Crocodile Gold looks to beat tough gold markets with sustainability plans Proactiveinvestors (NA)

Post on: 31 Март, 2015 No Comment

11th Feb 2014, 9:28 am by Deborah Bacal

The company, with three operating mines in Australia, just announced three key contracts for mining services at its Cosmo gold mine that it expects will reduce costs as a way to optimize its mining plan.

Crocodile Gold (TSE:CRK), coming off a transformative year that topped its own production expectations, is looking to focus 2014 on improving productivity and building sustainability at its Australian mines as part of its efforts to remain successful in light of volatile gold markets.

The company, with three operating mines in Australia, just announced three key contracts for mining services at its Cosmo gold mine that it expects will reduce costs as a way to optimize its mining plan.

There have been cost pressures in the industry, in Australia in particular, and weve had the opportunity to negotiate more favourable outcomes as a result, says CFO Robert Dufour in a recent interview with Proactiveinvestors .

Earlier this month, Crocodile unveiled new contracts for underground mining and diamond drilling as well as a new, lower rate power supply contract with the government-controlled Northern Territory Power and Water Corporation.

We are keenly aware of the need to manage costs. Gold prices have come back a little bit, but were really trying to make sure we build sustainability in the mine plan, giving us the ability to adapt to the recent volatility in the gold market.

The company is forecasting overall gold production in the range of 200,000 to 210,000 ounces this year, compared to total output of 210,686 ounces in 2013 as the Stawell gold mine ramps down.

Stawell is a large part of the reason Crocodile beat its previously increased production guidance of 205,000 ounces for 2013, as the mine was originally anticipated to complete underground mining operations last May. But the mine kept going, adding an extra 25,000 ounces last year, and according to Dufour, there is good potential to add more ounces from Stawell in 2014.

The underground resource is much smaller than it was. It has a lower ounce profile, but it is certainly still profitable.

As Stawell ramps down, the company is looking to permit the surface extension of the current underground mining operations, known as the Big Hill project, which is slated to release a final feasibility study later this quarter.

The Big Hill project, located about 250km northwest of Melbourne, currently has a total of 110,000 ounces, with a projected production period of four to five years based on a preliminary economic assessment (PEA) filed by the company in early 2013. According to the PEA, the project has a net present value of $40 million, and requires upfront capital of approximately $17 million. The property was the focus of intensive mining in the historic gold rush period of the late 1800s and early 1900s.

The feasibility study will support the ongoing permitting process, and we expect a decision on permitting in the later part of 2014, says Dufour. The CFO explains that Big Hill should be in place to start feeding the mill after Stawell underground ramps down, once permits have been granted.

As the company continues to work to extend the underground mine life, it also has access to a surface oxide pile of 1.5 million tonnes, which can be used to feed the mill at Stawell, generating revenue while it waits for Big Hill to come online.

At its two other mines, Fosterville and Cosmo, the Australia-focused gold producer is focused on growing the resource at the mines themselves, undertaking sufficient and sustainable drilling.

Indeed, like all of its peers in the gold mining industry, Crocodile has had to adapt to lower gold prices, and has undertaken a comprehensive cost-cutting plan, cutting all non-essential costs. The efforts have included redeploying unnecessary equipment from Stawell, cutting corporate expenses and scaling back exploration plans.

Were also looking at productivity, at ways we can move more ounces for similar costs, resulting in a positive cash flow outcome.

Dufour says Fosterville in particular is on the radar, with the mine having increased tonnage over the past year on account of strong grades. The mine produced 830,000 tonnes in 2013, up 100,000 tonnes from the previous year. In 2014, a significant amount of the companys capital budget will go towards maintenance at the Fosterville mine, including a ventilation system upgrade and a tailings dam lift necessary work to maintain the mines existing profile.

In terms of exploration, Crocodile will only be looking at near-mine exploration for resource extension purposes, as a function of its cash conservation requirements. We do have exploration plans though, with a detailed ranking of our tenements internally and over 4,000 square km of prospective land.

The CFO says the companys exploration budget goes hand in hand with its other initiative of divesting non-core assets. Our land has carrying costs associated with it, so we are taking a strong look at where our key properties are. If theyre non-core, we will look at divesting them, either through sale, joint venture or outright relinquishment.

If we do see some strength in the gold price, and we build up some cash, we do have the ability to execute on our exploration plans and are ready to go when it makes sense, he adds.

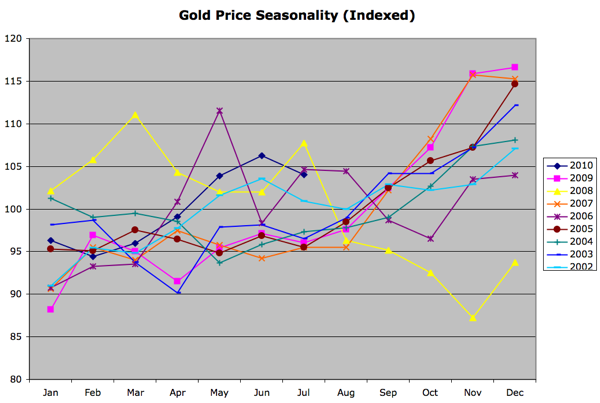

The companys strategy has the markings of a well-thought out plan, with gold markets extremely volatile in recent weeks amid uncertainty about the Feds bond buying program and improving U.S. economic data. Several banks have downgraded their forecasts for the price of gold, with Bank of America Merrill Lynch predicting gold could drop to as low as $1,000 an ounce this year.

Crocodiles full 2013 financial results and 2014 forecasts are slated to be released in March, which will include its capital outlook for this year.

The gold producer finished 2013 on a high note, capping the transformational year with a 26% rise in annual production and record fourth quarter output. The company also managed to reduce its credit facility with Credit Suisse from $70 million to $12 million last April through a gold-swap program, and is currently sitting with net debt of $4 million, having progressively paid down the loan ever since. It expects the debt to be repaid in full by the end of the second quarter of this year.

I came on board just under two years ago, and the company has changed quite a bit over that time, recalls Dufour.

2013 was a turning point, as everyone wanted to see if Cosmo would get up and going and it was a transformative year in that sense. Now that the profile is there, we have to ensure sustainability and production.

It will be tougher at these gold prices, but we are working to stay in the game and generate returns for our shareholders.

So far this year, Crocodiles stock has climbed 50%, sitting at roughly 18 Canadian cents, with a market cap of over $73 million. It has a 52-week trading range of 6 to 35 cents.