Top Three Companies With Which To Play Dollar Strength

Post on: 16 Март, 2015 No Comment

Over the last few months, much has been written about the negative effects of a strong dollar. It depresses the price of oil, hurts the nascent shale boom in the U.S. and, as we have been constantly told during the recent earnings season, negatively impacts the profit of exporters. Indeed, to hear the parade of CEOs blaming “currency impact” for missing expectations last quarter you would think that a strong dollar was a disaster for the American economy.

As with all price fluctuations, however, changes in the relative value of the dollar produces winners as well as losers. Companies that are heavily reliant on imports and those sensitive to gas prices benefit just as much as importers and oil companies suffer. Before identifying the biggest beneficiaries of “King Dollar” though, we should consider whether strength can be maintained or if the dollar is about to turn.

At some point, basic economic theory says that the direction of the dollar must reverse. That imbalance of cheap imports and expensive exports creates a self-correcting distortion. It increases the amount imported, meaning that more dollars are exchanged for foreign currency to pay for them, while having the opposite effect on exports; less dollars are bought by overseas firms to pay for them. In theory this increase in sellers and decrease in buyers should halt the rise of the dollar, and even reverse it until everything comes back to equilibrium.

As with a lot of theoretical things, though, reality can often rudely intrude in this equation. The reality in this case is that actual commercial demand is relatively insignificant in the foreign exchange market; speculation and future expectations are far more powerful. On that basis, the end to King Dollar could be some way off.

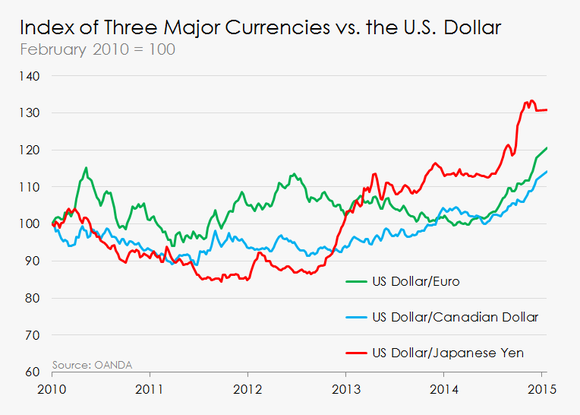

The Fed has ended QE and is preparing the market for gradual interest rate rises, making the dollar more attractive, while the two biggest “competitor” currencies, the euro and the yen are in the opposite position. The ECB has just begun QE in earnest and the BOJ seems stuck in an eternal liquidity loop. The dollar will probably top out before too long, but positioning to benefit from continued strength, at least until Q1 2015 earnings are released looks like a play with minimal risk. The question, then, is what to buy.

This is definitely a case where the KISS (Keep It Simple, Stupid) principle applies. A glance at the top 10 importers of 2014 reveals that the top three all have one thing in common. Not surprisingly, they are all retailers. This gives an added advantage to using them for a strong dollar trade. they all use immense amounts of gasoline to ship products around the country. In other words, they benefit twice from dollar strength.

Those top three shouldn’t come as too much of a surprise, being, in order, Wal-Mart (WMT ), Target (TGT ), and Home Depot (HD ).

Common sense dictates that, if you are to make this trade, you overweight Wal-Mart in your eventual purchase. Firstly, as the biggest importer and the biggest user of gasoline, the Arkansas giant benefits the most from continued dollar strength. Secondly, and to me, more importantly, buying WMT on recent weakness is a lot more attractive that getting in right at the (52 week) top of TGT or HD.

If you are more of a momentum investor than a contrarian you may think differently. That is fine; an equal weight in all three will work too. Whichever way you choose to do it though, positioning for continued dollar strength is likely to be profitable and will have one other added benefit. When CEOs really start bleating about “currency headwinds” in a couple of months, you can allow yourself a smile, safe in the knowledge that that is good news for at least part of your portfolio.