The ETF Portfolio An Approach for Every Investment Stage

Post on: 16 Март, 2015 No Comment

What are your investment goals?

This is, despite what anyone tells you, an ever-shifting, emotionally charged target. You might summarize the quest with suggestions such as I want to retire at 65 years old or younger or I want to leave my wealth to my heirs or even I want to never have to worry about money in retirement. These are not goals necessarily. They are more like aspirations, hopes or dreams that seem to hinge on a single key element. They do not.

Do investment goals depend on age?

What is your risk?

Once again, this is an ever-shifting situation. Popular thinking suggests that risk should be higher when you are young with a gradual downward slope of risk exposure as you move towards retirement.

How should younger investors approach risk?

Instead of embracing risk, the young investor may now be less risk tolerant than their older cohorts. For many, the market downturn in 2008 was not just any downturn: it was the only one they may have ever experienced. Small portfolios, such as those owned by younger investors seemed to be more heavily impacted. These same investors also witnessed their older family members and friends lose significant amounts of money. Rather than following the advice to take risks while they are young, many simply chose to invest as conservatively as an older investor might.

Should middle-aged investors embrace risk?

The result of that same downturn impacted middle-aged investors as well. They saw retirement savings halved, college savings plans lose ground and their companies make adjustments in their retirement plans they didn’t expect. The risk of loss has always been present in the markets and every mutual fund investor is given fair warning of that potential. They now see risk decoupled from reward.

Is a conservative approach advisable as you get older?

Older investors saw decades of retirement savings reduced forcing these folks to realize that their retirement would not be the same as their parents. This group had overestimated more than just the markets, which has corrected numerous times during their investment lifetime. That failure found many in this group firmly embracing risky investments.

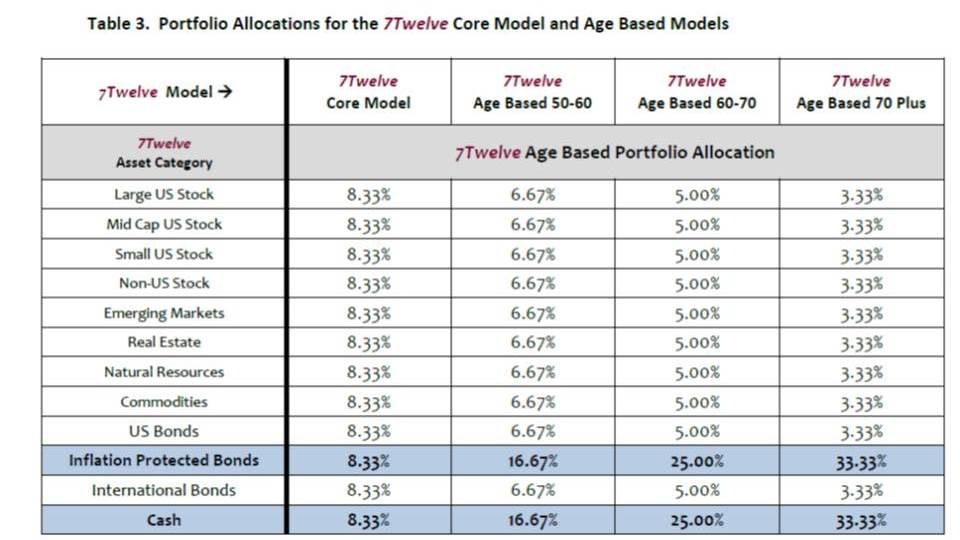

Does age play a role in which portfolio is used?

The answer is both yes and maybe. Yes because the older investor should be able to contribute far more than the younger investor. Maybe because the approach to investing should be the same.