5 Reasons To Buy Bond Funds And ETFs Instead Of Individual Bonds In 2013 And 2014

Post on: 1 Октябрь, 2015 No Comment

The thought of investing in bonds, if you’re like me, is about as exciting as going to the dentist for the second installment of a 58 part root canal. As someone that was drawn to trading from the excitement, I prefer the trades like option spreads up to binary events, earnings plays, and volatility plays. However, investing in all different instruments — stocks, options, funds, index funds, bonds, and bills — all serve their purpose in a properly diversified portfolio.

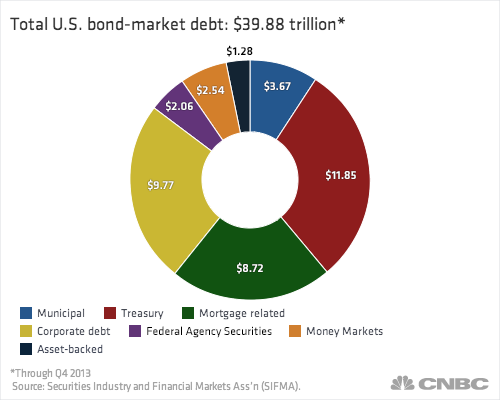

Today, I’m going to introduce the topic of bonds for the first time, and go over one of the first questions I had about bond investing: is it better to buy bonds through a fund or ETF than to buy them individually? There certainly is no limit to bond funds and ETFs out there — ranging from corporate bonds all the way down to junk bonds, and everything in between.

Nowadays, as interest rates are threatening to climb, bonds aren’t generally looking super attractive as an investment. However, the rise in rates doesn’t affect the return on bonds when you hold them to maturity — you’re paid at the value of the time the bond was purchased. Funds and ETFs are a bit different, as they rise and fall depending on the current value of the underlying holding.

Sure, individual bonds are a bit safer, if you hold them through maturity, and they’re offering guaranteed returns. But, funds and ETFs are going to be the way for 2013 and 2014. As the Fed begins to taper (assuming they eventually get around to it someday), bonds will begin to yield more than they do now.

Today, I’ll argue my case as to why I like buying bonds through funds and ETFs, as we head from 2013 into 2014. Here’s 5 reasons that I prefer these methods versus buying bonds outright for this coming year.

1. You Can Sell at Current Value

With the bond market likely to move up in the coming year, you want the flexibility to be able to sell whenever and wherever you want. Funds, unlike individual bonds, can be sold for their current value at any time — as opposed to safer individual bonds, which will yield the same thing until maturity. Because smaller bond positions are tougher to unload, you’re likely to not get a great market value price for individual bonds that you’re trying to sell.

2. No Laddering

Investopedia defines Bond Laddering as:

A portfolio of fixed-income securities in which each security has a significantly different maturity date. The purpose of purchasing several smaller bonds with different maturity dates rather than one large bond with a single maturity date is to minimize interest-rate risk and to increase liquidity. In a bond ladder, the bonds’ maturity dates are evenly spaced across several months or several years so that the bonds are maturing and the proceeds are being reinvested at regular intervals. The more liquidity an investor needs, the closer together his bond maturities should be.

Anyone that has managed their own bonds before knows that laddering is an enormous time consumer, and it’s sometimes a bit of a pain to keep up with. Managing the date of maturity for many bonds can sometimes be a lot to handle. In a fund, that is all dealt with by the company that is managing the fund. You have to do nothing, except get your distributions.

3. Generally Better Pricing & Diversification

Individual bonds are tricky to buy if you’re a normal small time investor. Bonds generally need to be purchased in large amounts — many, many thousands of dollars. This makes it tricky to diversify yourself. A bond fund does all of that work for you — as you buy into the fund, you’re automatically diversifying your money.

In addition, again, the pricing that funds get for bonds is generally better, as the spread for individual bonds that aren’t bought or sold in large groups tends to favor the larger/institutional investor.

4. You Can, and Need to, Take More Risk in 2013/14

Owning individual bonds is tough — you cannot subject yourself to the risk of a bond that could default, as it would ruin a good majority of your portfolio. Fund managers are just the opposite — because they manage massive amounts of bond positions, they’re afforded the right to diversify their bond position — sometimes taking on the riskier bonds. If a bond defaults, it’s not nearly as big of a deal, as there’s massive redundancy with the other bonds involved in the fund.

Because bond yields are so poor now, risk is almost a necessity — and you’re going to want risky bonds managed by a professional manager.

5. It’s a Better Option into 2014

Where do you keep your nest egg right now? Bank account? Money market? CDs or something else you can roll over?

Whatever safe vehicle it’s in, it’s likely that the yield from bond funds are higher. With the bond market soon to be on the rebound, funds are a major advantage to these other types of accounts.

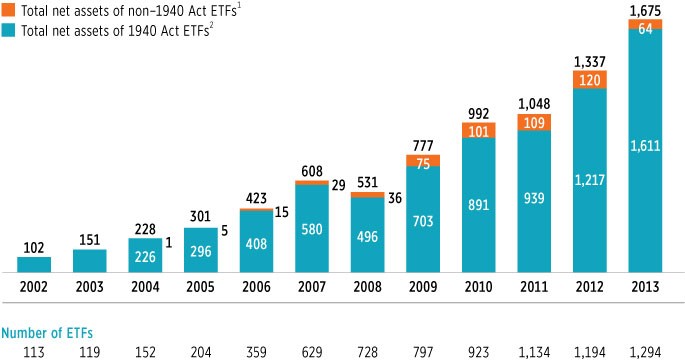

ETFs Make Bonds Easy

ETFs (exchange traded funds) have become extremely popular over the past few years. You may have invested in ETFs without even knowing it at some point; and there’s a lot of investors out there that still don’t know what an ETF is. Many people that invest in popular ETFs like gold (NYSEARCA:GLD ) and silver trusts (NYSEARCA:SLV ) think they’re actually buying a commodity when they’re not.

ETFs are basically funds that trade on exchanges similar to stocks. Usually, the ETF will hold an asset (commodities, bonds, etc.) and will trade at the value of the asset holdings. They’re tax efficient, cheap, work like stocks, and make it super easy for investors to invest in basically anything.

Bond ETFs are generally a little riskier than Bond funds, but that risk is made up for in how insanely easy they are to purchase and unload. Funds have the leg up on ETFs in performance, and more importantly — bond funds can’t be shorted like ETFs. If you decide to go down the ETF road, here are some Bond ETFs that can help you get started (information sourced from this amazing list of Bond ETFs on About.com — for the insanely long full list, click here ) :

Short-Term Government Bond ETFs

- SPDR Barclays Capital Short Term Treasury (NYSEARCA:SST )

- iShares Barclays 1-3 Year Treasury Bond Fund (NYSEARCA:SHY )

- Shares Barclays Short Treasury Bond Fund (NYSEARCA:SHV )

- PIMCO 1-3 Year U.S. Treasury Index Fund (NYSEARCA:TUZ )

Intermediate-Term Government Bond ETFs

- iShares Barclays 3-7 Year Treasury Bond Fund (NYSEARCA:IEI )

- iShares Barclays 7-10 Year Treasury Bond Fund (NYSEARCA:IEF )

- PIMCO Broad U.S. Treasury Index Fund (NYSEARCA:TRSY )

Long-Term Government Bond ETFs

- iShares Barclays 20+ Year Treasury Bond Fund (NYSEARCA:TLT )

- Vanguard Extended Duration Treasury ETF (NYSEARCA:EDV )

- SPDR Barclays Long Term Treasury ETF (NYSEARCA:TLO )

U.S. TIPS ETFs

- iShares Barclays TIPS Bond Fund (NYSEARCA:TIP )

- Vanguard Short-Term Inflation-Protected Securities Index Fund (NASDAQ:VTIP )

- Barclays 0-5 Year TIPS Bond Fund (NYSEARCA:STIP )

- iBoxx 3-Year Target Duration TIPS Index Fund (NYSEARCA:TDTT )

Mortgage-Backed Securities ETFs

- Barclays Agency Bond Fund (NYSEARCA:AGZ )

- iShares Barclays MBS Fixed-Rate Bond Fund (NYSEARCA:MBB )

- Vanguard Mortgage-Backed Securities ETF (NASDAQ:VMBS )

Municipal Bond ETFs

- iShares S&P National Municipal Bond Index Fund (NYSEARCA:MUB )

- SPDR Barclays Municipal Bond ETF (NYSEARCA:TFI )

- Market Vectors Short Municipal Index ETF (NYSEARCA:SMB )

- PIMCO Short Term Municipal Bond Strategy Fund (NYSEARCA:SMMU )

- SPDR Barclays Short Term Municipal Bond ETF (NYSEARCA:SHM )

Corporate Bonds

- iShares iBoxx US Dollar Investment Grade Corporate Bond Fund (NYSEARCA:LQD )

- iShares Barclays 1-3 Year Credit Bond Fund (NYSEARCA:CSJ )

- iShares 10+ Year Credit Bond Fund (NYSEARCA:CLY )

- iShares Barclays Credit Bond Fund (CFT)

- iShares Barclays Intermediate Credit Bond Fund (NYSEARCA:CIU )

High-Yield Bond ETFs

- PIMCO 0-5 Year U.S. High Yield Corporate Bond Index Fund (NYSEARCA:HYS )

- SPDR Barclays Capital Short Term High Yield Bond ETF (NYSEARCA:SJNK )

- iShares iBoxx $ High Yield Corporate Bond Fund (NYSEARCA:HYG )

- SPDR Barclays High Yield Bond ETF (NYSEARCA:JNK ) — I personally love this symbol. High yield bond? You mean JUNK.

Emerging Market Bond ETFs

- iShares JPMorgan USD Emerging Markets Bond Fund (NYSEARCA:EMB )

- PowerShares Emerging Markets Sovereign Debt Portfolio ETF (NYSEARCA:PCY )

- Vanguard Emerging Markets Government Bond ETF (NASDAQ:VWOB )

- WisdomTree Emerging Markets Local Debt Fund (NYSEARCA:ELD )

Leveraged Long ETFs

- Direxion 10-Year Treasury Bull 3X — Triple-Leveraged ETF (NYSEARCA:TYD )

- Direxion 30-Year Treasury Bull 3X — Triple-Leveraged ETF (NYSEARCA:TMF )

- PowerShares DB 3x Long 25+ Year Treasury Bond ETN (NYSEARCA:LBND )

- iPath US Treasury Long Bond Bull ETN (NASDAQ:DLBL )

Risks

Like everything, there are drawbacks to choosing funds and ETFs over individual bonds. For one, many bond traders will be quick to brag about the fact that individual bonds have a guaranteed return at maturity — something mentioned above.

Also, funds and ETFs — like other ETFs — have management fees that are higher than buying the underlying position.

Finally, just like any other ETFs, you’re at risk of not yielding as much as the underlying assets could go down. Unlike in an individual bond, where the closer to maturity the less risk, funds and ETFs have prices that fluctuate constantly.

With QE coming to a close towards the end of this year, the bond markets are likely to move upwards a bit. When I go to move part of my foundation money into bonds, I’ll likely be doing it through a fund or ETF bond vehicle.

I hope this article has given some perspective as to bond investing in the coming months, and wish all investors the best of luck.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.