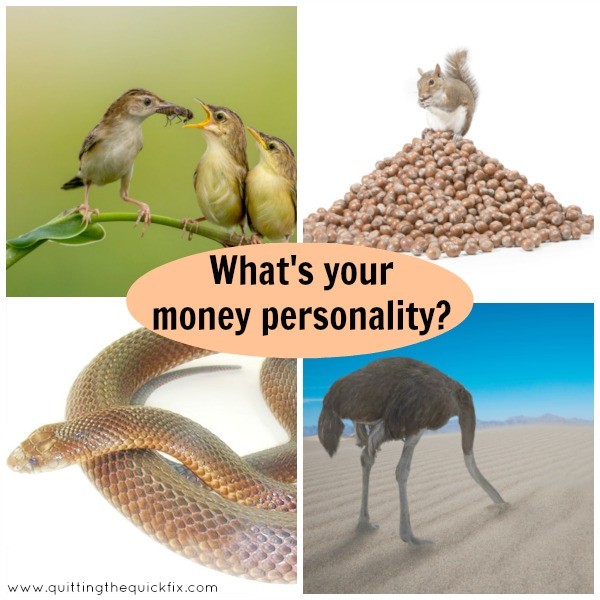

What’s Your Money Personality

Post on: 1 Июль, 2015 No Comment

From Cheapskate to Spendthrift, Visa and Financial Psychology Experts Develop Quiz to Help Consumers Understand Their Relationship to Money

San Francisco, CA – August 9, 2006 – Visa USA and nationally recognized financial psychology experts, Jon and Eileen Gallo, today launched a new interactive online “Money Personality” quiz to help consumers better understand their own individual approach to acquiring, using and managing money.

“Through the years we have discovered that closely studying how individuals relate to money is a key to achieving a more secure financial life,” said money psychotherapist Eileen Gallo, who works together as a team with her husband Jon, an estate-planning attorney. “The online tools we have worked with Visa to create will help consumers identify their relationships with money and based on those relationships give them free access to practical resources to make grabbing hold of their financial futures a little easier,” said Gallo.

As part of this joint effort, Visa and the Gallos have created an interactive, online quiz that helps consumers assess and measure different aspects of their money styles in the areas of acquisition, use and management. The tool, comprised of three interactive rulers that each represents these three different skill areas, is offered as part of Practical Money Skills for Life (www.practicalmoneyskills.com), a free, award-winning and comprehensive money management program provided by Visa. It can also be accessed at the Gallo’s www.fiparent.com website.

In the quiz, consumers are first asked to select a phrase from a variety of choices that best fits their money personality in each of the three areas of money acquisition, use and management. Based on their choices, users can find out how their current relationship with money might be described. For example, one can be insatiable when it comes to acquiring money, a miser when it comes to using it and chaotic when it comes to managing their finances. Each one of the money relationship descriptions are then matched to corresponding money management tips and resources offered on the Practical Money Skills for Life Web site.

Together, the Gallos are the coauthors of Silver Spoon Kids and The Financially Intelligent Parent. Additionally, they have developed the concept that everyone develops a unique relationship with money in three separate areas.

“Jon and Eileen Gallo have a great teamwork approach to helping consumers comprehend the strong connection between their relationships with money and the impact those relationships have on their daily financial decisions,” said Jason Alderman, director, Visa USA. “Creating this ‘Money Personality’ quiz is part of Visa’s continuing commitment to financial literacy and promoting responsible money management for American consumers,” said Alderman.

Practical Money Skills for Life (www.PracticalMoneySkills.com) is an award-winning, teacher tested and teacher approved financial education program. It is available for free, in English, Spanish and Chinese and is designed for teachers, students, parents and consumers. This free educational resource provides teachers with lesson plans (kindergarten-college) mapped to their state education requirements, as well as teacher guides, overheads, instructional videos and CD-ROMs. For students, there are interactive games and calculators designed to teach financial responsibility and important concepts such as earning, saving and budgeting money.

About Eileen Gallo, Ph.D.

Eileen is a licensed psychotherapist in private practice in Los Angeles, where she helps individuals and families work with the psychological and emotional issues related to money and families. Her doctoral dissertation examined the psychological impact of sudden wealth. Eileen is a regular columnist for the Journal of Financial Planning, where she writes about the emotional issues of money. She is a member of the American Association of Marriage and Family Therapy, the California Association of Marriage and Family Therapists, and the Stepfamily Association of America.

About Jon Gallo, J.D.

Jon chairs the Family Wealth Practice Group of a major Los Angeles law firm. He is a Fellow of the American College of Trust and Estate Counsel and an Academician of the International Academy of Estate and Trust Law, as well as being certified by the California Board of Legal Specialization as a Specialist in Probate, Estate Planning and Trust Law. He is a prolific author of more than 70 treatises and articles on estate planning and, like Eileen, is a regular columnist for the Journal of Financial Planning. Together, they co-chair the Committee on the Psychological and Emotional Issues of Estate Planning of the American Bar Association. Through the Gallo Institute (www.galloinstitute.org), they provide educational and consulting services for families and financial advisors on the issues of families, children and money.

About Visa

Visa USA is the nation’s leading payment brand and largest payment system, enabling banks to provide their consumers and business customers with a wide variety of payment alternatives tailored to meet their evolving needs. Visa USA is committed to increasing the choice, convenience, acceptance, and security of Visa payments for all stakeholders in the payment system — Members, cardholders and merchants. Through its 13,500 Member financial institutions, more than 488 million Visa-branded cards have been issued to cardholders in the United States. Last year, U.S.-based financial institutions relied on Visa’s processing system, VisaNet, to facilitate $1.3 trillion in transactions with unparalleled reliability.

Worldwide, cardholders in over 150 countries carry more than 1 billion Visa-branded cards, accounting for more than $3 trillion in annual transaction volume.

Visa offers a trusted, reliable and convenient way to access and mobilize financial resources — anytime, anywhere, anyway.