What Is a Roth 401(k)

Post on: 16 Март, 2015 No Comment

What a Roth 401(k) Is, How it Works, and When You Should Consider One

You can opt-out at any time.

The Roth 401(k) is a 21st Century invention, made official just in 2006. And it has been offered by an increasing number of employers every year since. It may even be an option in your company’s retirement plan package. But how is a Roth 401(k) different from a traditional 401(k)? And is it right for you? Let’s find out.

What Is a Roth 401(k)

A Roth 401(k) is exactly what it sounds like: it’s a combination of a 401(k) and a Roth IRA. Like a 401(k), it’s offered by an employer, contributions are taken out of your paycheck and can be invested for retirement in a number of defined investment choices. Like a Roth IRA, contributions are made after tax (unlike pre-tax 401(k) contributions) but the money is generally not taxed again, even when withdrawn at retirement at or after age 59 . (I say generally because Roth withdrawal rules are slightly trickier. For example, you must be invested five consecutive years before you withdraw the money.)

Roth 401(k) Contribution Limits

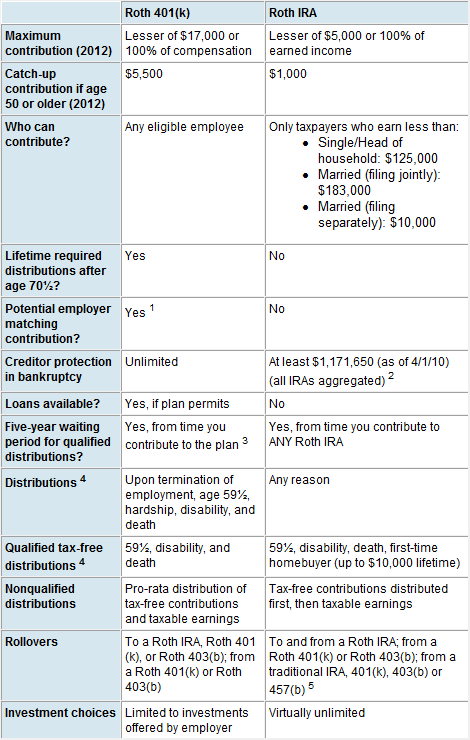

Contribution limits for a Roth 401(k) are the same as those for a regular 401(k). In 2014, you can contribute up to $17,500 to a Roth 401(k). If you are age 50 or older, you can contribute an additional $5,500 in either year. Compare these maximums to those for a Roth IRA: $5,500 a year in 2014, with an extra $1,000 in catch up contributions. Plus, there are fewer restrictions on eligibility for a Roth 401(k).

If you work at a nonprofit or a school, you may have seen a Roth 403(b) in your company’s retirement offerings. Just as a 403(b) works like a 401(k), a Roth 403(b) works like a Roth 401(k). So you can make your decisions just as you would if you had a Roth 401(k).

Benefits of the Roth 401(k)

If you think your taxes will be higher in retirement than they are today, a Roth 401(k) makes a lot of sense. You pay a lower tax rate on your investment money now, and no taxes in the future. For wealthier individuals who are not eligible for a traditional Roth IRA—singles making more than $127,000 in 2013 or $129,000 in 2014 are ineligible, as are couples filing jointly making more than $188,000 in 2013 or $191,000 in 2014—a Roth 401(k) is a great way to get in on this retirement tax strategy. With a traditional 401(k), when you withdraw funds at retirement, you’ll pay a tax rate of between 10% and 35% or more depending on your tax bracket. You can’t predict where taxes are headed in the future, but with taxes for the wealthy currently at relative lows, a Roth 401(k) could make more sense.

Young people who are not yet in established in their careers are also more likely to see their taxes rise in the future, which makes a Roth 401(k) or Roth IRA a great way to save on future taxes. But if you’re making a good amount now and expect your tax rate to drop significantly in retirement, a regular 401(k) may be the better bet.

Drawbacks of the Roth 401(k)

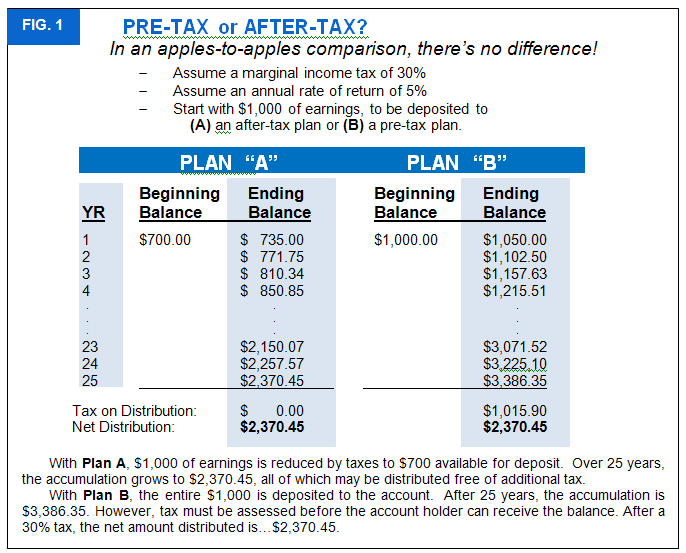

But before you dump all of your retirement savings into a Roth 401(k), consider their biggest drawback compared to the 401(k): after-tax contributions. With a traditional 401(k), contributions are made pre-tax, so there is not a dollar-for-dollar impact on your paycheck. A 401(k) also offers you a great way to lower your taxable income and your income tax bill without feeling too much financial pain. Since Roth 401(k) contributions are made after taxes are taken out, your paycheck will take a bigger hit. See the difference using a traditional 401(k) vs. Roth 401(k) calculator .

Rollovers for Roth 401(k)s

Other than the big after-tax difference, Roth 401(k)s work a lot like regular 401(k)s. When you leave one job for another, you may have the choice to keep your Roth 401(k) where it is with the former employer, to move it into your new employer’s plan if a Roth 401(k) is offered there, or to move it into a rollover Roth IRA, where you will be subject to the same withdrawal rules.

What Should You Do?

You can contribute to both a 401(k) and a Roth 401(k), but the contribution limits are for the combined accounts. So should you move some of your 401(k) contributions to a Roth 401(k)? It really depends on the tax factors discussed above. You may instead want to continue with the goal of maxing out contributions to your regular 401(k), and get yourself a Roth IRA that’s not sponsored by an employer. If you don’t plan to contribute more than $5,000 to $6,000, a regular Roth IRA gives you the same benefits you would get with a Roth 401(k). And a 401(k) and Roth IRA combination makes a lot of sense for financial overachievers.

More than 50% of large employers offer a Roth 401(k). If you are really interested in a Roth 401(k) option and your employer does not currently offer one, ask them to add it. It doesn’t hurt, and it’s one more investment option that can help you build a sound financial future in retirement.

The content on this site is provided for information and discussion purposes only, and should not be the basis for your investment decisions. Under no circumstances does this information represent a recommendation to buy or sell securities.