15% every year from

Post on: 16 Март, 2015 No Comment

Related Topics

Alright. Let's look at the facts and see if we can get you your money.

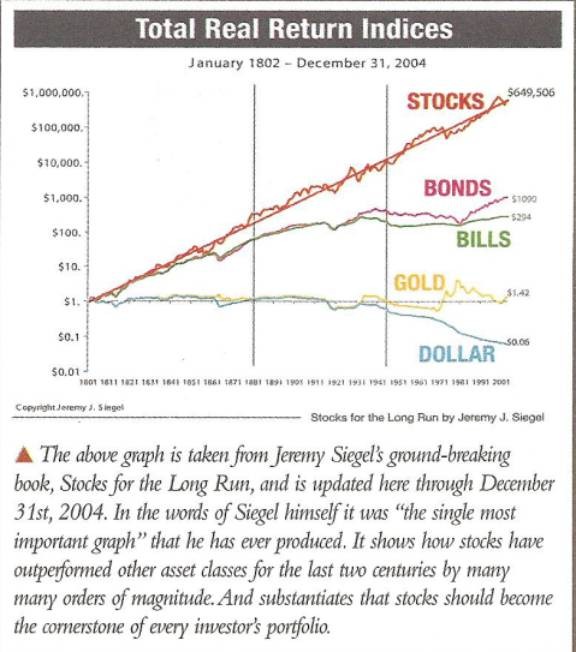

- The average rate of return for the stock market (S&P) from 1871-2013 was 10.75%. which actually isn't too far off the mark.

- Unfortunately, that's the simple average. when you're talking about consistent rates of return over time, what you actually want to know is the Compound Annual Growth Rate (CAGR) also known as the geometric mean. Over that same period, the S&P's CAGR was 9.07% (a little further off the mark).

- We still have one more problem, inflation. Since I assume that you want to invest this money for quite a long time, you need to understand what your inflation-adjusted CAGR is. Over the period in question, the market's Real returns (adjusted for inflation) were 6.86% .

- This is about half of what you want, which means to get to where you want to be, you have to attempt to beat the market.

Your problem is that once you start trying to beat the market, you are playing the same game that every active money manager in the world is playing. It's a hard game that almost no one wins. The reasons for this are myriad, but the ones that will really scorch you are:

- Investment Risk

- Expenses

- Commissions

- Taxes

Active strategies that payout higher than market returns require that you trade, perhaps quite heavily, and when you do that you will be generating taxable events and incurring commission fees. While some of this can be mitigated, it will still eat into your returns substantially in the long run.

Even if, by some miracle, you find a way to rid yourself of the rest, Investment Risk never really goes away. There is always a chance that you'll make a bad decision and reverse your gains.

Of course, in the short and perhaps even in the mid-term you can juice your returns. If you are really lucky you might come out ahead by making a few smart, lucky moves. This, however, can be said about any gamble.

The odds of you consistently more than doubling the Real market returns over any period of time is basically a pipe dream, and almost any strategy that you use to do it will involve taking on a substantial amount of additional risk.

Risk that could very easily blow up in your face.

This leaves you with two choices:

- Invest in a low-cost, diversified portfolio of index funds and dollar cost average. Make use of your retirement account, and take advantage of commission-free ETFs. If your employer offers a 401k match, make use of that too, and if you happen to have extra money laying around during a substantial market downturn, invest it.

- Take really, really big risks consistently and hope for the best.

The key constraint in your question is the word consistent, if you just wanted to know how to make 15%. for a bit, that's a different question.