Capital Losses and Tax

Post on: 17 Октябрь, 2015 No Comment

It’s never fun to lose money in an investment, but declaring a capital loss on your tax return can be an effective consolation prize in many cases. Capital losses have limited impact on earned income in subsequent tax years, but they can be fully applied against future capital gains. Investors who understand the rules of capital losses can often generate useful deductions with a few simple strategies.

Capital losses are, of course, the opposite of capital gains. When a security or investment is sold for less than its original purchase price, then the dollar amount of difference is considered a capital loss. For tax purposes, capital losses are only reported on items that are intended to increase in value. They do not apply to items used for personal use such as automobiles (although the sale of a car at a profit is still considered taxable income).

Capital losses are reportable as deductions on the investor’s tax return, just as capital gains must be reported as income. Unlike capital gains, capital losses can be divided into three categories. Realized losses occur on the actual sale of the asset or investment, whereas unrealized losses are not reportable.

Example

An investor buys a stock at $50 a share in May. By August, the share price has dropped to $30. The investor has an unrealized loss of $20 per share. He holds on to the stock until the following year, and the price climbs to $45 per share. He sells the stock at that point and realizes a loss of $5 per share. He can only report that loss in the year of sale; he cannot report the unrealized loss from the previous year.

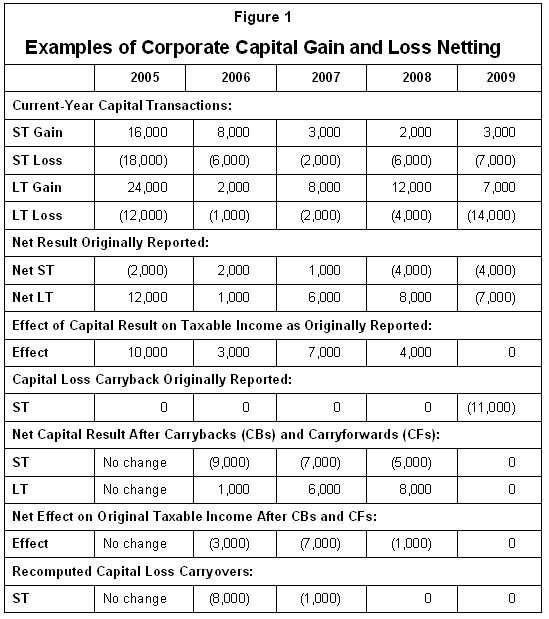

The third category is recognizable gains. Although all capital gains realized in a given year must be reported for that year, there are some limits on the amount of capital losses that may be declared in a given year in some cases. While any loss can ultimately be netted against any capital gain realized in the same tax year, only $3,000 of capital loss can be deducted against earned or other types of income in a given year.

Example

Frank realized a capital gain of $10,000 in 2013. He also realized a loss of $30,000. He will be able to net $10,000 of his loss against his gain, but can only deduct an additional $3,000 of loss against his other income for that year. He can deduct the remaining $17,000 of loss in $3,000 increments every year from then on until the entire amount has been deducted. However, if he realizes a capital gain in a future year before he has exhausted this amount, then he can deduct the remaining loss against the gain. Therefore, if he deducts $3,000 of loss for the next two years and then realizes a $20,000 gain, he can deduct the remaining $11,000 of loss against that gain, leaving a taxable gain of only $9,000.

The Long and Short of It

Capital losses do mirror capital gains in their holding periods. An asset or investment that is held for a year to the day or less, and sold at a loss, will generate a short-term capital loss. A sale of any asset held for more than a year to the day, and sold at a loss, will generate a long-term loss. When capital gains and losses are reported on the tax return, the taxpayer must first categorize all gains and losses between long and short term, and then aggregate the total amounts for each of the four categories. Then the long-term gains and losses are netted against each other, and the same is done for short-term gains and losses. Then the net long-term gain or loss is netted against the net short-term gain or loss. This final net number is then reported on Form 1040 .

Example

Frank has the following gains and losses from his stock trading for the year:

Short-term gains — $6,000

Long-term gains — $4,000

Short-term losses — $2,000

Long-term losses — $5,000

Net short-term gain/loss — $4,000 ST gain ($6,000 ST gain — $2,000 ST loss)

Net long-term gain/loss — $1,000 LT loss ($4,000 LT gain — $5,000 LT loss)

Final net gain/loss — $3,000 short-term gain ($4,000 ST gain — $1,000 LT loss)

Again, Frank can only deduct $3,000 of final net short- or long-term losses against other types of income for that year and must carry forward any remaining balance.

Tax Reporting

A new tax form was recently introduced. This form provides more detailed information to the IRS, so that it can compare gain and loss information with that reported by brokerage firms and investment companies. Form 8949 is now used to report net gains and losses, and the final net number from that form is then transposed to the newly revised Schedule D and then to the 1040.

Capital Loss Strategies

Although novice investors often panic when their holdings decline substantially in value, experienced investors who understand the tax rules are quick to liquidate their losers, at least for a short time, to generate capital losses. Smart investors also know that capital losses can save them more money in some situations than others. Capital losses that are used to offset long-term capital gains will not save taxpayers as much money as losses that offset short-term gains or other ordinary income. Wealthy taxpayers will now find capital losses more valuable than ever because of the capital gains rate increase for those in the top two brackets.

Wash Sale Rules

Investors who liquidate their losing positions must wait at least 31 days after the sale date before buying the same security back if they want to deduct the loss on their tax returns. If they buy back in before that time, the loss will be disallowed under the IRS wash sale rule. This rule may make it impractical for holders of volatile securities to attempt this strategy, because the price of the security may rise again substantially before the time period has been satisfied.

But there are ways to circumvent the wash sale rule in some cases. Savvy investors will often replace losing securities with either very similar or more promising alternatives that still meet their investment objectives. For example, an investor who holds a biotech stock that has tanked could liquidate this holding and purchase an ETF that invests in this sector as a replacement. The fund provides diversification in the biotech sector with the same degree of liquidity as the stock. Furthermore, the investor can purchase the fund immediately, because it is a different security than the stock and has a different ticker symbol. This strategy is thus exempt from the wash sale rule, as it only applies to sales and purchases of identical securities.

The Bottom Line

Capital losses make it possible for investors to recoup at least part of their losses on their tax returns by offsetting capital gains and other forms of income. For more information on capital losses, download the Schedule D instructions from the IRS website at www.irs.gov or consult your financial advisor.