How to Pass the Level III CFA Exam

Post on: 16 Март, 2015 No Comment

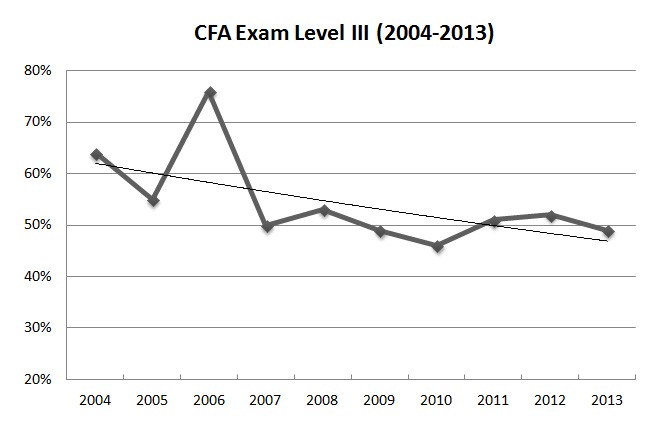

Arriving at the level III exam for the CFA charter is an accomplishment in itself. With a fail rate of around 50% at each level, you have made it where approximately 75% of candidates could not. While the final exam is not one to underestimate, there are some strategic decisions that will make it easier.

There are strategies that will get you through all three exams and those that you will need to change for each test. We will cover those strategies and advice specific to the Level III CFA exam here and hold the broader suggestions for a future post. We will also look at two different schedules in the strategy post that could aid in planning.

Format and Basic Strategy:

The Level III CFA exam can be the most intimidating for some because of the essay questions. Unlike the other two levels, you will be asked to take the concepts in the curriculum and develop your own recommendations and solutions. This can be tough for a lot of people and will almost certainly test your ability to manage time during the test. The good news is that the essay section does not have to be overly difficult, you just need to follow some basic preparation strategy. I was actually pretty surprised at how easy it seemed compared to what the monster I had built it up to be before exam day.

The level III exam is more conceptual and practically-based than the other two exams, making it easier for those that can put everything together. The morning session of the CFA III exam has a maximum score of 180 points and will include 10-15 essay questions with as many as 7-8 separate questions within each. Some questions will require that you write on lines directly under the questions, other questions will be answered in a template box on another page. Do not answer the ‘template’ box questions directly under the question on the exam. It will not be graded! It can be confusing answering some questions directly below while others are answered on separate pages so you want to go through and draw a line under the ‘template’ box questions so you are not tempted to put your answers under the question.

Time is many CFA level 3 candidate’s worst nightmare, but it doesn’t have to be. Just because you have five lines or a three-inch by three-inch box in which to answer does not mean that you must use this entire space. Nor does it mean that you cannot use bullets! Graders are not looking for spelling or grammatical ability, only that you understand the curriculum and can put together a solution.

Topic Weight Differences on the Exam

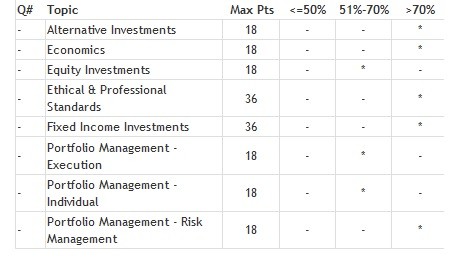

Comparing the topic weights for the level II and the level III exam provided by the CFA Institute, there are a couple of things you should note.

- First, it is much harder to concentrate on ‘core’ topics because the Institute rolls up many of the topics into Portfolio Management. This means that, while the percentage weights for Investment Tools shows a zero weighting, these sections are still tested within the 45-55% of the exam under portfolio management.

- The topic weight ranges in Asset Classes is fairly wide and difficult to draw conclusions as well. Fixed Income is given a slightly higher weighting, but only on average. You are guaranteed of seeing at least one essay or item set from each topic, but could get more. This, combined with the fact that no clues are given as to which subjects within each topic are more important, means that you must cover these topics fairly broadly as well.

Fortunately, the level III exam revolves around the essay questions and the Institute makes available the last three years’ essay exams for practice. While the Institute changes the questions each year, practicing these essay exams is a great start to building your confidence and understanding of the material.

As with the level II strategy for item set questions, you may want to answer those essay questions which you feel strong in the material. This will get you the points you know, will help you bank some time and help your confidence. What I mean by ‘banking’ some time is that you will be able to do those questions you know in less time than the allotment leaving you more time for the more difficult questions.

Do not spend too much time on relatively low-point questions within the essay section. Time is a problem for many candidates, so If a question is only worth a few points it doesn’t make any sense spending 15 minutes trying to get it right. Spend time on the higher-point items and the easy ones, then return to unanswered questions if you have time.

Another critical point on the essay section is to show your calculations when the question asks for it. The graders are allowed to assign partial credit for correct procedures or partial answers. If you do not show your calculations in the exam booklet, not only will you not get partial credit you may not even get credit for correct answers.

Ethical and Professional Standards is off less importance on the last exam but still two item sets in the afternoon. You should have a good understanding of the Standards, so spend some time understanding the new material and move on to other topic areas.

Corporate Finance and Economics are again fairly conceptual sections other than a few growth and market valuation formulas. The topics are also secondary, so make sure you understand the key points and reasoning then spend your time on other areas.

The asset classes (Alternative Investments. Derivatives, Equity Investments, Fixed Income) are also much less quantitatively intensive at the third exam but still include quite a few formulas. The impetus on the third exam is how these asset classes fit together in a portfolio. A large section is devoted to risk management and how the asset classes each have different fundamentals. Be sure to understand return drivers and risk characteristics for each class.

Portfolio and Wealth Management is the focus of the level III exam. Your first two essay questions in the morning will be individual and institutional wealth questions. While these specifics of these two questions vary from year to year, there are a limited number of topics that are tested. This makes it extremely important to practice the old essay questions to get a feeling for what and how questions are asked.

Key in this section is the Investor Policy Statement (IPS) and its components. Spend as much time as you need to master this section because it will be big points on the exam. Understand the differences in risk and return needs for the institutional investors as well as their differences in IPS constraints. The biggest aid here is again the past essay exams posted by the Institute. Besides the exams, also available are guideline answers. These are important to get a feel for what the graders are looking for within the questions. Study the answers in detail to see what information you need to write in your own answers.

This completes the series of strategies specific to each exam. Next post, we will look at a strategy and advice that can be used across all three tests.

‘til then, happy studyin’