UPDATE How copper lost its role as a leading indicator

Post on: 1 Август, 2015 No Comment

By Myra P. Saefong, MarketWatch

The metal went ‘from Ph.D to deadbeat’

SAN FRANCISCO (MarketWatch)—Copper started losing its Ph.D. in U.S. economics and equities two years ago.

Dr. Copper was one of the best economic commodity indicators out there, but it isn’t clear right now what the doctor is prescribing, said Kevin Kerr, president of Kerr Trading International.

The metal has historically been dubbed a doctor for its ability to serve as an indicator for economic trends and equity markets.

www.marketwatch.com/story/us-stocks-futures-point-to-upbeat-end-to-2014-2014-12-31) and gained almost 30% in 2013.

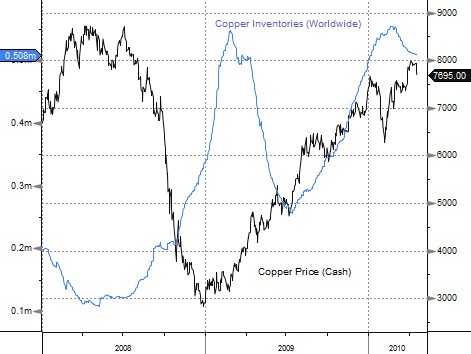

The divergence may not be news to everyone but, as always, a picture is worth a thousand words.

www.marketwatch.com/story/does-dr-copper-deserve-a-malpractice-suit-2013-03-22).

If one was primarily using copper prices and trends as an indicator for the direction of the stock market or economy, they would not be a happy camper at this point, said Alan Konn, executive vice president of Uhlmann Price Securities and co-chairman of Price Holdings Inc. Not only has the U.S. stock market been particularly strong as copper prices eroded, the U.S. economy has continually improved with unemployment on a steady decline.

The chart below of copper prices and the Conference Board Leading Economic Index also shows a split between the two beginning in 2013.

He pointed out that the tightening of credit in the Chinese real-estate market has hampered demand for copper, but China’s easier interest-rate policy seems to be supporting its equity market.

Looking ahead, copper doesn’t look as if it’ll re-earn its degree any time soon, but prices may improve.

Robert Barone, an adviser representative of Concert Wealth Management Inc. said copper went from Ph.D. to deadbeat.

During the prerecession years, there was a strong correlation between economic growth and the demand for copper, often showing up as a high correlation of copper’s price with economic growth and stock prices, he said. After the recession, China stepped in with its infrastructure building spree and copper demand soared, along with their prices.

Much of that has changed, said Barone, who is also an employee of Universal Value Advisors. Now we observe that copper’s price, like the prices of many other base commodities, has fallen while stock prices in the U.S. China and elsewhere have recently risen. So why has copper’s role as an indicator taken such a dive?

Copper prices have been more reflective of economic activity outside the U.S. which in general has been slowing, especially in China and Europe, said Rob Haworth, senior investment strategist at U.S. Bank Wealth Management.

With sustained weakness in prices the past 4 years, there is less [production] capacity being built and will lead to tight supplies in the future, Konn said. That puts upward pressure on prices even without any growth in demand—so copper may continue to be less than a good indicator than it used to be.

-Myra P. Saefong; 415-439-6400; AskNewswires@dowjones.com

online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

03-12-15 1547ET